Andhra Pradesh BIEAP AP Inter 1st Year Accountancy Study Material 3rd Lesson Double Entry Book Keeping System Textbook Questions and Answers.

AP Inter 1st Year Accountancy Study Material 3rd Lesson Double Entry Book Keeping System

Short Answer Questions

Question 1.

Define double entry system Of accounting and explain its features.

Answer:

According to J.R. Batliboi “Every business transaction has two-fold effect and that it affects two accounts in opposite directions and if a complete record were to be made of each such transaction, it would be necessary to debit one account and credit another account. This recording of the two-fold effect of every transaction has given rise to the term Double Entry System”.

Features:

- Every business transaction affects two accounts.

- Each transaction has two aspects i.e. debit and credit.

- It is based upon accounting assumptions, concepts and principles.

- It helps in preparing balance which is a test arithemetical accuracy in accounting.

- Finally it helps in preparation of final accounts with the help of trial balance.

Question 2.

Explain different types of accounts along with their debit, credit rules. (Mar. 2019; May ’17 – A.P. & T.S.) (Mar. 2018, ’17 – A.P.)

Answer:

All the transactions are divided into two types of accounts. Personal accounts and Impersonal accounts. The impersonal accounts are further subdivided into Real accounts and Nominal accounts. There are three types of accounts in all. They are Personal accounts, Real accounts and Nominal accounts.

1) Personal accounts : The accounts which relate to individuals or persons are known as “Personal accounts’. Personal accounts are of two types. They are Natural persons and Artificial persons.

Ex: Ramesh a/c, Sita a/c, Andhra bank a/c, capital a/c, drawing a/c, outstanding salaries a/c.

Rule :

Debit the receiver

Credit the giver

2) Real accounts : Accounts relating to properties and assets which are owned by the business concern are, real accounts which include tangible and intangible assets.

Ex: Cash a/c, bills receivable a/c, goods a/c, furniture a/c, goodwill a/c.

Rule : Debit what comes in

Credit what goes out

3) Nominal accounts : These accounts do not have any existence, form or shape. They relate to incomes and expenses or gains and loss of a business concern.

Ex : Salaries a/c, commission a/c, rent a/c, discount a/c, bad debts a/c.

Rule : Debit all expenses and losses

Credit all incomes and gains

![]()

Question 3.

Explain the advantages of double entry system.

Answer:

Advantages : The following are the main advantages of double entry system.

- Complete record of transactions : Double entry system maintains a complete record of all business transactions, because it records both the aspects of financial transaction.

- Scientific system : This is the only scientific system of recording business transactions. It helps to attain the objectives of accounting.

- Ascertainment of profit or loss : It helps in ascertainment of profit or loss for a particular period by preparing the profit and account.

- Ascertainment of the financial position : The financial position of the concern can be as¬certained at the end of each period by preparing balance sheet.

- Full details for control : This system permits accounts to be kept in a very detailed form, and thereby provides sufficient information for the purpose of control.

- Comparative study: The results of one year may be compared with those of previous years and the reasons for change may be ascertained.

- Helps in decision making: This system provides sufficient information to the management for making decision.

Very Short Answer Questions

Question 1.

Double entry book keeping system (May. ’17 – A.P. ; Mar. ’15 – T.S.)

Answer:

According to J R. Batliboi Every business transaction has a two-fold effect that it affects two accounts in opposite directions and if a complete record were to be made of each such transaction, it would be necessary to debit one account and credit another account. This recording of the two-fold effect of every -transaction has given rise to the term Double Entry System”.

Question 2.

What is an account ? (Mar. 2019 – T.S.)

Answer:

Every transaction has two aspects and each aspect has an account. It is stated that an account is ‘a summary or relevant transactions at one place relating to a particular head’.

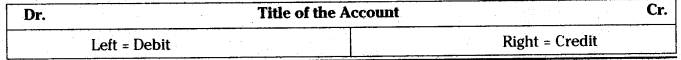

The common form of an account has three parts.

- A Title’ that describes the name of the asset, liability or equity account.

- A ‘left side’ or the “debit” side

- A right side’ or the “credit” side

Format of Account

Question 3.

Explain accounting equation.

Answer:

Accounting equation is based on dual aspect concept (Debit and Credit). The accounting equa¬tion shows the relationship between the economic resources of a business and the claims against those resources.

Economic Resources = claims

Another term for economic resources is assets.

The claims consist of liabilities and owners claims or equity.

Assets = Equities or Capital + Liabilities

![]()

Question 4.

Impersonal accounts

Answer:

Impersonal accounts are two types i.e. Real accounts and Nominal accounts.

- Real accounts: Accounts relating to properties and assets which are owned by the business concern are, Real accounts, which include tangible and intangible accounts.

Ex: Cash a/c, bill receivable a/c, goodwill a/c, goods a/c, furniture a/c. - Nominal accounts: These accounts do not have any existence, form or shape. They relate to incomes and expenses or gains, and losses of a business concern.

Ex: Salaries a/c, bad debts, rent a/c, commission a/c, discount a/c etc.

Student Activity

Visit a nearest business organization and make a list of various personal, real and nominal accounts from the books of accounts.