Andhra Pradesh BIEAP AP Inter 2nd Year Accountancy Study Material 1st Lesson Bills of Exchange Textbook Questions and Answers.

AP Inter 2nd Year Accountancy Study Material 1st Lesson Bills of Exchange

Essay Questions

Question 1.

Define a bill of exchange. Explain the main features of a bill of exchange.

Answer:

Sec. 5 of the Negotiable Instruments Act, of 1881 defines a bill of exchange as follows:

“A bill of exchange is an instrument in writing containing an unconditional order signed by the maker, directing a certain person to pay a certain sum of money only to, or to the order of a certain person or to the bearer of the instrument”.

Features of a bill of exchange: The following are the features of a bill of exchange.

- A bill of exchange must be in writing.

- It must contain an order and not a request to make payment.

- The order of payment must be unconditional.

- The amount of the bill of exchange must be certain.

- The date of the bill of exchange should be clearly mentioned.

- It must be signed by the maker or drawer of the bill.

- It must be accepted by the drawee by signing on it.

- The amount is payable either to a certain person or to his order or to the bearer of the bill.

- The amount of the bill of exchange is payable either on demand or on the expiry of a certain period.

- It must be properly stamped as per legal requirements.

Question 2.

What are the advantages of a bill of exchange?

Answer:

A bill of exchange as an instrument or credit is used frequently in business because of the following advantages.

- It helps in the purchase and sale of goods on a credit basis.

- It is a legally valid document in the eyes of law. It assures an easier recovery to the drawer if the drawee fails to make payments.

- It acts as a source of finance since it can be discounted from the file bank before the due date.

- It is a written and signed acknowledgment of debt.

- It can be easily transferred from one person to another person by endorsement.

- By drawing accommodation bills on one another traders can raise money.

![]()

Question 3.

What are the different types of bills of exchange?

Answer:

Bills of exchange can be classified as follows:

- Time bill: When the payment of a bill of exchange is to be made after a particular period of time. The bill is termed a time bill. In such a case, the date of maturity is always calculated by adding three days of grace.

- Demand bill: In the case of a demand bill, payment is to be made on demand. Neither the acceptance of the drawee is necessary nor any days of grace allowed.

- Trade bill: When a bill of exchange has been drawn and accepted for a genuine trade transaction, it is termed a trade bill.

Ex: A sold goods to B on credit and draws a bill of exchange on B who accepted it. It is a trade bill. - Accommodation bill: Accommodation bills refer to those bills which are drawn, accepted endorsed without any consideration. These bills are drawn and accepted to meet the financial needs of drawer/drawee/both for a temporary period by getting bills disconnected at the bank.

- Inland bill: A bill is termed as an Inland bill if it is drawn in India on a person residing in India whether payable in or outside India.

Or

It is drawn in India on a person residing outside India but payable in India. - Foreign bill: A bill that is not an inland bill is a foreign bill. A foreign bill is generally drawn up in triplicate and each copy is sent by separate post so that atleast one copy reaches the concerned party at the earliest. Of course, the drawer of the acceptor will sign on a single set. It becomes the actual bill and the payment will be made on the such bill.

Question 4.

Explain the differences between a bill of exchange and a promissory note.

Answer:

The differences between bill of exchange and promissory note are as follows:

| Basis of difference | Bills of exchange | Promissory note |

| 1. Drawer | It is drawn by the creditor. | It is drawn by the debtor. |

| 2. Order or promise | It contains an order to make payment. | It contains a promise to make payment. |

| 3. No. of parties | It has three parties namely

|

It has two parties namely

|

| 4. Acceptance | It is valid only when it is accepted by the drawee. | It does not require any acceptance. |

| 5. Payee | The drawer and payee can be the same person. | The drawer cannot be the payee of it. |

| 6. Noting | In case of dishonour of bill noting becomes important. | Noting is not necessary in case of dishonour of promissory note. |

Question 5.

Explain the differences between a bill of exchange and a cheque.

Answer:

A cheque is a bill of exchange drawn on a specified banker and payable on demand (sec 6 of N.I Act, 1881). A cheque is similar to a bill of exchange with two additional conditions. They are:

- It is always drawn by a specified banker.

- It is always payable on demand.

Differences between Bill of exchange and Cheque

| Basis of difference | Bills of exchange | Cheque |

| 1. Acceptance | It requires acceptance to become a legal instrument. | It does not require any acceptance. |

| 2. Stamp duty | It requires the necessary stamp as per the act. | It does not require any stamp. |

| 3. Crossing | It will not have any crossing on the instrument. | It may be crossed. |

| 4. Due date for payment | The proceeds of the bill will be payable on the due date of the instrument. | The cheque amount should be paid immediately as and when it is presented to the bank for payment. |

| 5. Days of Grace | Three days of grace are allowed after the due date of the bill for payment of the bill amount. | Days of grace are not applicable in the case of cheques. |

| 6. Withdrawal | Once accepted the bill cannot be withdrawn by the drawee. | It can be withdrawn by the maker by giving a stop payment order to the bank. |

Short Answer Questions

Question 1.

What is a bill of exchange?

Answer:

When goods are sold on credit, the buyer promises the seller that he will pay the number of goods purchased after a certain period. The buyer has to give a promise in writing. The bill of exchange contains an unconditional order to pay a certain amount on an agreed date.

Question 2.

State the three parties involved in a bill of exchange.

Answer:

There are three parties to a bill of exchange.

- Drawer: The drawer is the person who writes the bill of exchange or the person who granted credit.

- Drawee: Drawee is the person on whom the bill of exchange is drawn or to whom the credit is granted.

- Payee: Payee is the person who receives the amount of the bill on maturity. Usually, the drawer and payee are the same people. But when the bill is discounted with a bank by the drawer then the payee is the banker. Similarly, when the bill is endorsed by the drawer to a third party then the payee is the endorsee.

![]()

Question 3.

What is a Promissory Note?

Answer:

A promissory note is an instrument in writing (not being a bank note or currency note) containing an unconditional undertaking signed by the maker, to pay a certain sum of money only to or to the order of a certain person or to the bearer of the instrument.

Question 4.

What is the due date of a bill?

Answer:

A bill payable on demand or at sight, presentment becomes due as soon as the bill is presented. A bill payable a certain period after the date or after sight becomes nominally due after the expiry of such period. The date which becomes after adding 3 days of grace to be nominally due date of a bill is called the date of maturity.

Question 5.

What are the days of Grace?

Answer:

For making the payment of the bill, the drawee is allowed three extra days after the normal due date. Such three days are known as ‘Days of Grace. If the due date is a public holiday previous day is the due date. If the due date is a sudden holiday, the next day is the due date.

Question 6.

What do you mean by Noting Charges?

Answer:

To obtain proof of dishonour, the bill is re-sent to the drawee through a legally authorized person called a notary public. Notary public charges a small fee for providing this service known as noting charges. Noting charges are paid to the notary public first by the holder of the bill but are ultimately recovered from the drawee because he is the responsible person for the dishonour.

Question 7.

What is meant by acceptance of a bill of exchange?

Answer:

The drawee has to accept the bill prepared by the drawer. Unless the drawee gives his acceptance by writing the word ‘accepted’ and also putting his signature along with the date, the bill does not become a legal document. Before the acceptance, the bill is called ‘Draft’. After acceptance, the bill is returned to the drawer. This is called acceptance of a bill of exchange.

Question 8.

What is meant by discounting a bill?

Answer:

When the bill is encashed from the bank before its due date, it is known as discounting of the bill. Bank deducts a small sum of money as a discount from the amount of the bill and disburses the balance amount to the drawer of the bill.

Question 9.

What is the retirement of the bill of exchange?

Answer:

When the drawee makes the payment of the bill before its due date it is called ‘retirement of the bill’. In such a case, the holder of the bill usually allows a certain amount as a rebate to the drawee.

![]()

Question 10.

What do you mean by the renewal of the bill of exchange?

Answer:

Sometimes the drawee of a bill finds himself unable to meet the bill on the due date. To avoid dishonouring of the bill, he may request the holder of the bill to cancel the original bill and draw a new bill in place of the old one. If the holder agrees, the old bill is cancelled and a new bill with new terms is drawn on the drawee and also accepted by him. This is called ‘Renewal of a bill’.

Question 11.

What is meant by ‘Dishonour of a Bill’?

Answer:

When the drawee or acceptor of the bill fails to make payment of the bill on the date of maturity it is called ‘Dishonour of the bill’.

Textual Exercises

A. Bills of Exchange Honoured

Question 1.

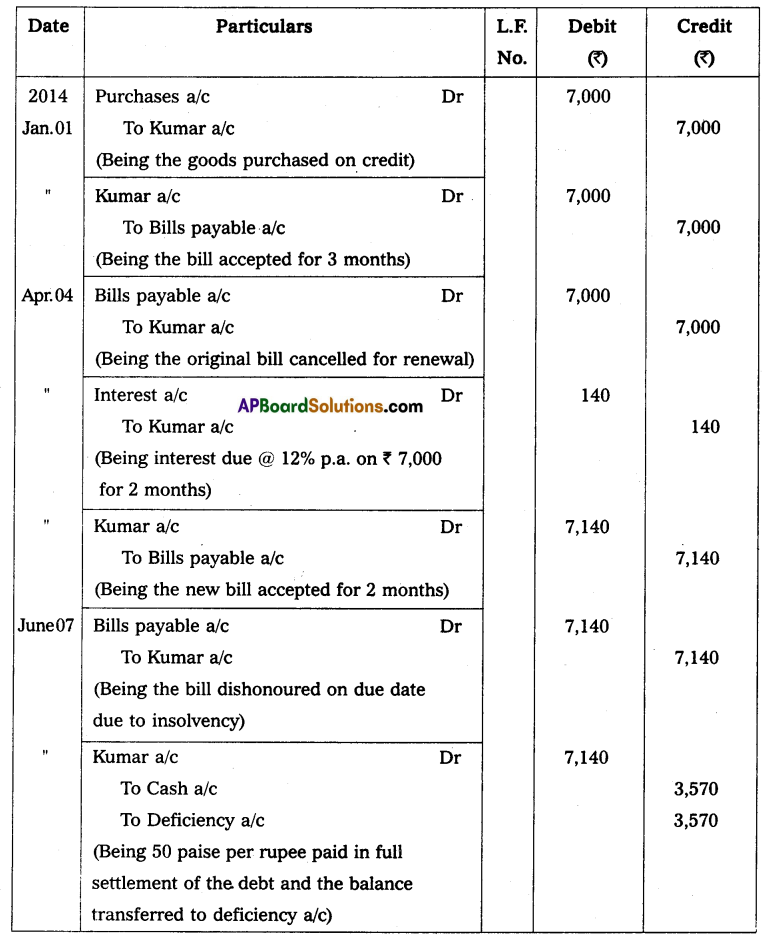

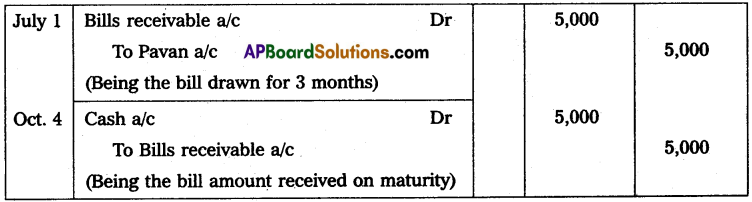

On 1st July 2014, Madhu sold goods to Pavan for ₹ 5,000 on credit and drew a bill of exchange for 3 months for the same amount. Pavan accepted the bill and returned it to Madhu. Pavan met his acceptance on maturity.

Pass the necessary Journal entries in the books of Madhu and Pavan.

Solution:

Journal entries in the books of Madhu

Journal entries in the books of Pavan

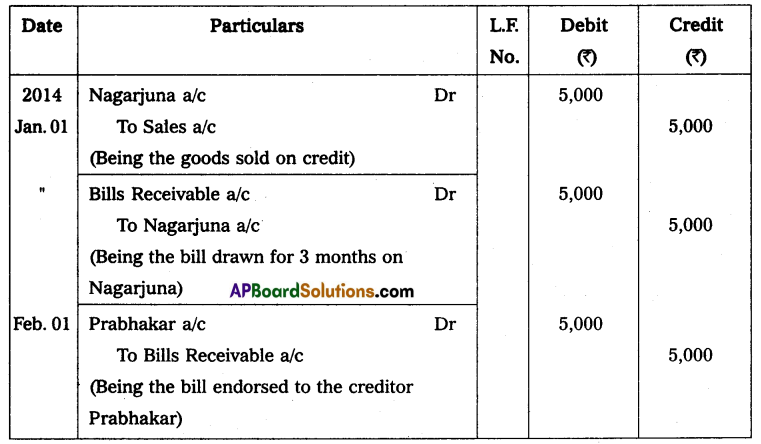

Question 2.

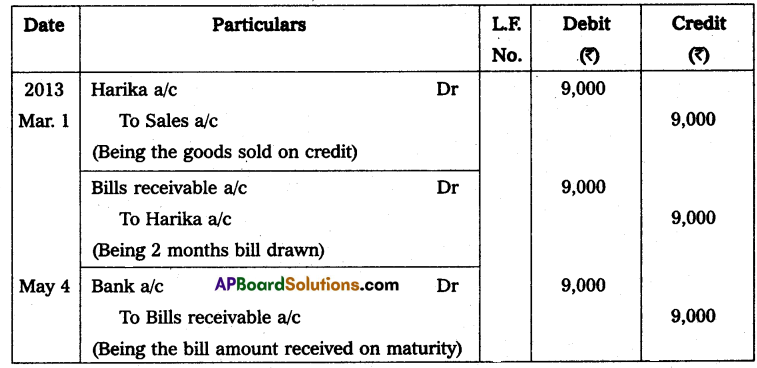

On 1st March 2013, Radhika sold goods to Harika worth ₹ 9,000 and drew a bill for 2 months for the same amount. Harika accepted the bill and returned it to Radhika. The bill is honoured on the date of maturity.

Pass the necessary Journal entries in the books of Radhika and Harika.

Solution:

Journal entries in the books of Radhika

Journal entries in the books of Harika

![]()

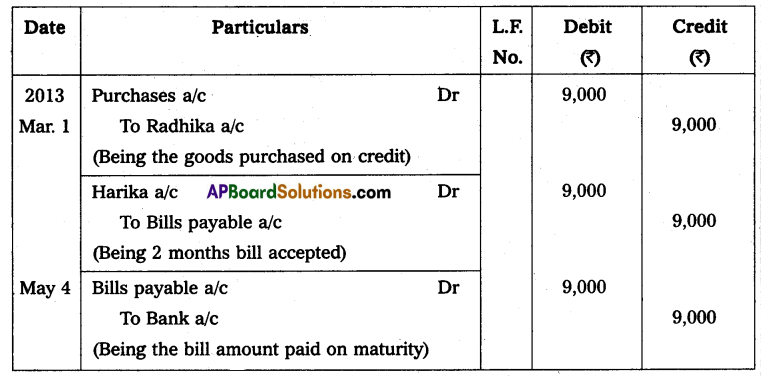

Question 3.

On 25th March 2014, Vinod drew a bill for 3 months on Prakash for ₹ 3,000. Prakash accepted the bill and handed it over the bill to Vinod. The bill is honoured on the date of maturity.

