Andhra Pradesh BIEAP AP Inter 1st Year Accountancy Study Material 6th Lesson Subsidiary Books Textbook Questions and Answers.

AP Inter 1st Year Accountancy Study Material 6th Lesson Subsidiary Books

Questions

Question 1.

Explain the various Subsidiary Books with suitable examples.

Answer:

Separate Books or special books which are maintained to record a particular category of trans¬actions are known as “Subsidiary books”.

The journal is divided into eight subsidiary books. They are :

a) Purchase book : This book records all the goods purchased on credit. Cash purchases and purchase of assets are not recorded in this book.

Whenever goods are bought on credit we receive an invoice from the seller. It is called “Inward Invoice”. It is evidence for recording in purchase book.

b) Sales book : The goods sold on credit are recorded in this book. Cash sales and assets sold for cash or credit are not recorded in this book.

Whenever goods are sold on credit we send an Invoice to the customer. It is called “Outward Invoice”. It is evidence for recording in sales book.

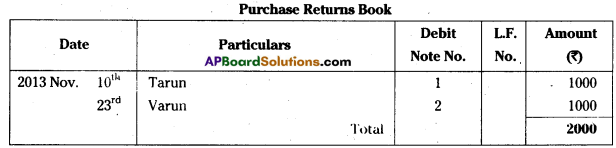

c) Purchase returns book: This book is also known as returns outward book. This book records the goods returned to the suppliers. When goods are returned to their sellers a Debit Note’ is prepared and sent to the suppliers along with goods.

d) Sales returns book: This book is also known as returns inward book. This book records the goods returned by the customers. When the sellers receive goods back from the customer along with a debit note, then he prepares a credit note and sends to the customer.

e) Cash book: Cash book is used for recording all cash transactions i.e. cash receipts and cash payments either in cash or by cheque are recorded in this book.

f) Bills receivable book: This book is used to record all the bills received from the customers for the amount due. It contains details of acceptor of the bill, its due date, date bill, the amount due, etc.

g) Bills payable book: If the goods are purchased on credit and bills are accepted for the due amounts, all these bills payable are recorded in this book. It contains the amount due, date of bill, place of payment, due date, etc .

h) Journal proper : This book is used to record only those transactions, which cannot be recorded in any one of the seven subsidiary books side above.

Question 2.

Give the advantages of subsidiary books.

Answer:

Subsidiary Book Advantages:

a) Saving of Time : No need of writing the Journal Entries. Transactions are directly entered into their respective journals.

b) Division of Work: By entrusting different Subsidiary Books to different persons, division of principle can be implemented.

c) Easy Recording: Transactions can be recorded very fast and easy.

d) Improves Efficiency: Accounting work will be done efficiently by allotting work to different experts who prepare the Special Books.

e) Detection of Errors : Since Separate Books are maintained to record a particular set of transactions, errors can be easily noticed.

![]()

Question 3.

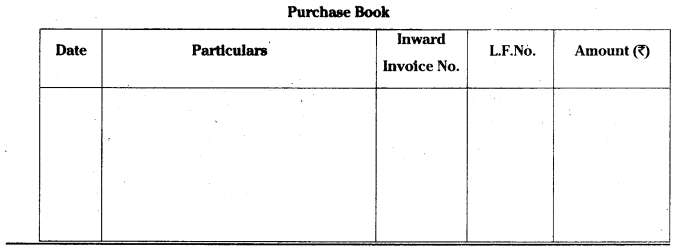

Explain about Purchases book and draw the pro forma of it.

Answer:

This book records all the goods purchased on credit. Cash purchases and purchase of assets are not recorded in this book.

Whenever goods are bought on credit we receive an invoice from the seller. It is called “Inward Invoice”. It is evidence for recording in purchase book. It is numbered serially and filed in a separate file.

Proforma of purchase book:

Purchase book contains five columns, such as Date, Particulars, Invoice No., L.F.No. and Amount.

Question 4.

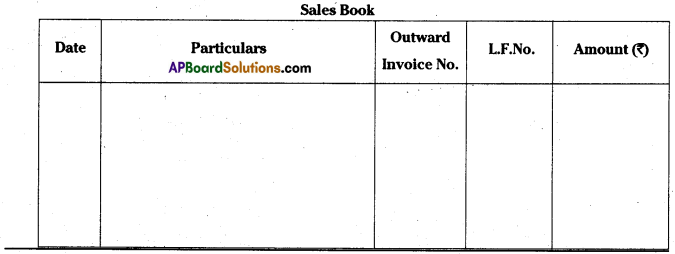

Explain about Sales book and draw the pro forma of it.

Answer:

The goods sold on credit are recorded in this book. Cash sales and assets sold for cash or credit are not recorded in this book.

Whenever goods are sold on credit we send an invoice to the customer. It is called “Outward invoice”. It is evidence for recording in sales book. It is serially numbered and kept in a separate file.

Proforma of sales book:

Sales book contains five columns, such as Date, Particulars, Invoice No., L.F.No. and Amount.

![]()

Question 5.

Answer the following in not more than 5 lines. (Mar. ’17 – A.P.)

a) Invoice

b) Debit Note

c) Credit Note

d) Trade Discount

e) Journal Proper

Answer:

a) Invoice:

It is the document prepared by the supplier of goods with all the details like quantity, price discount offered and other terms and conditions. This is also known as “Inward Invoice”.

b) Debit Note: (Mar. 2019 – A.P.) (Mar. 2018 – T.S.)

If goods are returned to the supplier, a debit note or letter is sent along with goods, informing the supplier about the debit given to his account for the value of the goods returned. This note is known as debit note.

c) Credit Note:

If the customer returned the goods, a credit note is sent to him by the traders informing the customer that his account has been credited with the value of the goods returned.

d) Trade Discount:

It is a reduction in the catalogue price of an article. This is given by the wholesaler to the retailer to enable him to sell at a catalogue price and make a profit. It is not entered in books.

e) Journal Proper: (May ’17 – A.P.)

This book is used for recording only those transactions which cannot be recorded in any one of the seven subsidiary books said above.

Examples: Opening entries, closing entries, adjustment entries, transfer entries.