Show the journal entries in the books of Vinod and Prakash.

Solution:

Journal entries in the books of Vinod

Journal entries in the books of Prakash

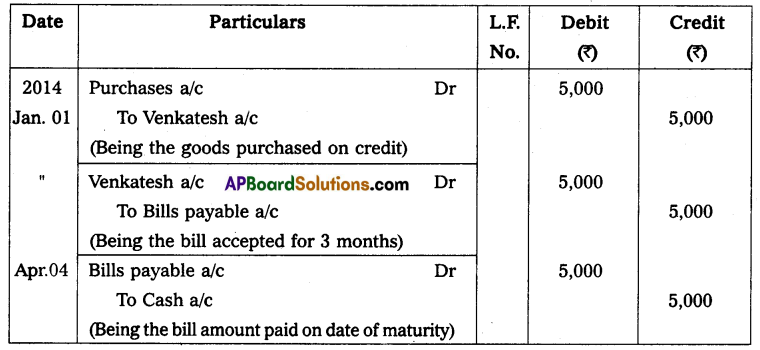

Question 4.

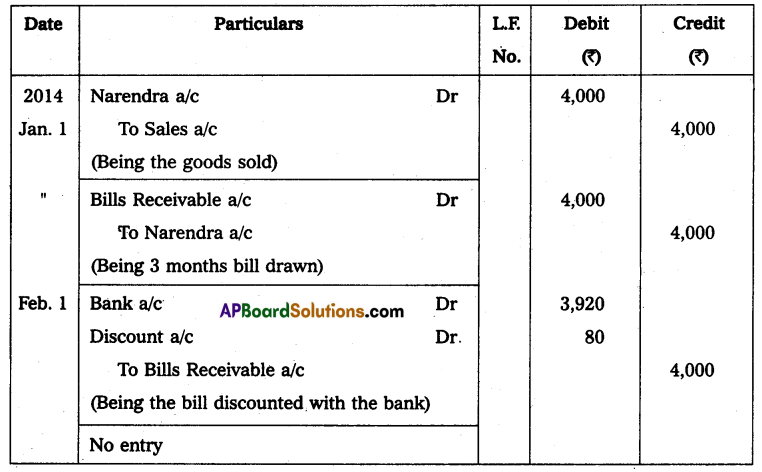

On 1st January 2014, Rajendra sold goods to Narendra worth ₹ 4,000 and drew a bill on Narendra payable after three months. After securing Narendra’s acceptance, Rajendra discounted the bill with his bank at 12% p.a. on 1st February 2014. On the due date, the bill is honoured.

Pass necessary journal entries in the books of Rajendra and Narendra.

Solution:

Journal entries in the books of Rajendra

Journal entries in the books of Narendra

Question 5.

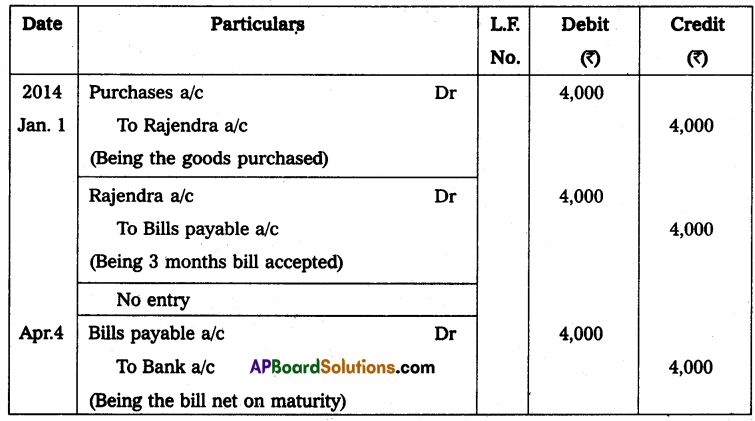

Amar sold goods for ₹ 10,000 to Sundar OD credit on 1st July 2014. Amar drew a bill of exchange on Sundar for the same amount for three months. Sundar accepted the bill and returned it to Amar. Amar discounted the bill with his bank at 10% per annum on the same day. Sundar met bis acceptance on maturity.

Pass necessary journal entries in the books of Amar and Sundar.

Solution:

Journal entries in the books of Amar

Journal entries in the books of Sundar

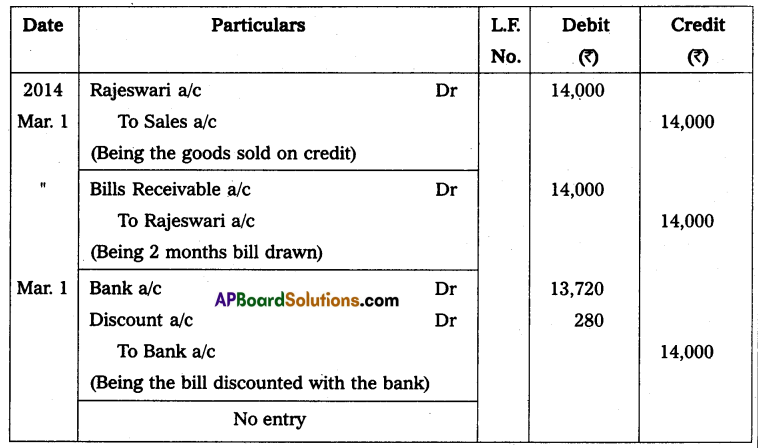

Question 6.

Sandhya sold goods for ₹ 14,000 to Rajeswari on 1st March 2014 and drew upon her a bill of exchange payable after 2 months. Rajeswari accepted the bill and handed over the same to Sandhya. Sandhya immediately discounted the bill with her bank @ 12% p.a. On the due date, Rajeswari met her acceptance.

Pass the necessary journal entries in the books of Sandhya and Rajeswari.

Solution:

Journal entries in the books of Sandhya

Journal entries in the books of Rajeswari

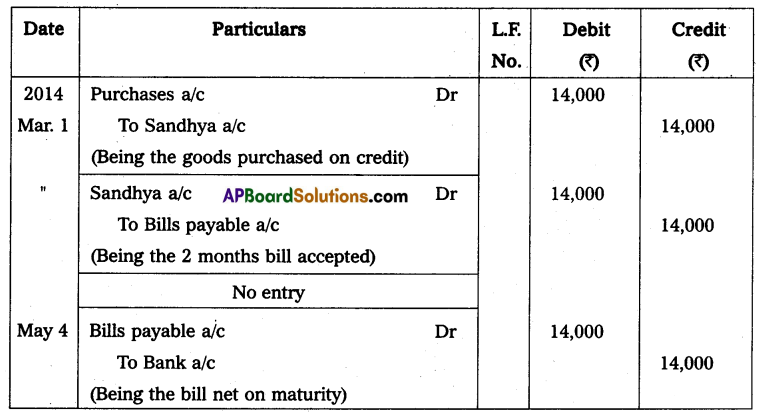

Question 7.

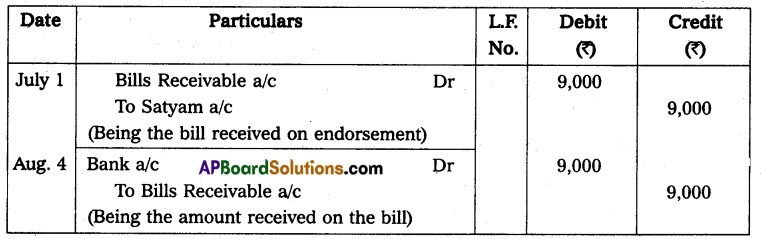

Satyam sold goods to Sivam worth ₹ 9,000 on 1st June 2013 and drew a bill for 2 months for the same amount. Sivam accepted the bill and returned it to Satyam. Satyam endorsed the bill to his creditor Sundaram on 1st July 2013. The bill was honoured on the due date.

Pass necessary journal entries in the books of Satyam, Sivam, and Sundaram.

Solution:

Journal entries in the books of Satyam

Journal entries in the books of Sivam

Journal entries in the books of Sundaram

![]()

Question 8.

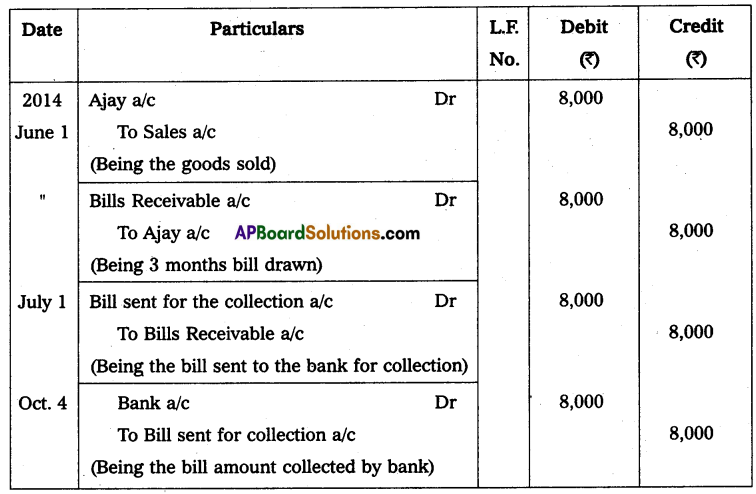

On 1st July 2014, Ajay purchased goods worth ₹ 8,000 from Kiran and accepted the bill which was drawn by Kiran payable after three months for the same amount. Kiran sent the bill to his bank for collection. The bill was honoured on the date of maturity.

Pass necessary journal entries in the books of Kiran and Ajay.

Solution:

Journal entries in the books of Kiran

Journal entries in the books of Ajay

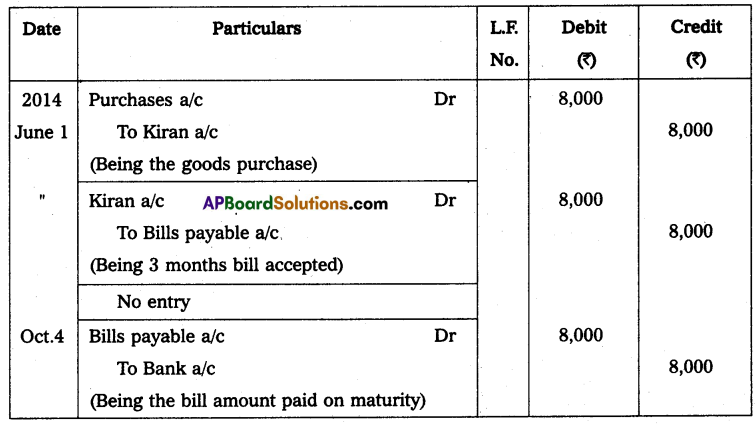

Question 9.

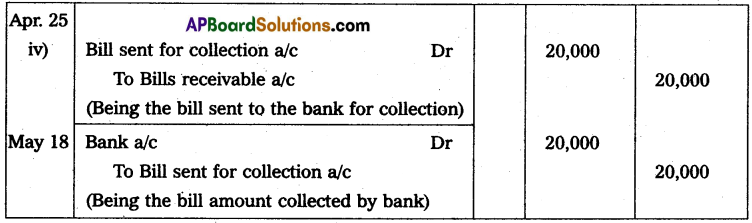

Jayaram sold goods for ₹ 20,000 to Sivaram on 15th March 2014 and drew upon him a bill of exchange payable after two months. Sivaram accepted the bill and returned the same to Jayaram. On the due date, the bill was honoured.

Pass the necessary journal entries in the books of Jayaram and Sivaram in the following circumstances.

I. When the bill was retained by Jayaram till the date of its maturity.

II. When Jayaram immediately discounted the bill @ 6% p.a. with his bank.

III. When the bill was endorsed immediately by Jayaram in favour of his creditor Seetharam.

IV. When the bill was sent by Jayaram to his bank for collection on 25th April 2014.

Solution:

Journal entries in the books of Jayaram

Journal entries in the books of Sivaram

B. Dishonour of bills of exchange

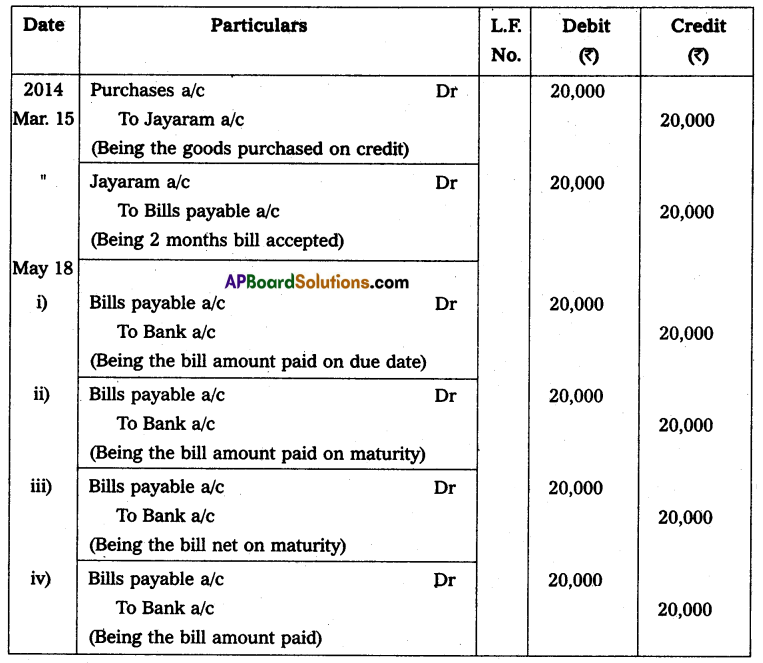

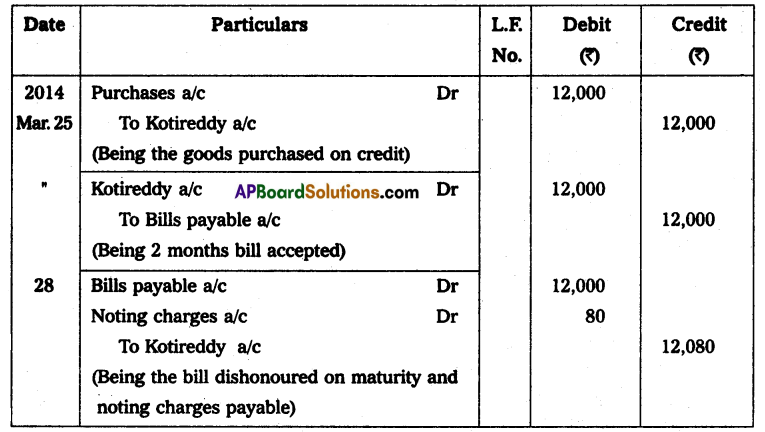

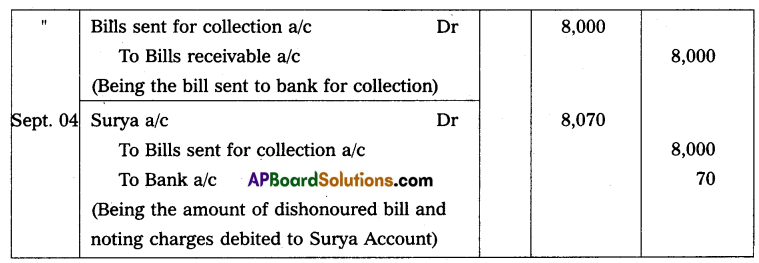

Question 10.