Problems

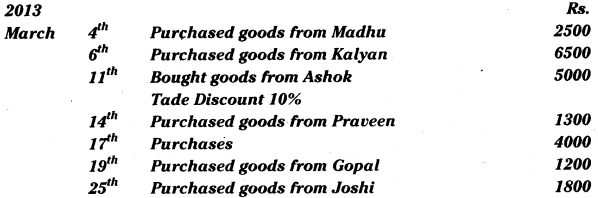

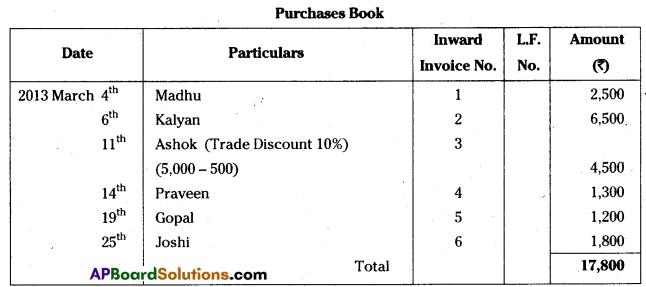

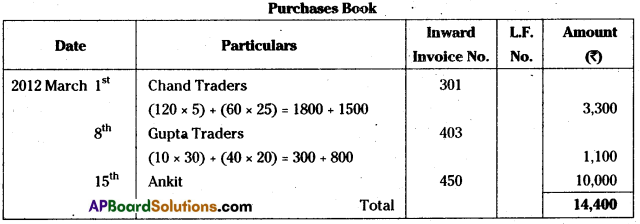

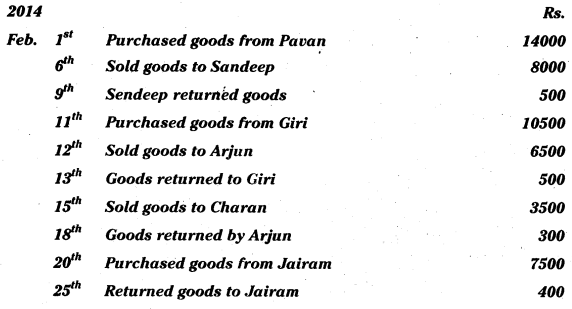

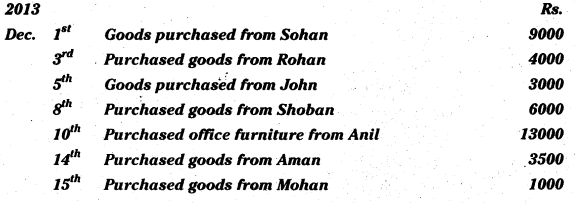

Question 1.

Record the following transactions in the purchase book.

Hint 1: For transaction dated on 11th Calculate trade discount @ 10% on Rs. 5,000/- i.e. 5000 × \(\frac{10}{100}\) = 500, and take net purchases as 5000 – 500 = 4500.

Hint 2: Transaction dated 17th March is a cash transaction. So, it is not to be taken in purchase book.

Answer:

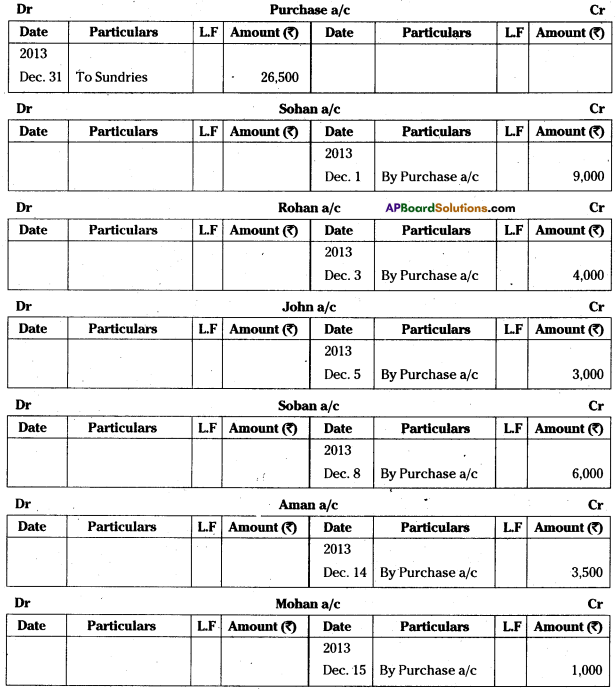

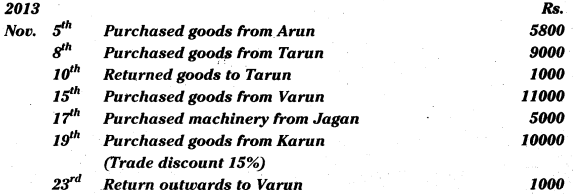

Question 2.

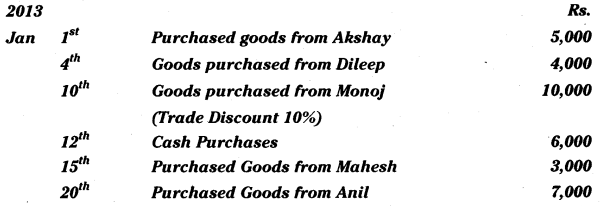

Prepare Purchase Book from the following:

Hint 1: For transaction dated on 10th calculate discount @ 10% on 10,000/-

i.e. 1,000 and takes net purchases as 10,000 – 1,000 = 9,000.

Hint 2: Transaction dated on 12th is a cash transaction. So, it is not entered in purchases book.

Answer:

![]()

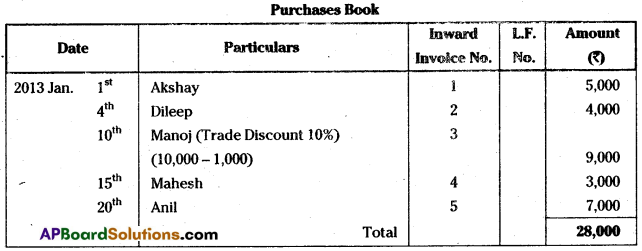

Question 3.

Record the following in Purchases Book:

2012

March 1st Purchase goods on credit from Chand traders Invoice No. 301.

120 reams of white paper @15 per ream

60 dozen ink pots @ 25 per dozen

March 8th Purchased from Gupta traders Invoice No. 403

10 Drawing boards @ 30 each

40 Notebooks @ 20 each

March 10th Purchased goods from Goyal and Company for cash 3,000.

March 15th Purchased goods from Ankit Rs. 10,000 as per Invoice No. 450.

Hint 1 : Transaction dated on March 1st Net Purchases amount is to be calculated as, (120 × 15) + (60 × 25) = 1800 + 1500 = 3300

Hint 2 : Transaction dated on March 8th Net Purchases amount is,

(10 × 30) + (40 × 20) = 300 + 800 = Rs. 1100

Answer:

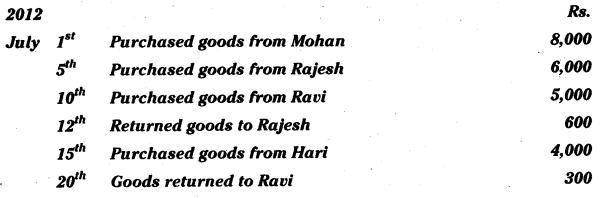

Question 4.

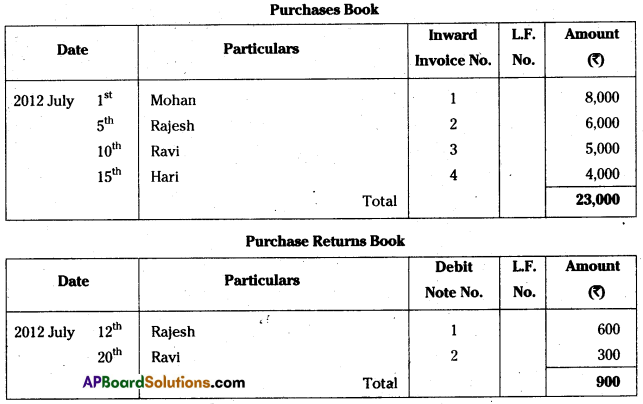

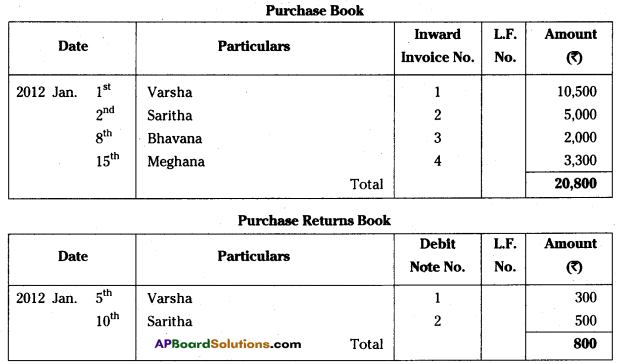

Enter the following in Purchase Book and Purchase Returns Book: (Mar. 2019 – A.P. & T.S.)

Answer:

Question 5.

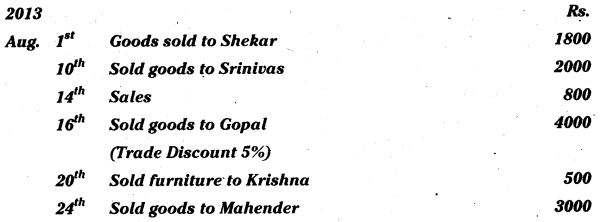

Prepare Sales Book (May 17 – T.S.)