Kotireddy purchased goods worth ₹ 12,000 from Rajareddy on 25th March 2014 and accepted a bill of exchange drawn upon him by Rajareddy payable after two months. On the date of maturity, Kotireddy dishonoured the bill. Rajareddy paid ₹ 80 as noting charges.

Pass the necessary journal entries in the books of Rajareddy and Kotireddy.

Solution:

Journal entries in the books of Kotireddy

Journal entries in the books of Rajareddy

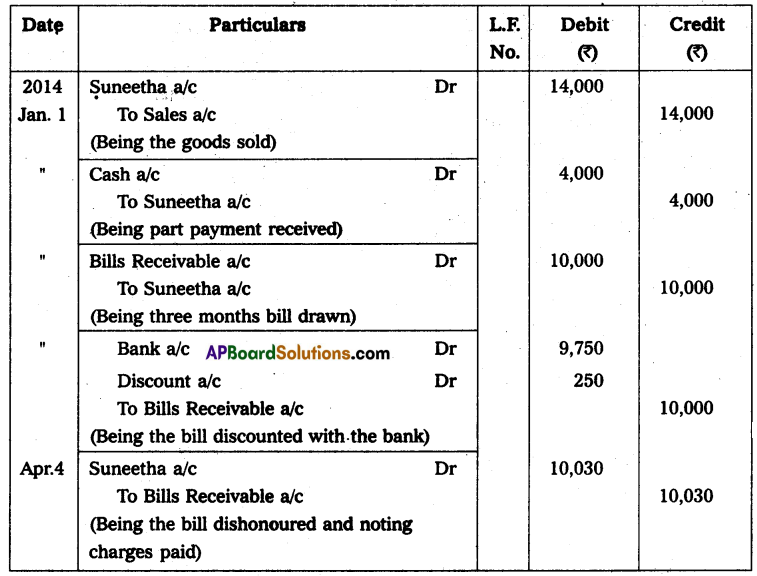

Question 11.

Parvathi sold goods worth ₹ 14,000 to Suneetha on 1st January 2014. Suneetha paid ₹ 4,000 immediately and for the balance, she accepted a bill of exchange drawn upon her by Parvathi payable after 3 months. Parvathi discounted the bill immediately with her bank @ 10% p.a. On the due date, Suneetha dishonoured the bill and the bank paid ₹ 30 as noting charges.

Pass the necessary journal entries in the books of Parvathi and Suneetha.

Solution:

Journal entries in the books of Parvathi

Journal entries in the books of Suneetha

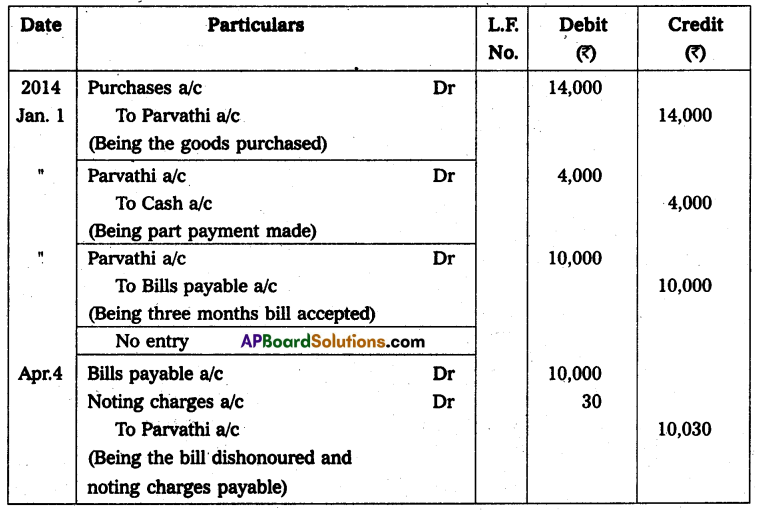

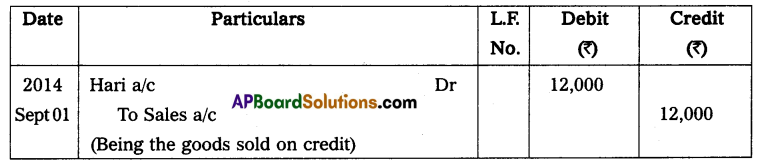

Question 12.

On 1st January 2014, Hari accepted 3 months bill for ₹ 12,000 drawn on him by Raju. Raju discounted the bill with his bank @ 9% p.a. on the Same day. On the due date, Hari dishonoured his acceptance.

Pass the necessary journal entries in the books of Raju and Hari.

Solution:

Journal entries in the books of Raju

Journal entries in the books of Hari

![]()

Question 13.

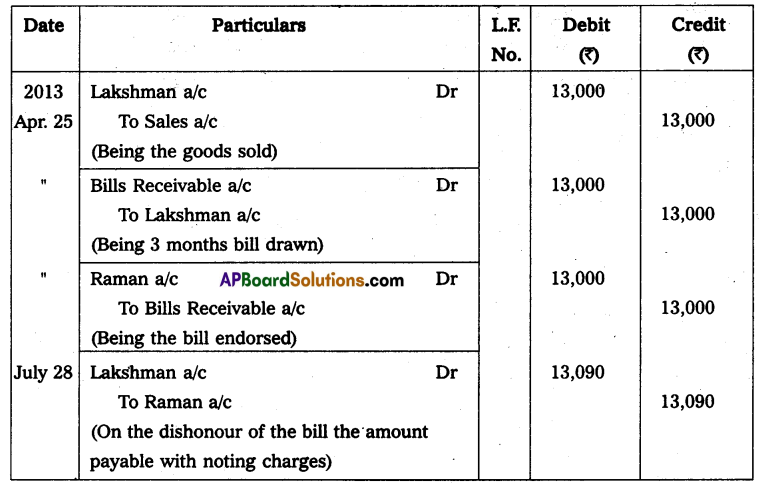

On 25th April 2013, Bhagavan sold goods for ₹ 13,000 to Lakshman and drew upon him a bill of exchange for 3 months for the same amount Lakshman accepted the bill and sent the same to Bhagavan. Bhagavan endorsed the bill in favour of his creditor Raman. On the due date, the bill was dishonoured and Raman paid ₹ 90 as Noting charges.

Pass the necessary journal entries in the books of Bhagavan and Lakshman.

Solution:

Journal entries in the books of Bhagavan

Journal entries in the books of Lakshman

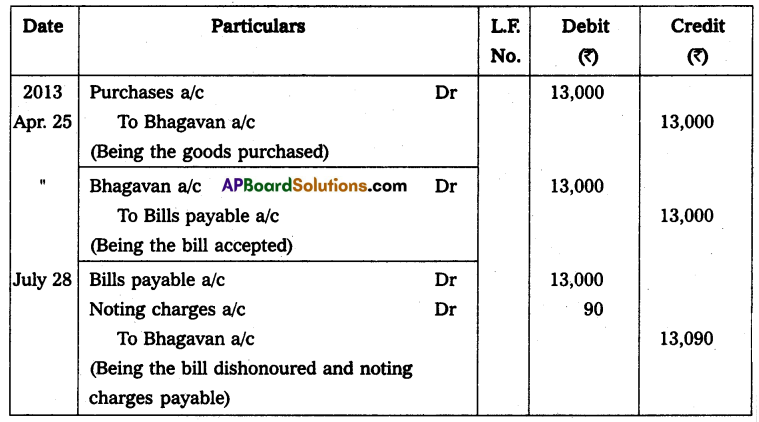

Question 14.

Manga purchased goods for ₹ 20,000 from Gangs on 1st February 2013 and accepted a bill of exchange drawn by Gangs for the same amount payable after 2 months. On 20th February 2013 Gangs sent the bill to her bank for collection. On the due date, Manga dishonoured the bill and the bank paid ₹ 100 as noting charges.

Pass the necessary journal entries in the books of Gangs and Manga.

Solution:

Journal entries in the books of Ganga

Journal entries in the books of Manga

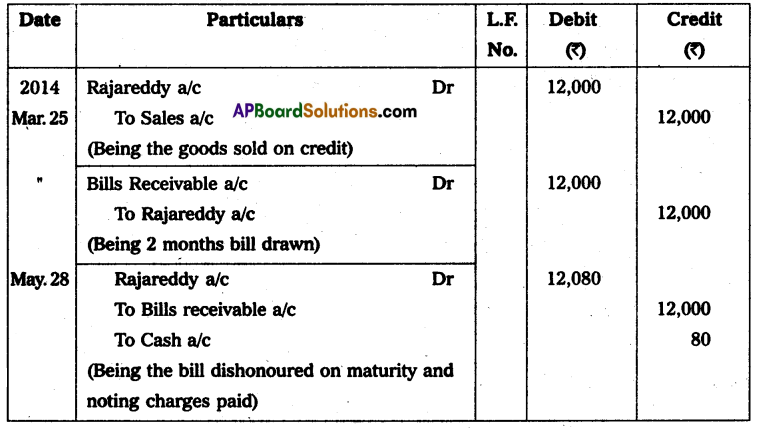

Question 15.

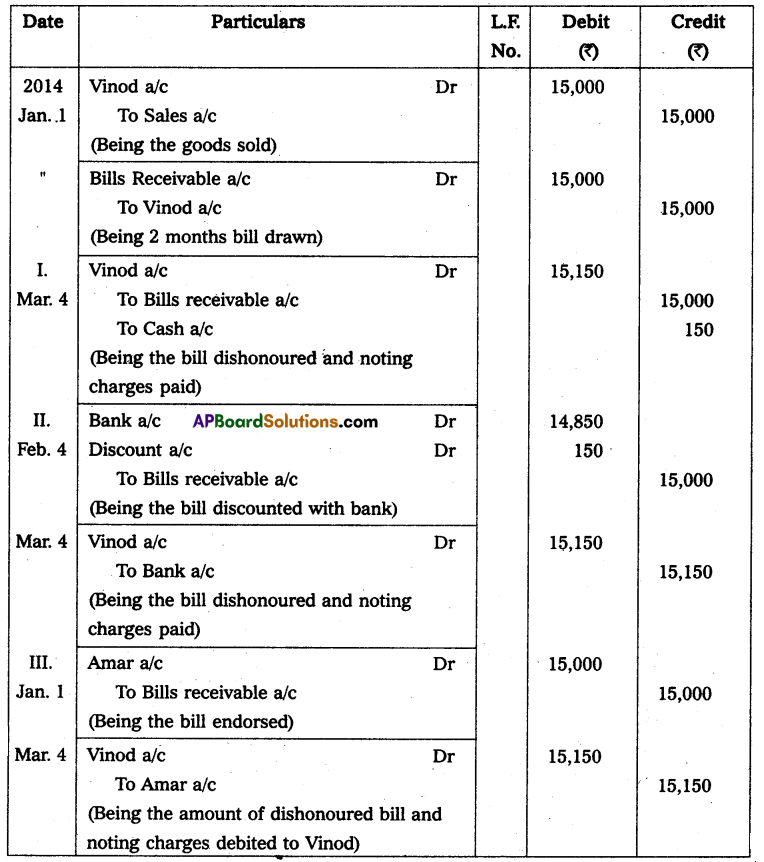

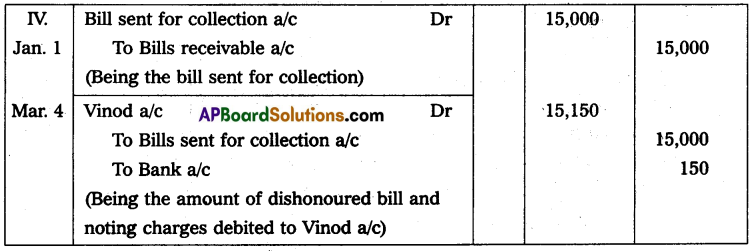

Mohan sold goods for ₹ 15,000 to Vinod on 1st January 2014 and drew upon him a bill of exchange for the same amount to payable after two months. Vinod accepted the bill and handed it over the bill to Mohan. On the due date, the bill was dishonoured.

Pass the necessary journal entries in the books of Mohan and Vinod in the following cases.

I. When Mohan retained the bill till the due date and paid ₹ 150 as noting charges.

II. When Mohan discounted the bill @ 12% p.a. on 4th February 2014 and the bank paid ₹ 150 as noting charges.

III. When Mohan endorsed the bill immediately in favour of his creditor Amar and paid ₹ 150 as noting charges.

IV. When Mohan sent the bill to his bank for collection on 25th January 2014 and bank paid ₹ 150 as noting charges.

Solution:

Journal entries in the books of Mohan

Journal entries in the books of Vinod

C. Renewal of a bill

Question 16.