Hint 1: Trade discount is 4000 × 5/100. Net sales = 3,800.

Hint 2: Transaction dated on 14th is a Cash transaction.

Answer:

![]()

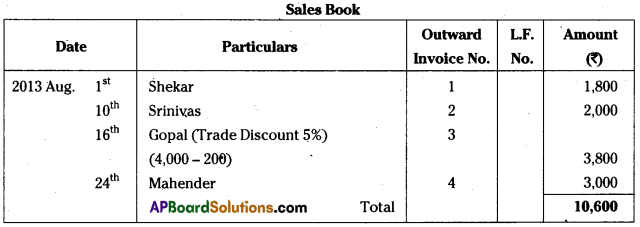

Question 6.

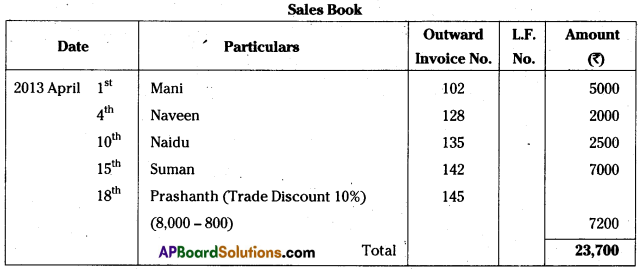

Enter the following transactions in Sales Book and prepare Ledger.

Hint 1: For transaction dated on 18th calculate trade discount i.e. 8000 × 10/100 = 800, net sales = 7200.

Hint 2: Transaction dated on 20th is a cash transaction.

Answer:

Ledgers:

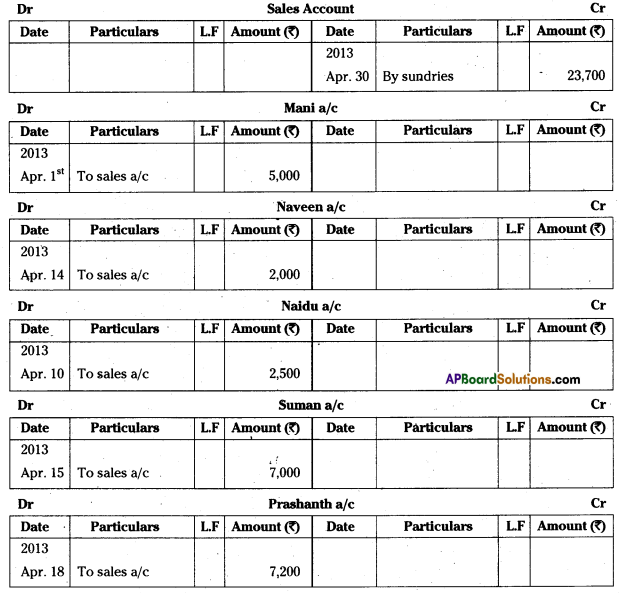

Question 7.

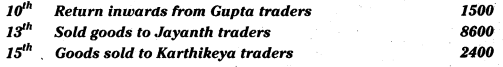

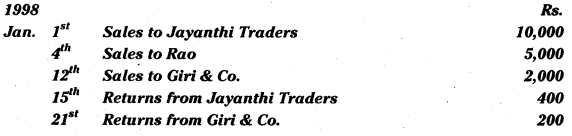

Prepare Sales Book and Sales Returns Book from the following. (Mar. 2018 – A.P. & T.S.)

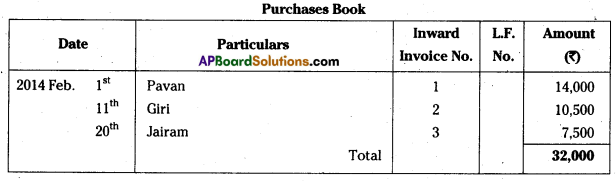

Answer:

Question 8.