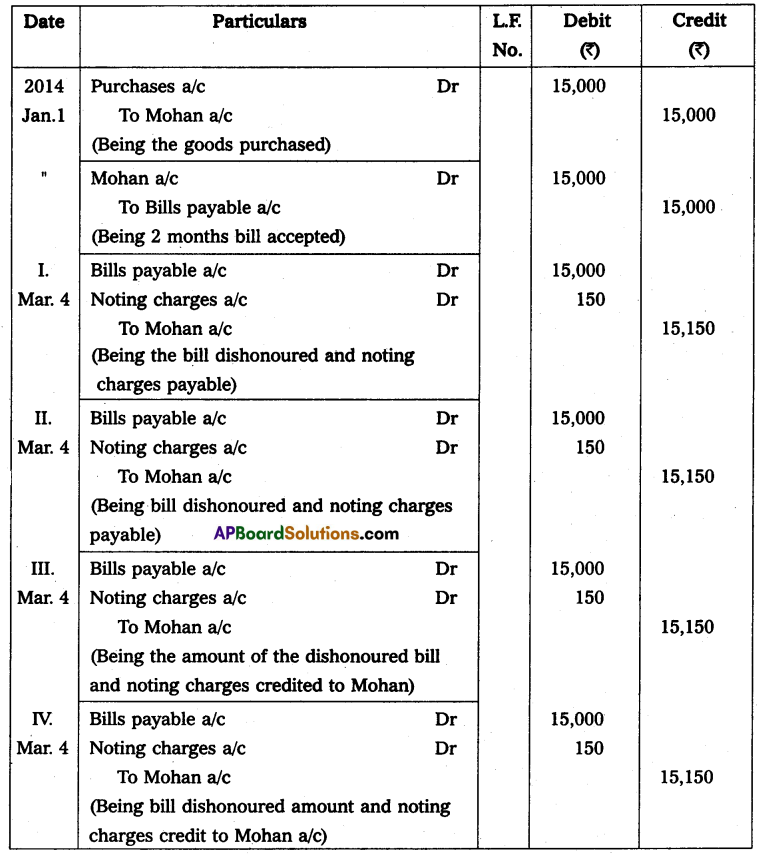

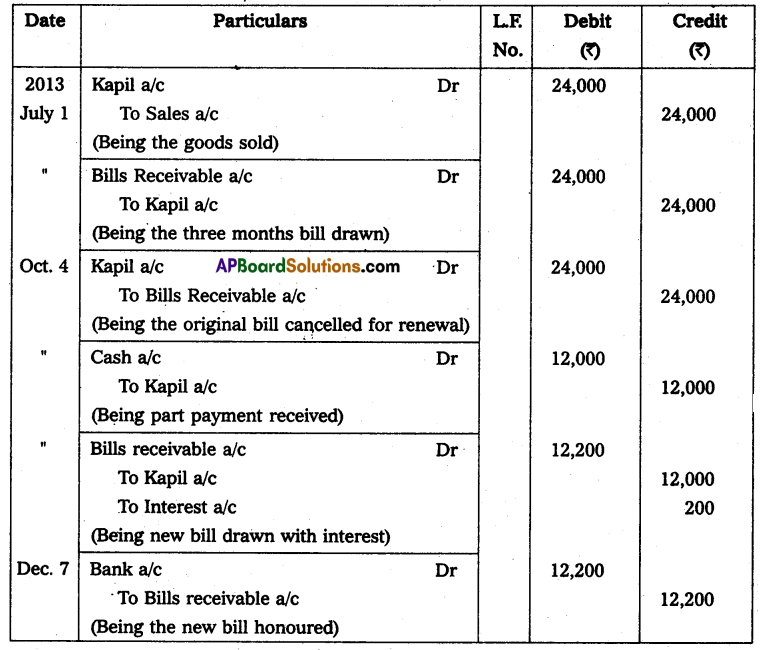

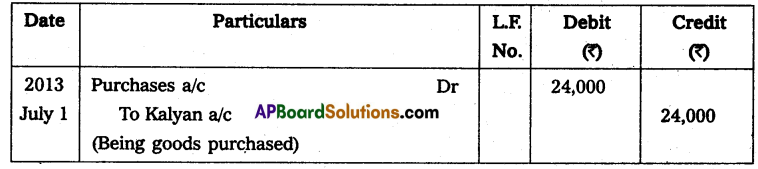

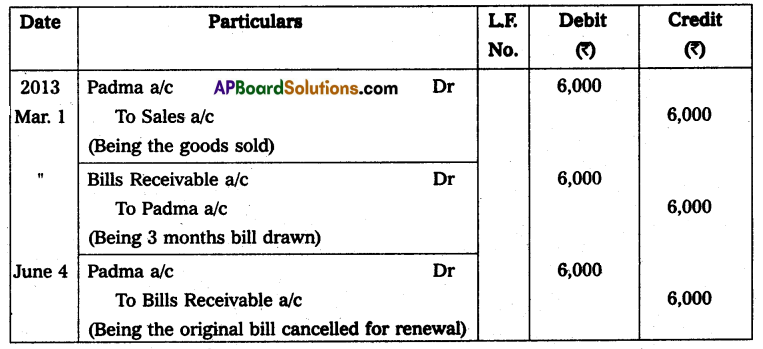

On 1st July 2013, Kalyan sold goods to Kapil for ₹ 24,000 and drew upon him a bill for the same amount payable after 3 months. Kapil accepted the bill and returned it to Kalyan. On the due date, Kapil expressed his inability to honour the bill and offered to pay ₹ 12,000 in cash and to accept a new bill for the balance amount including interest at 10% p.a. for 2 months. Kalyan agreed to this proposal. On the due date, the new bill was honoured.

Pass the necessary journal entries in the books of Kalyan and Kapil.

Solution:

Journal entries in the books of Kalyan

Journal entries in the books of Kapil

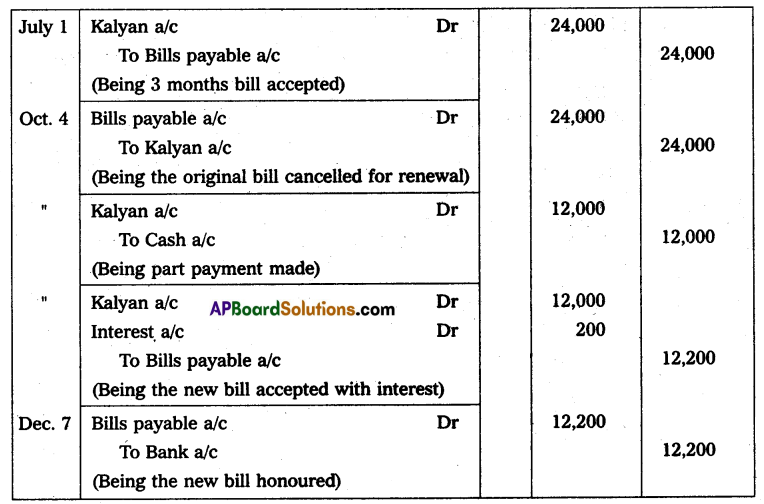

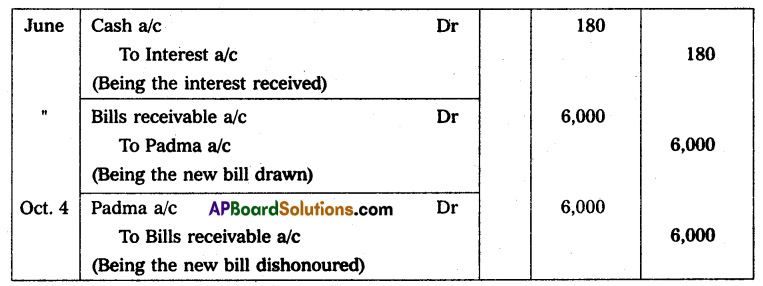

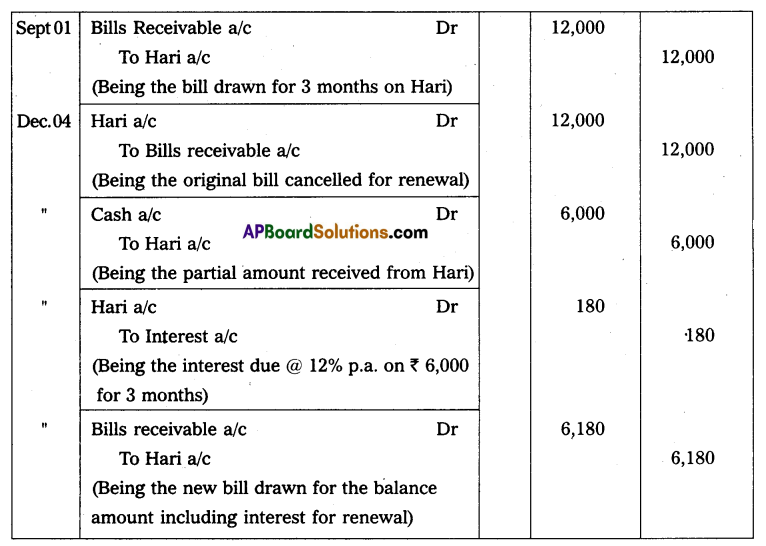

Question 17.

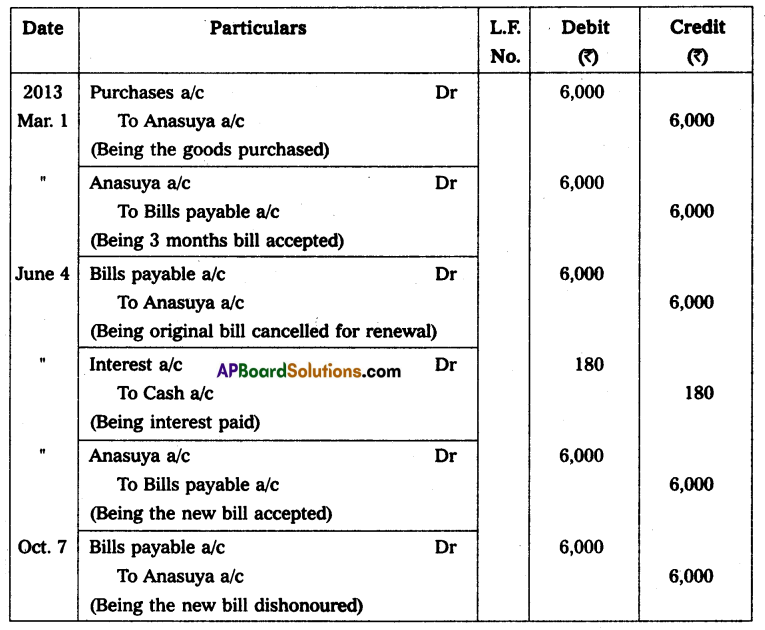

Anasuya sold goods worth ₹ 6,000 to the Padma on 1st March 2013 and drew upon her a bill for the same amount payable after three months. The Padma accepted the bill and sent it back to Anasuya. On the due date, Padma expressed her inability to honour the bill and requested Anasuya to cancel the original bill and draw a new bill for three months. Anasuya agreed the proposal provided interest at 12% was paid immediately in cash. The Padma paid such interest in cash and accepted a new bill. The new bill was dishonoured on the due date.

Pass the necessary journal entries in the books of Anasuya and Padma.

Solution:

Journal entries in the books of Anasuya

Journal entries in the books of Padma

![]()

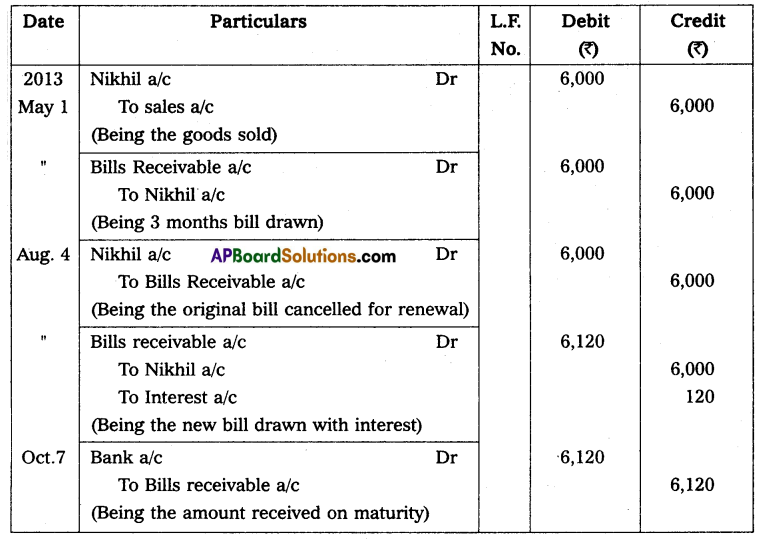

Question 18.

On 1st May 2014 Akhil sold goods to Nikhil for ₹ 6,000 on credit and drew a bill on him for three months for the same amount. Nikhil accepted the bill and returned it to Akhil. On 4th August 2014, Nikhil requested Akhil to draw a new bill for the amount due. Akhil agreed to draw a new bill for 2 months but he charged interest @ 12% p.a. This bill was honoured on its maturity.

Pass necessary journal entries in the books of Akhil and Nikhil.

Solution:

Journal entries in the books of Akhil

Journal entries in the books of Nikhil

D. Retiring of a bill under rebate

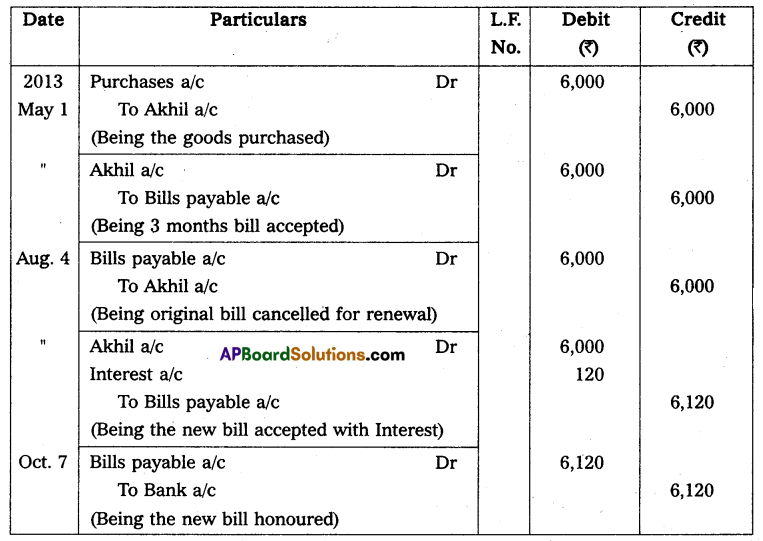

Question 19.

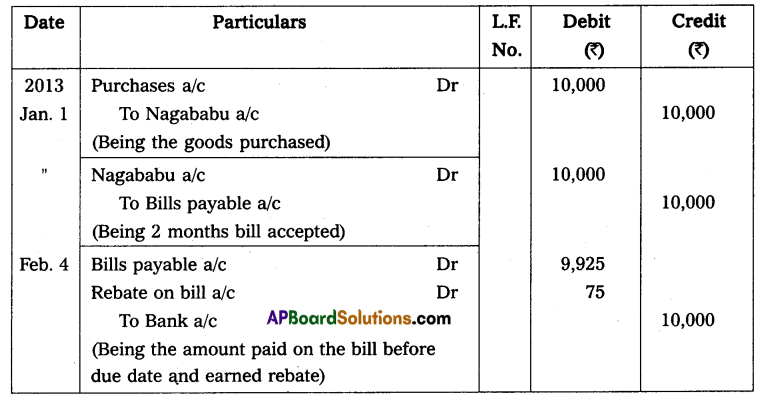

On 1st January 2013, Nagababu sold goods for ₹ 10,000 to Damodhar and drew upon him a bill of exchange payable after two months. Damodhar accepted the bill and handed over the same to Nagababu. One month before the maturity of the bill Damodhar approached Nagababu to accept the payment against the bill under a rebate of 9% p.a. Nagababu agreed to the request Damodhar. Damodhar retired the bill under the agreed rate of rebate.

Pass the necessary journal entries in the books of Nagababu and Damodhar.

Solution:

Journal entries in the books of Nagababu

Journal entries in the books of Damodhar

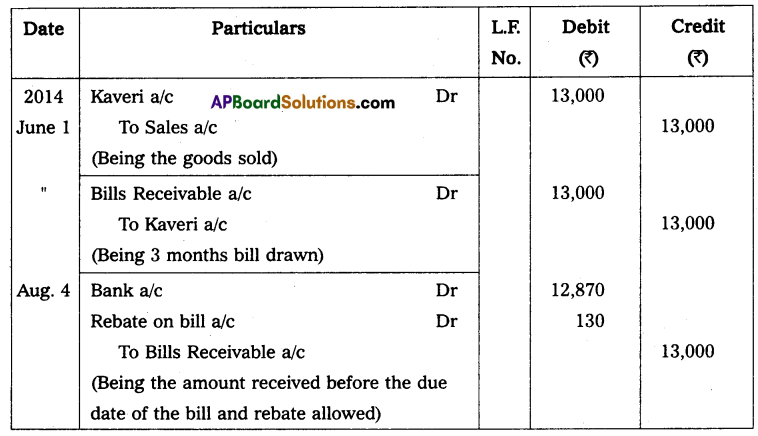

Question 20.

On 1st June 2014, Meghana sold goods for ₹ 13,000 to Kaveri and drew upon her a bill of exchange payable after 3 months. Kaveri accepted the bill and returned it to Meghana. One month before the maturity of the bill Kaveri approached Meghana to accept the payment against the bill under a rebate of 12% p.a. Meghana agreed to the request of Kaveri to retire the bill under the agreed rate of rebate.

Pass the necessary journal entries in the books of Meghana and Kaveri.

Solution:

Journal entries in the books of Meghana

Journal entries in the books of Kaveri

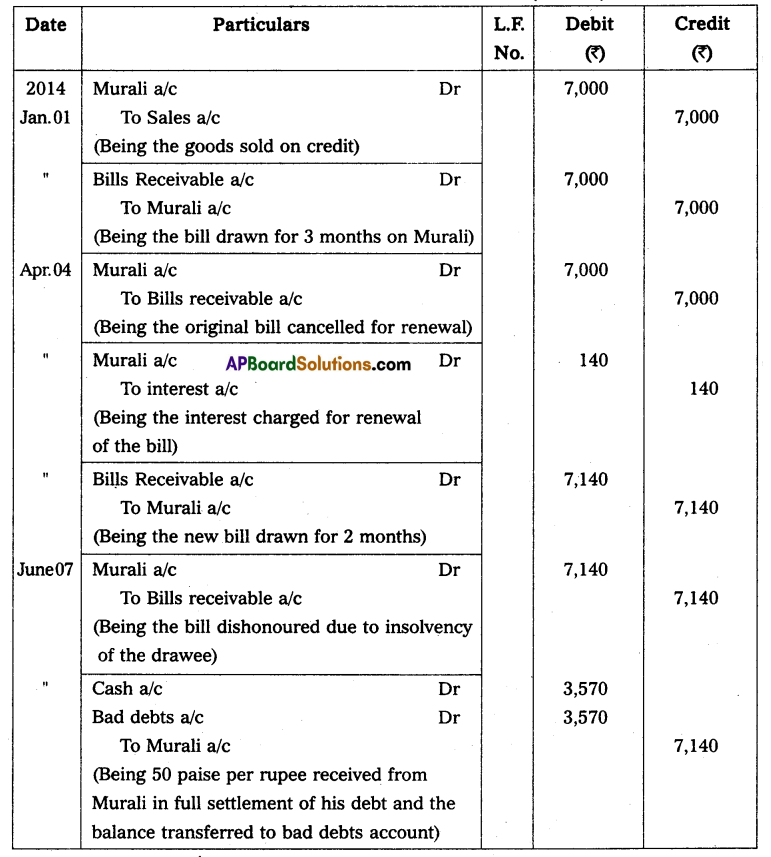

E. Insolvency of Drawee

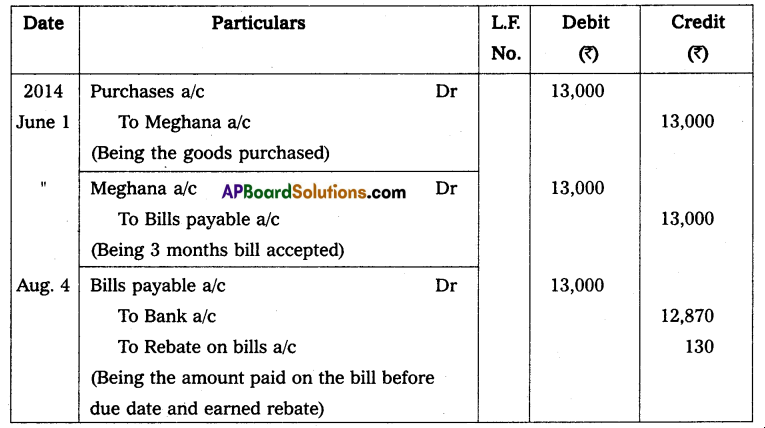

Question 21.

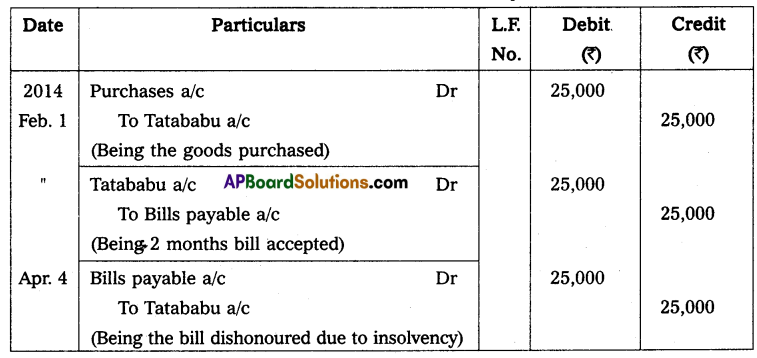

Jayababu purchased goods for ₹ 25,000 from Tatababu on 1st February 2014 and accepted a bill of exchange drawn by Tatababu for the same amount The bill was payable after 2 months. Before the due date of the bill, Jayababu became insolvent and nothing could be recovered from his estate.

Write necessary journal entries in the books of Tatababu and Jayababu.

Solution:

Journal entries in the books of Tatababu

Journal entries in the books of Jayababu

![]()

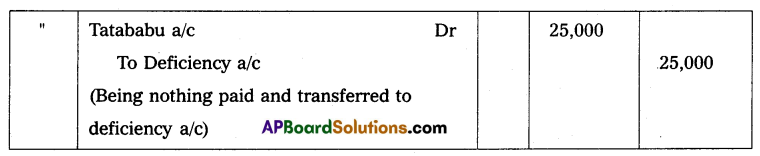

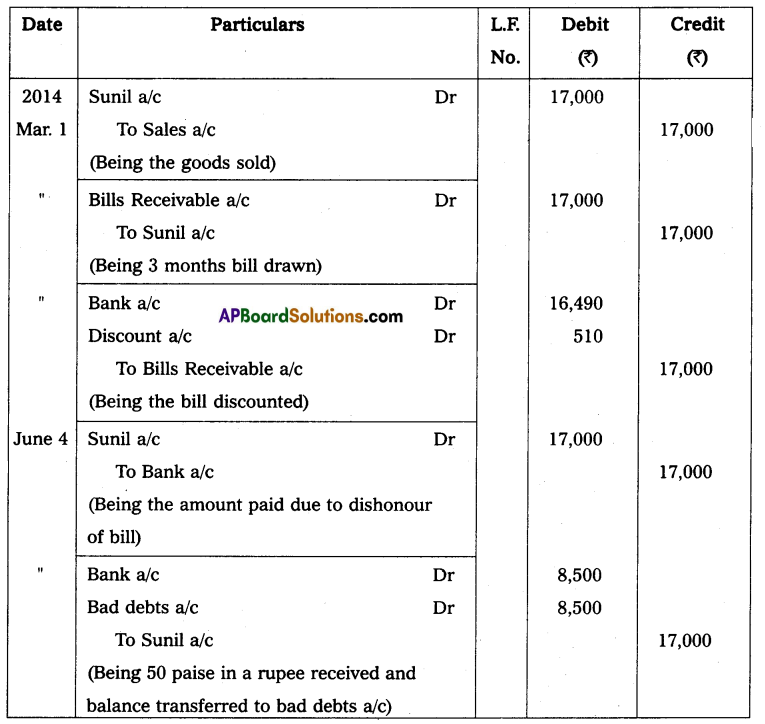

Question 22.

Anil sold goods worth ₹ 17,000 to Sunil on 1st March 2014 and drew upon him a bill for three months for the same amount Sunil accepted the bill and handed over it to Anil. On the same day, Anil discounted the bill @ 12% p.a. with his bank. Before the due date of the bill, Sunil became insolvent and only 50 paise in a rupee could be recovered from his estate.

Pass necessary journal entries in the books of Anil and Sunil.

Solution:

Journal entries in the books of Anil

Journal entries in the books of Sunil

Textual Examples

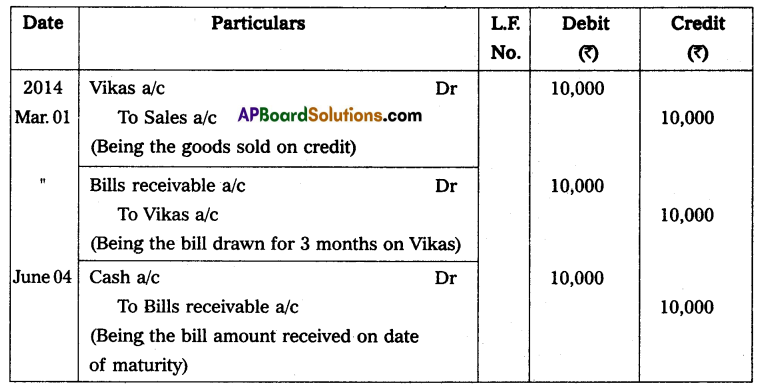

Question 1.

On 1st March 2014, Ravi sold goods for ₹ 10,000 to Vikas on credit and drew a bill for 3 months for the same amount Vikas accepted the bill and returned it to Ravi. This bill is honoured on the date of maturity.

Pass the necessary journal entries in the books of Ravi and Vikas.

Solution:

Journal entries in the books of Ravi (Drawer)

Journal entries in the books of Vikas (Drawee)

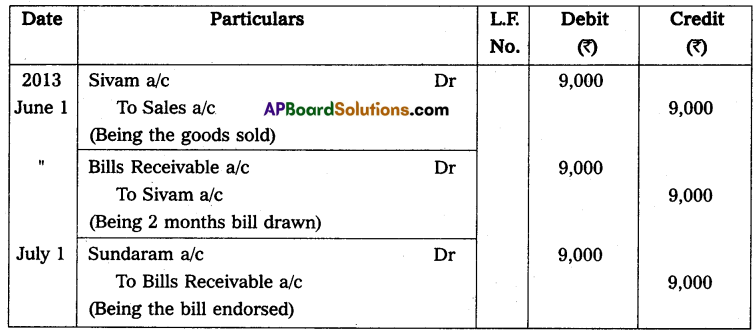

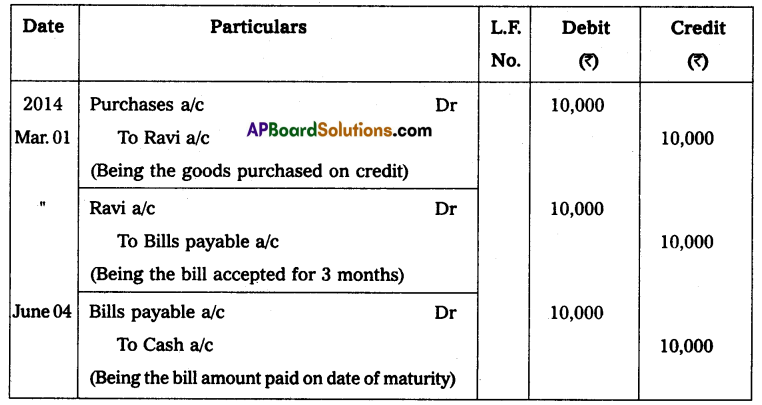

Question 2.

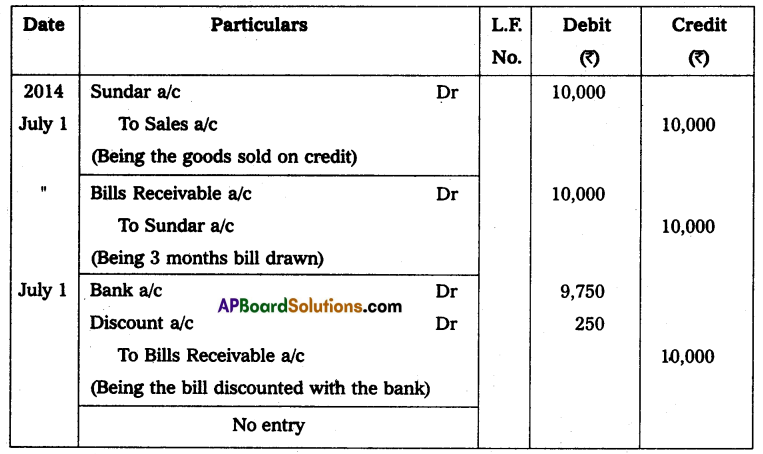

On 1st January 2013, Sankar sold goods worth ₹ 20,000 to Bhaskar on credit and drew a bill for 3 months for the same amount. Bhaskar accepted the bill and returned it to Sankar. On the same day, Sankar discounted the bill with his bank at 10% per annum. On the due date, the bill is honoured.

Pass the necessary journal entries in the books of Sankar and Bhaskar.

Solution:

Journal entries in the books of Sankar (Drawer)

Journal entries in the books of Bhaskar (Drawee)

![]()

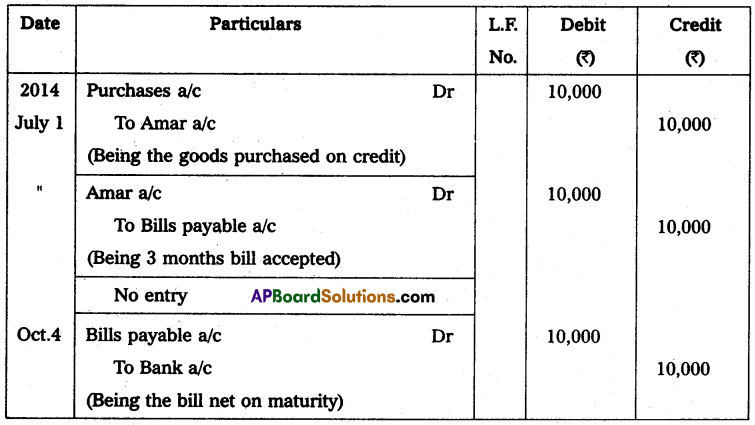

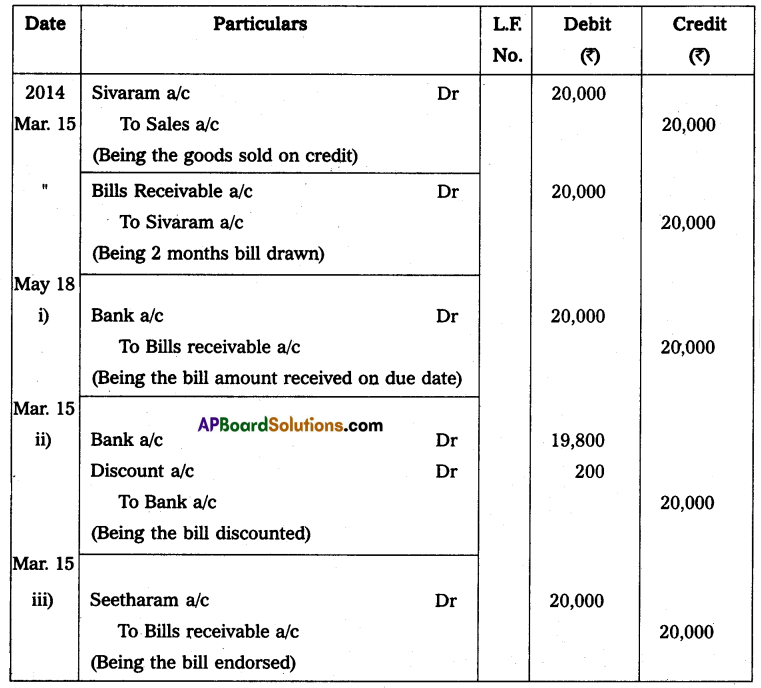

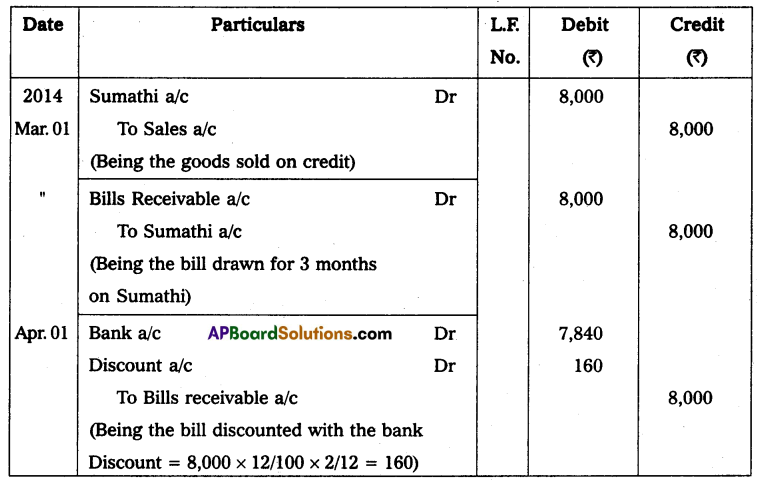

Question 3.