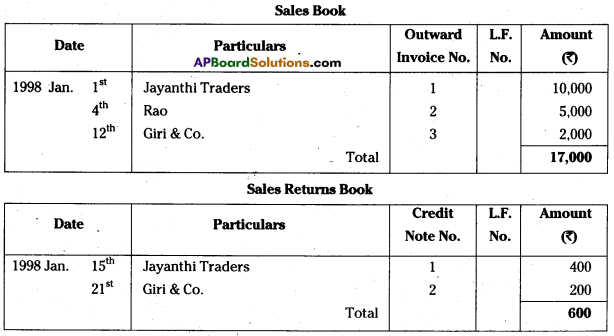

Record the following transactions in Proper Subsidiary Books.

Answer:

![]()

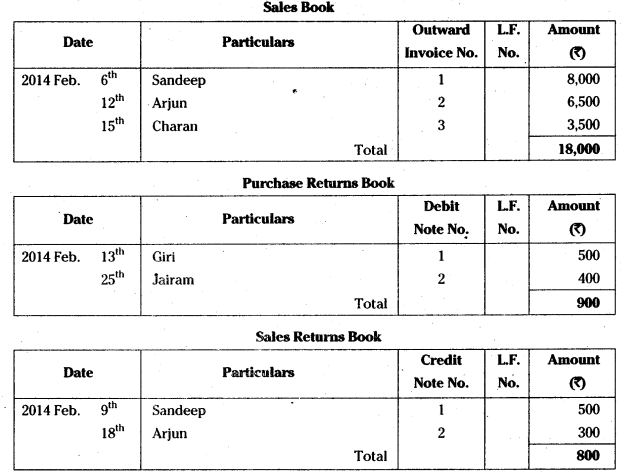

Question 9.

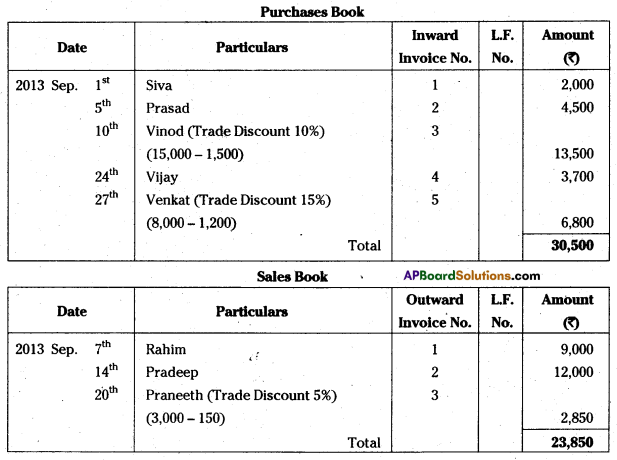

Enter the following transactions in the related Subsidiary Books.

Hint 1: For transaction dated on 10th Trade discount is 15000 × 10/100 = 1500

Net purchases = 13500

Hint 2: Transaction dated on 18th is a cash transaction.

Hint 3: For transaction dated on 20th Trade discount is 3000 × 5/100 = 150

Net sales = 2850

Hint 4: Transaction dated on 26th is to be entered in journal proper.

Hint 5: For transaction dated on 27th Trade discount is 8000 × 15/100 = 1200

Net sales = 6,800

Answer:

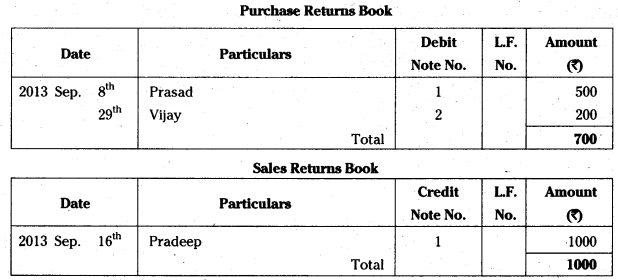

Question 10.

Prepare Purchases Book.