On 1st March 2014, Sumathi purchased goods for ₹ 8,000 from Lakshmi and accepted a bill for the same amount drawn by Lakshmi payable after 3 months. Lakshmi discounted the bill with her bank on 1st April 2014 at 12% per annum. Sumathi met her acceptance on the due date.

Pass the necessary journal entries in the books of Lakshmi and Sumathi.

Solution:

Journal entries in the books of Lakshmi (Drawer)

Journal entries in the books of Sumathi (Drawee)

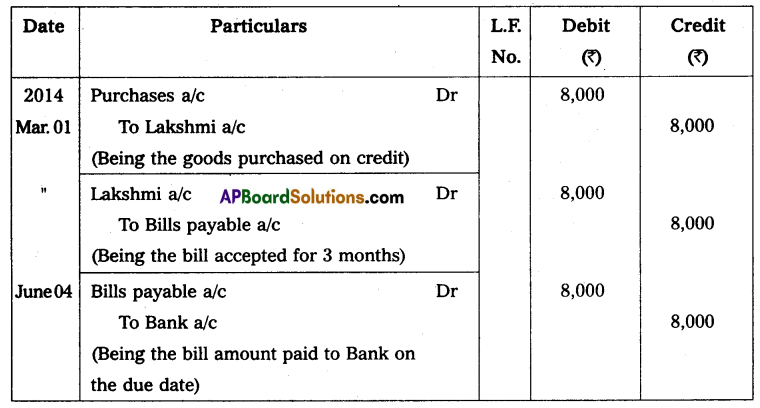

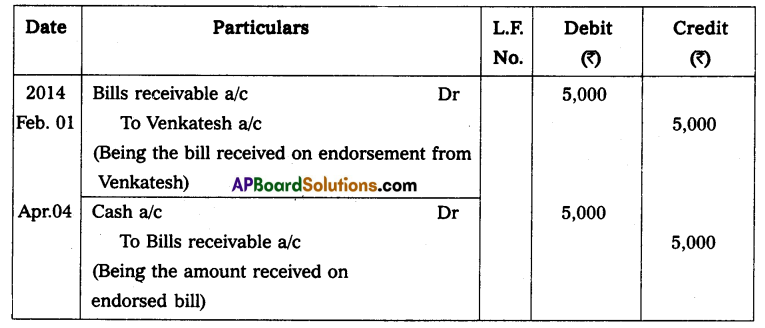

Question 4.

On 1st January 2014, Venkatesh sold goods worth ₹ 5,000 to Nagarjuna and drew a bill on Nagarjuna for 3 months for the same amount Nagaijuna accepted the bill and returned it to Venkatesh. On 1st February 2014, Venkatesh endorsed the bill in favour of his creditor Prabhakar in the settlement of his debt. The bill was honoured on the due date.

Pass the necessary journal entries in the books of Venkatesh, Nagarjuna, and Prabhakar.

Solution:

Journal entries in the books of Venkatesh (Drawer)

Journal entries in the books of Nagarjuna (Drawee)

Journal entries in the books of Prabhakar (Endorsee)

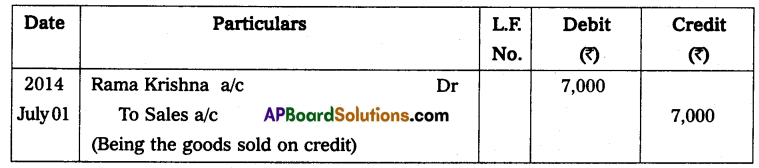

Question 5.

On 1st July 2014, Parasuram sold goods to Rama Krishna for ₹ 7,000 and drew a bill on him for the same amount for two months. Rama Krishna accepted the bill and returned the same to Parasuram. Immediately after its acceptance, Parasuram sent the bill to his bank for collection. On the due date, bill is honoured.

Pass necessary journal entries in the books of Parasuram and Rama Krishna.

Solution:

Journal entries in the books of Parasuram (Drawer)

Journal entries in the books of Rama Krishna (Drawee)

![]()

Question 6.

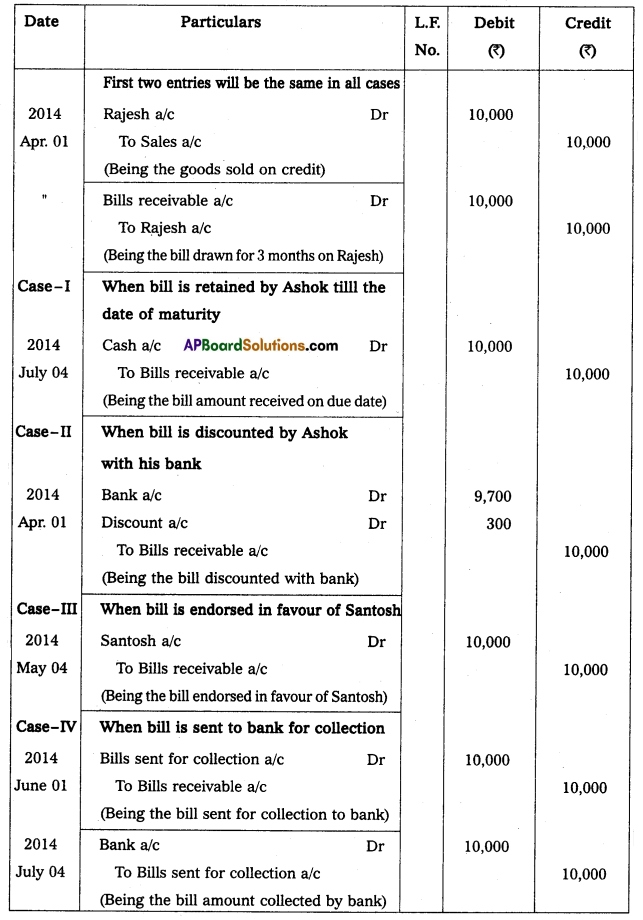

Ashok sold goods to Rajesh on 1st April 2014 for ₹ 10,000 on credit and drew upon him a bill for the same amount payable after 3 months. Rajesh accepted the bill and returned it to Ashok. On the date of maturity, a bill was presented to Rajesh for payment and he honoured it.

Pass the journal entries in the books of Ashok and Rajesh when

Case I: Bill is retained by Ashok till the date of maturity.

Case II: Bill is discounted by Ashok with his bank on the same date @ 12% p.a.

Case III: Bill is endorsed in favour of Santosh on 4th May 2014.

Case IV: Bill is sent to the bank for collection on 1st June 2014.

Also, record the journal entries in the books of Santosh.

Solution:

Journal entries in the books of Ashok (Drawer)

Journal entries in the books of Rajesh (Drawee)

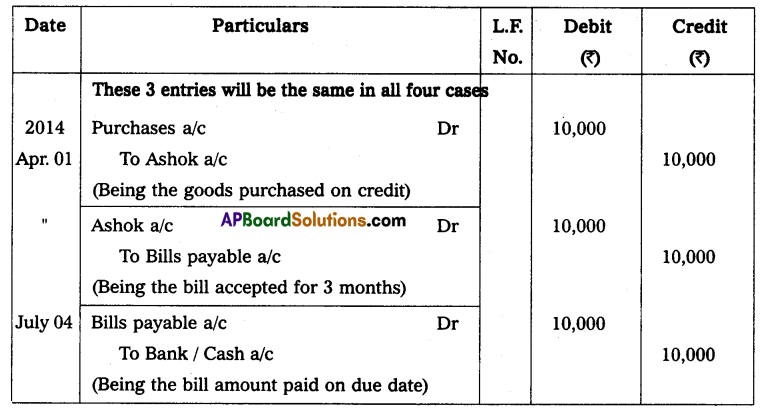

Journal entries in the books of Santosh (Endorsee)

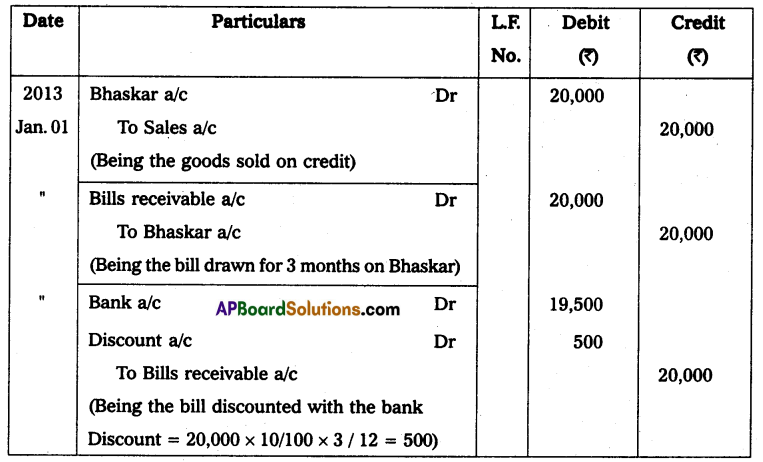

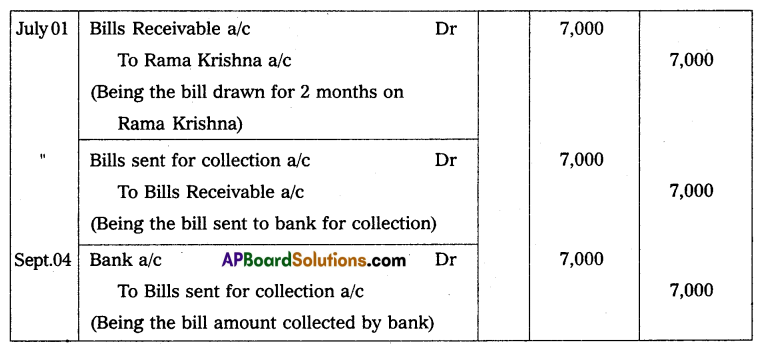

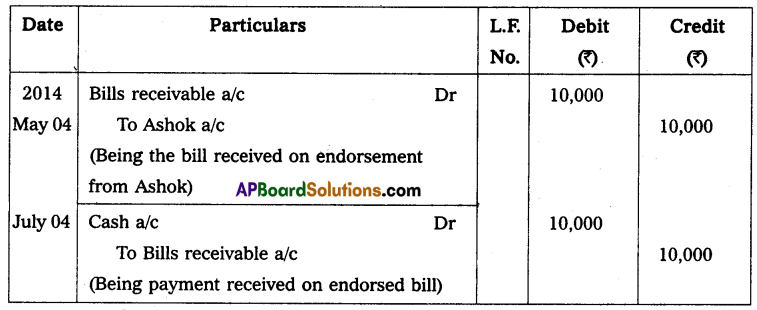

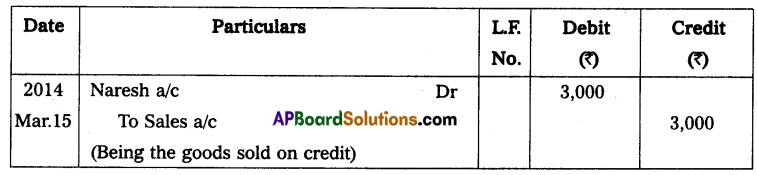

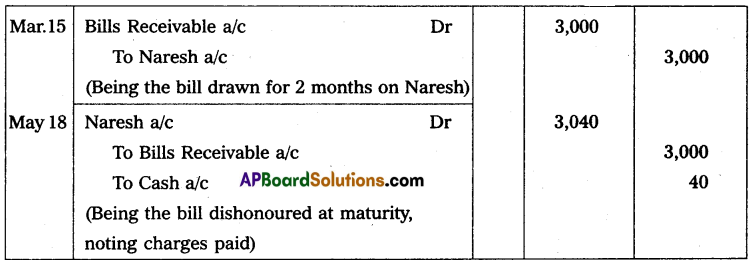

Question 7.

On 15th March 2014, Suresh sold goods for ₹ 3,000 to Naresh on credit. Naresh accepted the bill of exchange drawn upon him by Suresh payable after 2 months. On the due date, the bill was dishonoured and Suresh paid ₹ 40 as noting charges.

Pass the journal entries in the books of Suresh and Naresh.

Solution:

Journal entries in the books of Suresh (Drawer)

Journal entries in the books of Naresh (Drawee)

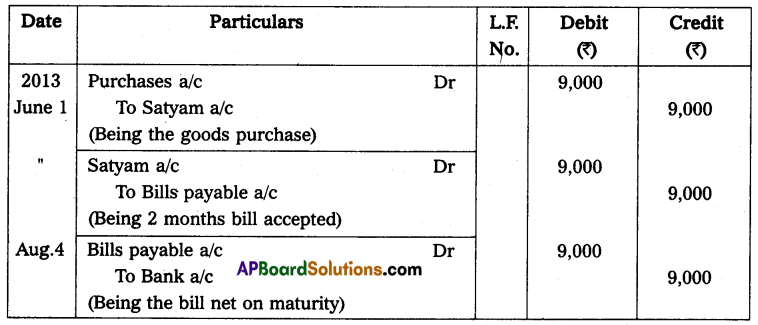

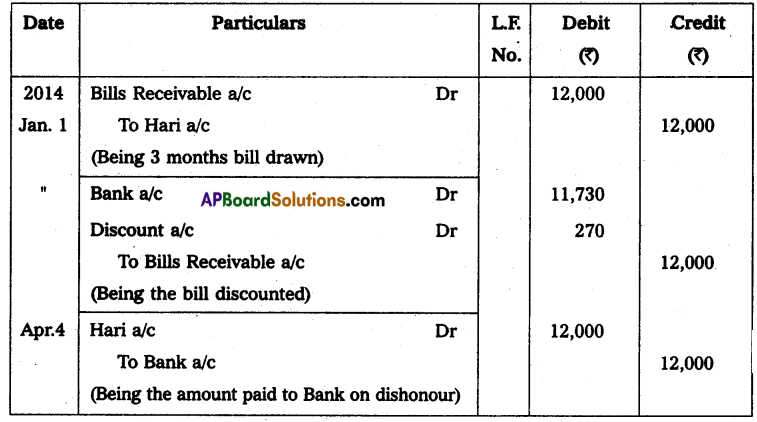

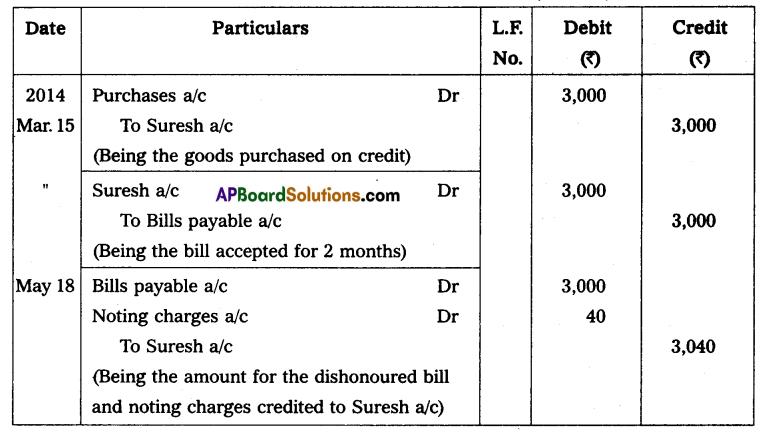

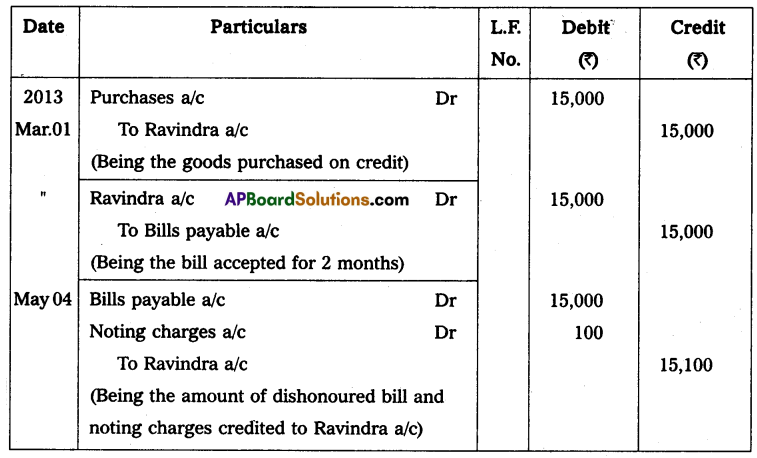

Question 8.

Narayana purchased goods for ₹ 15,000 from Ravindra on 1st March 2013. Ravindra drew upon Narayana a bill of exchange for the same amount payable after two months. The bill was immediately discounted by Ravindra with his bank @ 6% p.a. On the due date, the bill was dishonoured and Bank paid ₹ 100 as noting charges.

Pass the necessary journal entries in the books of Ravindra and Narayana.

Solution:

Journal entries in the books of Ravindra (Drawer)

Journal entries in the books of Narayana (Drawee)

![]()

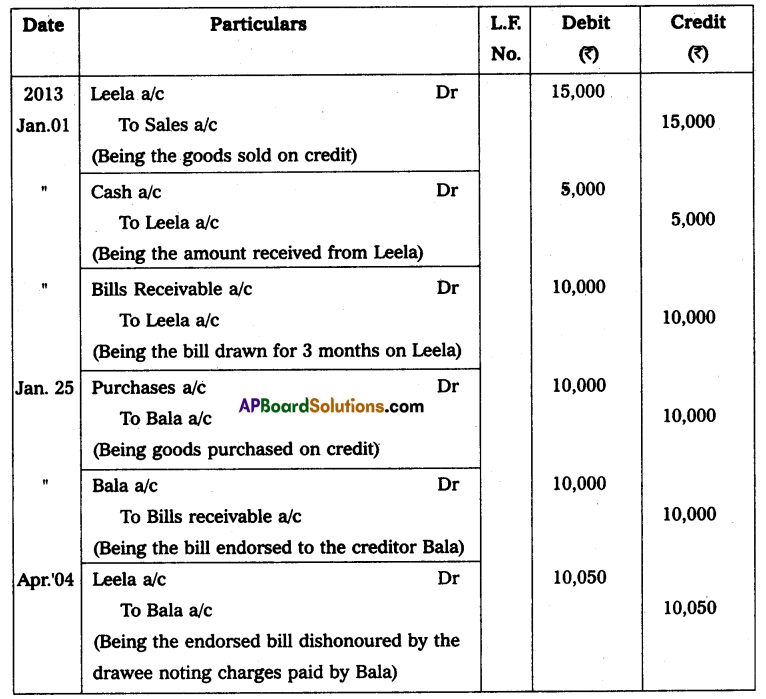

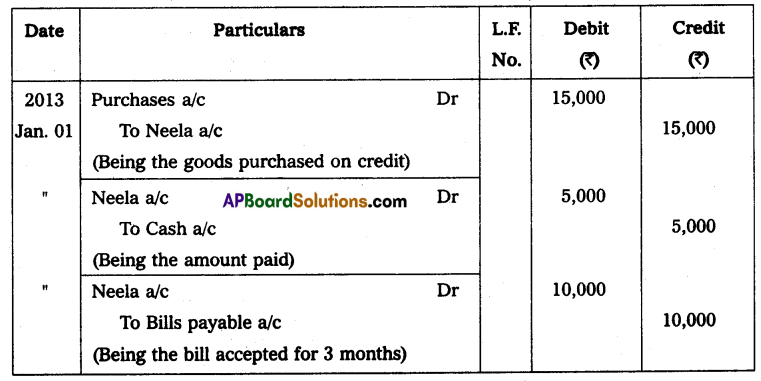

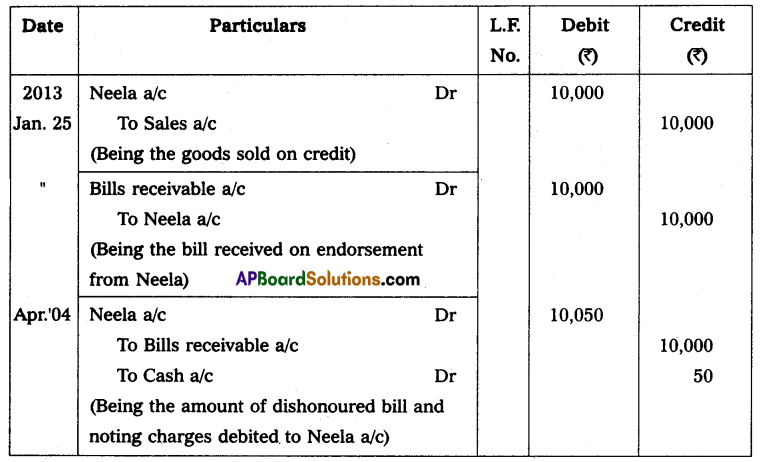

Question 9.

On 1st January 2013, Leela purchased goods for ₹ 15,000 from Neela. She immediately made a payment of ₹ 5,000 by cash and for the balance accepted the bill of exchange for 3 months drawn upon her by Neela. On 25th January 2013, Neela purchased goods worth ₹ 10,000 from Bala and endorsed the above bill to Bala. On the due date, the bill was dishonoured and Bala paid ₹ 50 as noting charges.

Pass the necessary journal entries in the books of Neela, Leela, and Bala.

Solution:

Journal entries in the books of Neela (Drawer)

Journal entries in the books of Leela (Drawee)

Journal entries in the books of Bala (Endorsee)

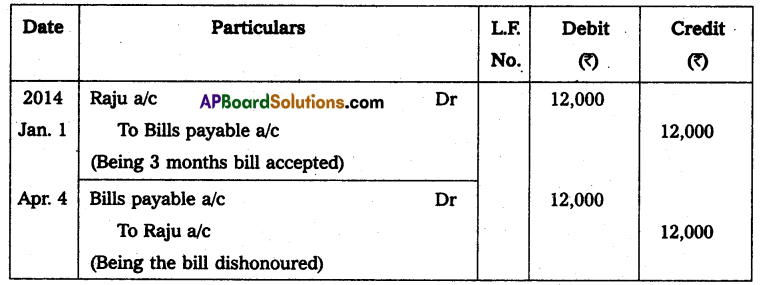

Question 10.

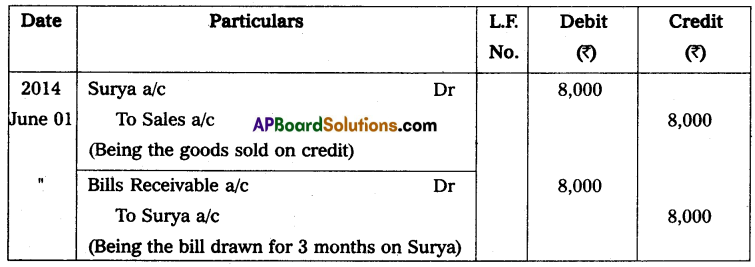

On 1st June 2014 Jaya sold goods to Surya for ₹ 8,000 on credit and drew a bill on Surya for the above amount payable after 3 months. Immediately after its acceptance, Jaya sent the bill to her bank for collection. On the due date, the bill was dishonoured and the noting charges amounted to ₹ 70.

Pass the necessary journal entries in the books of Jaya and Surya.

Solution:

Journal entries in the books of Jaya (Drawer)

Journal entries in the books of Surya (Drawee)

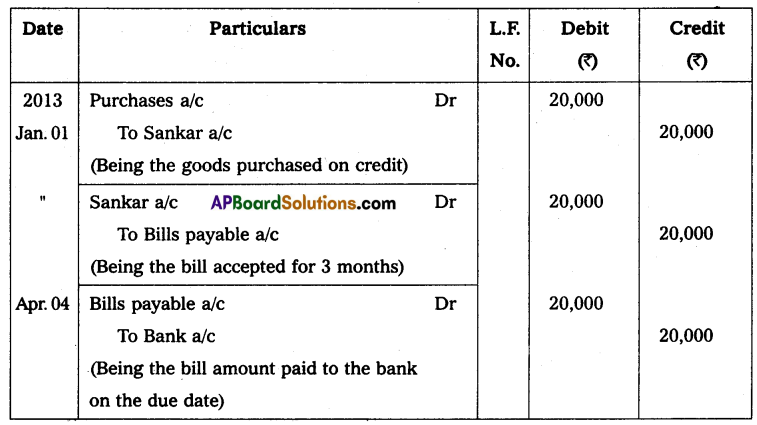

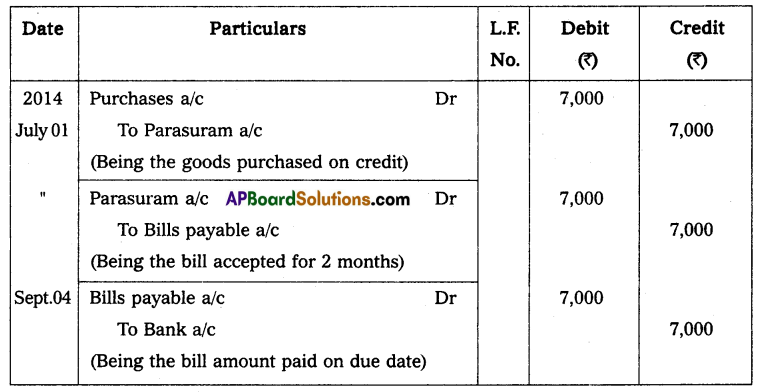

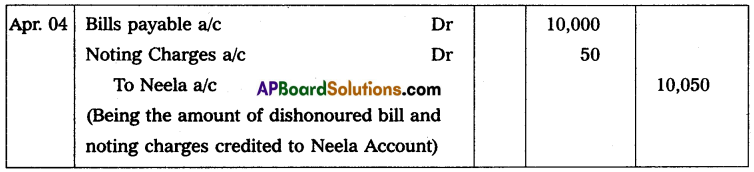

Question 11.

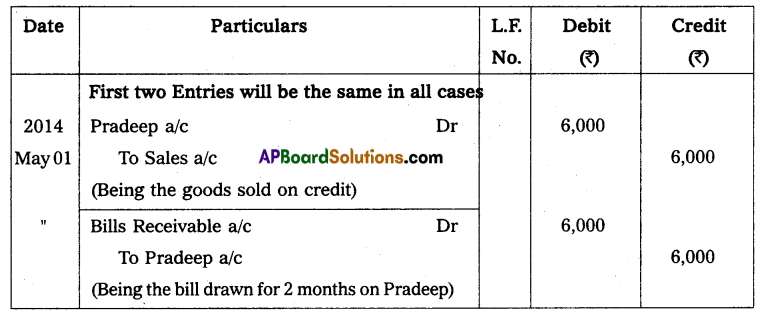

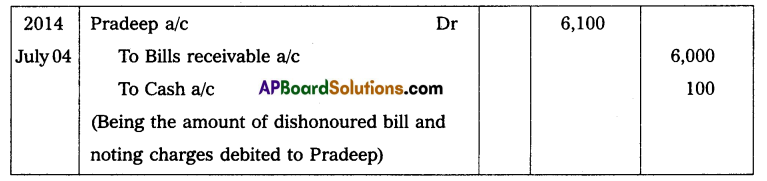

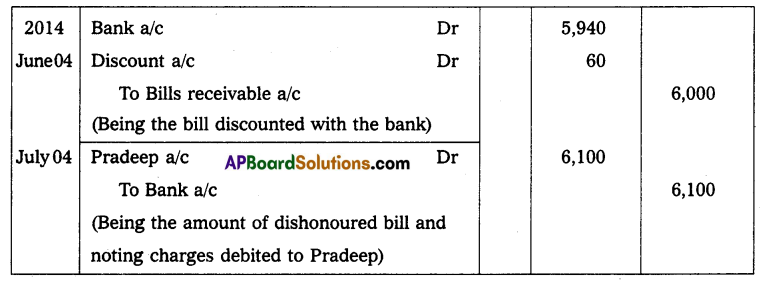

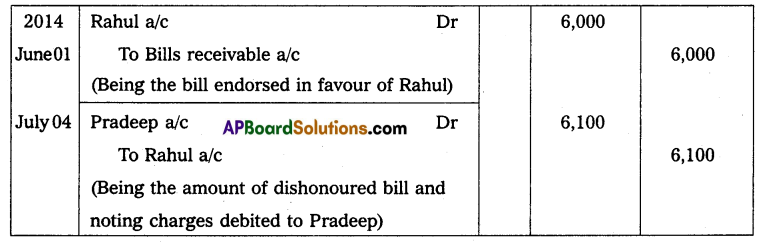

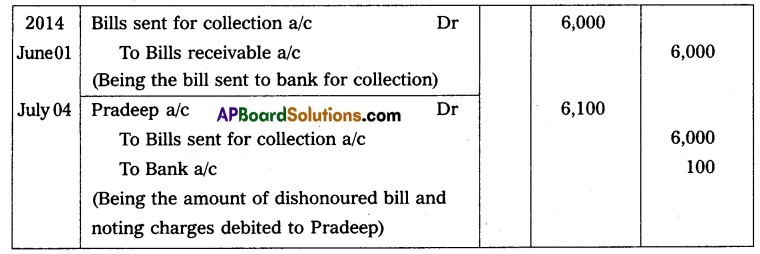

Siva sold goods to Pradeep on 1st May 2014 for ₹ 6,000 on credit and drew upon him a bill for the same amount payable after 2 months. Pradeep accepted the bill and returned it to Siva. On the date of maturity, Pradeep failed to make payment of the bill.