Answer:

Question 11.

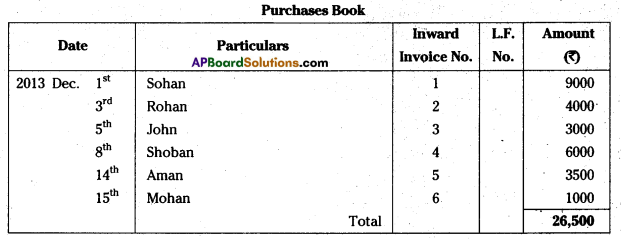

Enter the following transactions in Purchases Book and post them in Ledger.

Answer:

Ledgers:

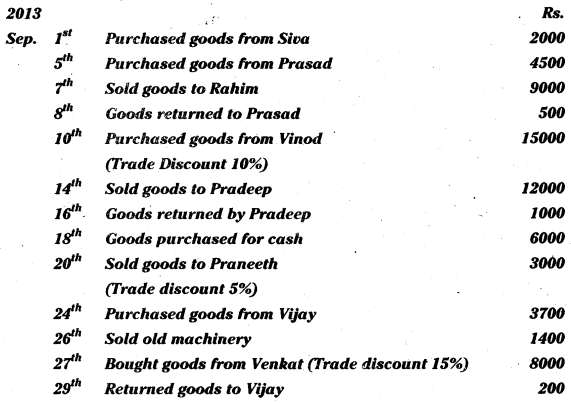

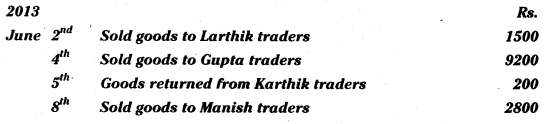

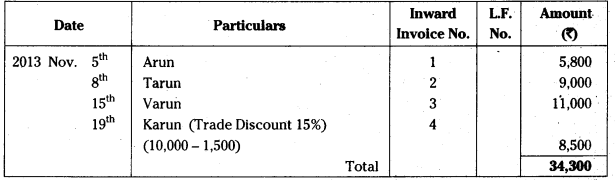

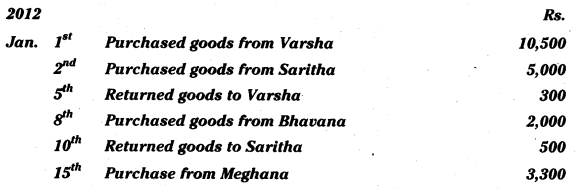

Question 12.

Record the following in Sales Book and Sales Returns Book.

Answer:

![]()

Question 13.

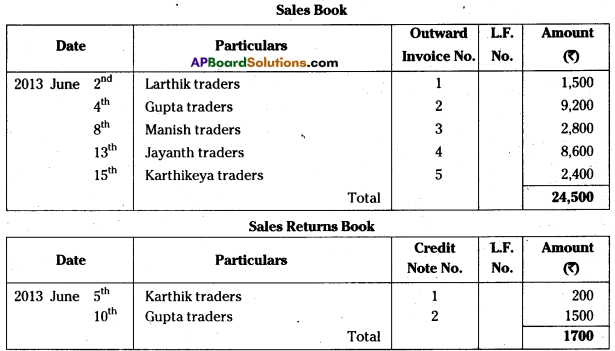

Enter the following transactions in Proper Subsidiary Books: (May ’17 – A.P.)

Hint : Transaction dated Nov. 19th trade discount 15% of 10000 i.e.,

10000 × 15/100 = 1500 is to be deducted from purchase amount Rs. 10000.

Net purchases 10000 – 1500 = 8500

Question 14.

From the following transactions prepare Sales Book and Sales Returns Book. (IPE. Mar. 14)

Answer:

Question 15.

Enter the. following transactions in proper Subsidiary Books. (IPE. Mar. 14)

Answer:

Student Activity

Collect the invoices, debit notes, credit notes from any business organization.