Pass the necessary journal entries in the books of Siva and Pradeep in the following cases:

Case I: When Siva retained the bill till the due date and paid noting charges of ₹ 100.

Case II: When Siva discounted the bill with his bank on 4th June 2014 @ 12% p.a. and the bank paid noting charges of ₹ 100.

Case III: When Siva endorsed the bill in favour of his creditor Rahul on 1st June 2014 and Rahul paid noting charges of ₹ 100.

Case IV: When Siva sent the bill to his bank for collection on 1st June 2014 and bank paid noting charges of ₹ 100.

Solution:

Journal entries in the books of Siva (Drawer)

Case I: When the bill is retained by Siva till the date of maturity

Case II: When the bill is discounted by Siva with his bank

Case III: When the bill is endorsed in favour of Rahul

Case IV: When the bill is sent to the bank for collection

Journal entries in the books of Pradeep (Drawee)

![]()

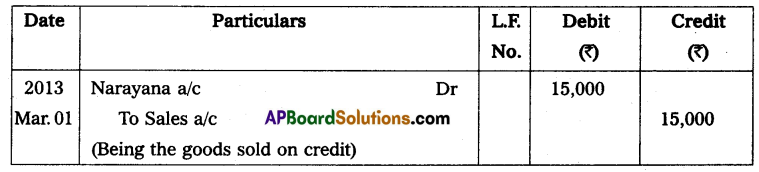

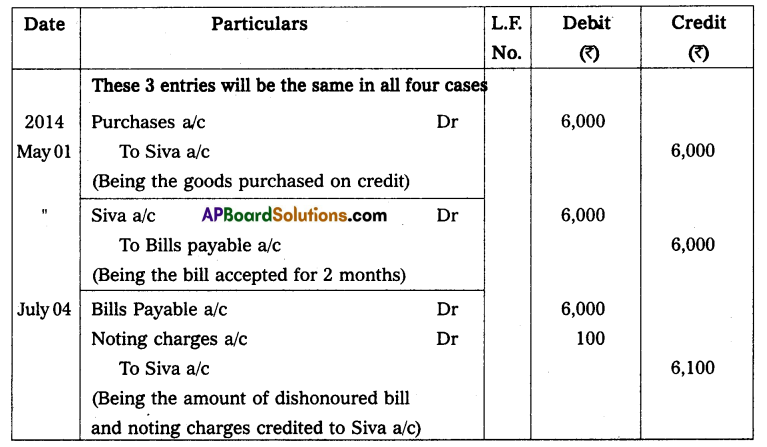

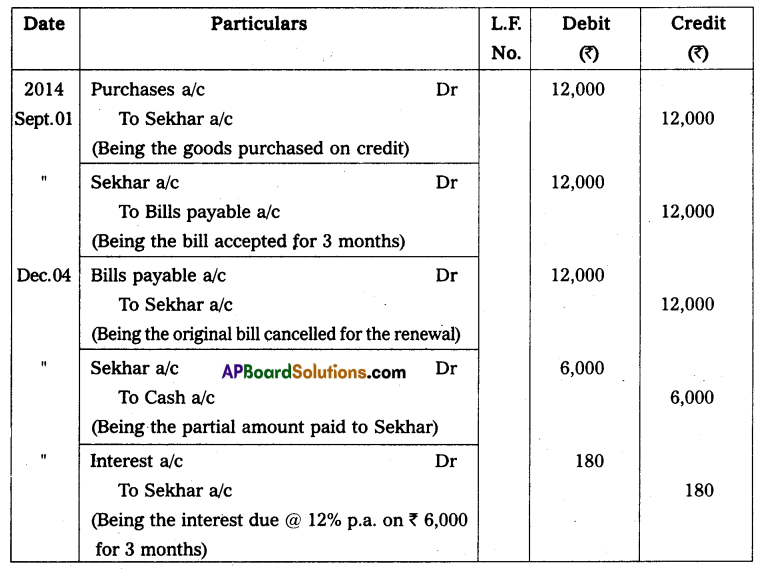

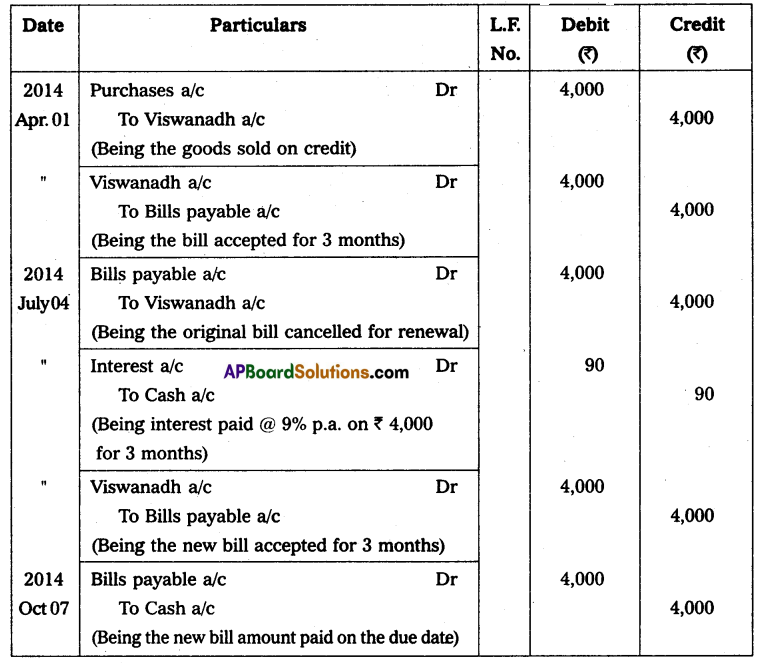

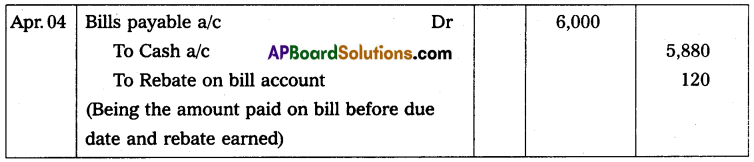

Question 12.

On 1st September 2014, Hari purchased goods for ₹ 12,000 from Sekhar and accepted a bill for the same amount drawn by Sekhar payable after 3 months. On the date of maturity, Hari offered to pay ₹ 6,000 and requested Sekhar to draw a new bill for 3 months for the balance amount including interest at 12% p.a. Sekhar agreed to this proposal.

Pass the necessary journal entries in the books of Sekhar and Hari.

Solution:

Journal entries in the books of Sekhar (Drawer)

Journal entries in the books of Hari (Drawee)

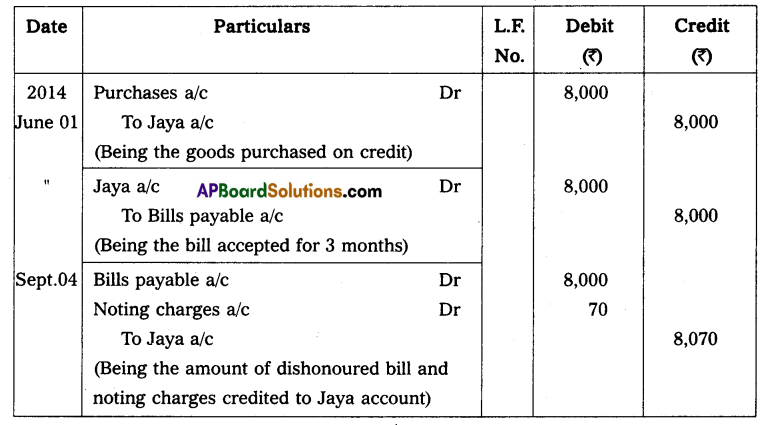

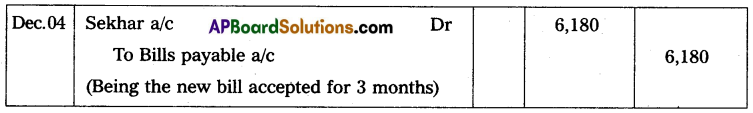

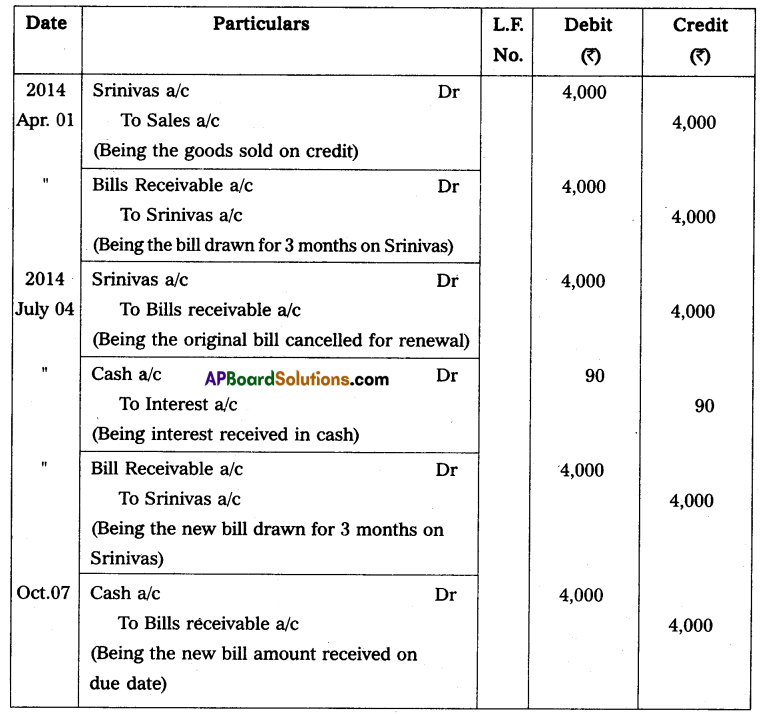

Question 13.

Viswanath sold goods to Srinivas on 1st April 2014 for ₹ 4,000 and drew a bill for 3 months on Srinivas for the same amount Srinivas accepted the bill and returned it to Viswanath. On the due date, Srinivas requested Viswanadh to draw a new bill for the period of 3 months. Srinivas agreed to pay interest in cash @ 9% p.a. immediately. Viswanath agreed to this proposal. The new bill was honoured on the due date.

Pass the necessary journal entries in the books of Viswanath and Srinivas.

Solution:

Journal entries in the books of Viswanath (Drawer)

Journal entries in the books of Srinivas (Drawee)

Question 14.

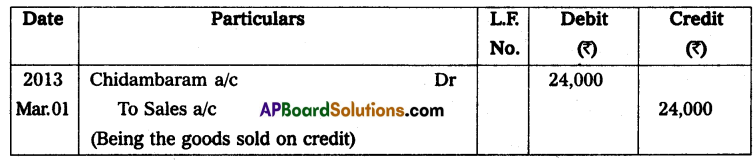

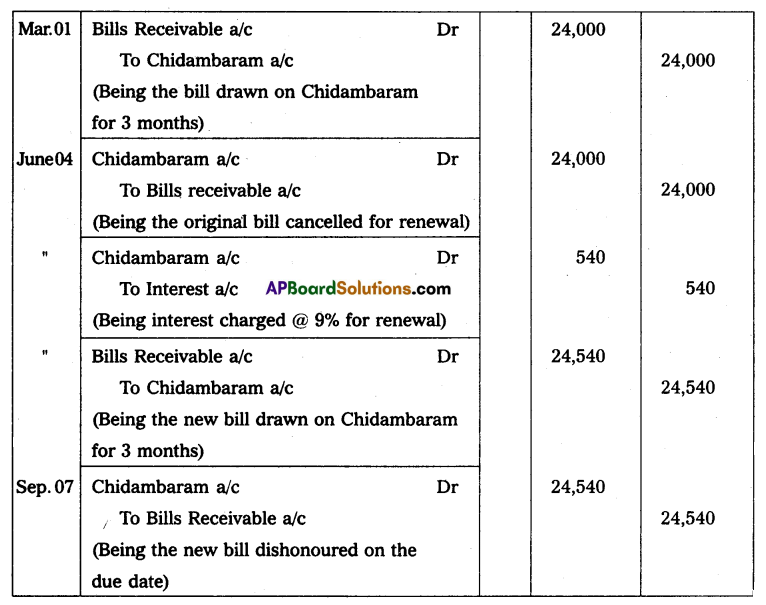

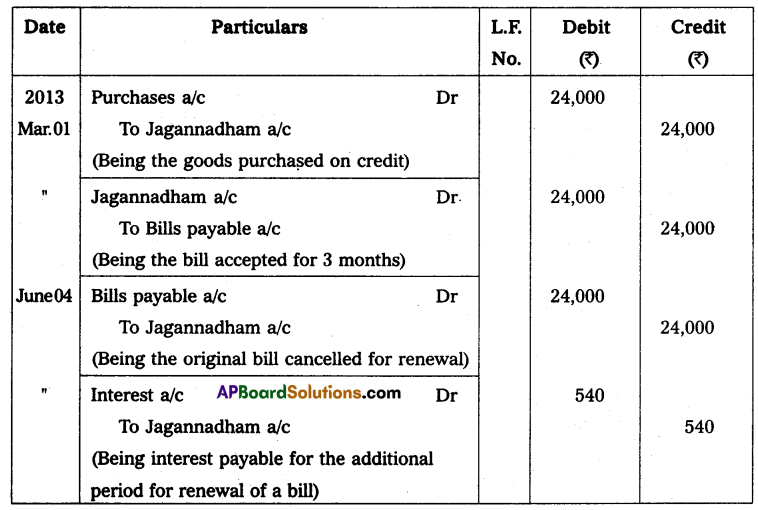

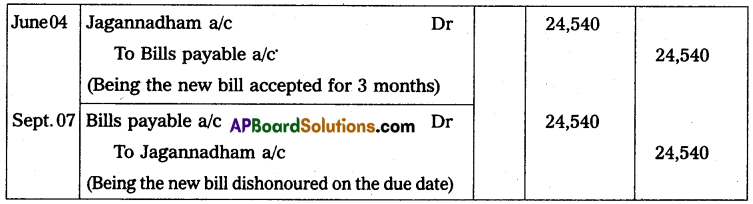

On 1st March 2013 Jagannadham sold goods to Chidambaram for ₹ 24,000 and drew upon him a bill for the same amount payable after 3 months. On the due date, Chidambaram requested Jagannadham to renew the bill for a further period of 3 months at 9% interest per annum. Jagannadham agreed to this proposal. Chidambaram accepted a new bill drawn by Jagannadham for the amount of the old bill including interest payable after 3 months. On the due date, a new bill was dishonoured.

Pass the necessary journal entries in the books of Jagannadham and Chidambaram.

Solution:

Journal entries in the books of Jagannadham (Drawer)

Journal entries in the books of Chidambaram (Drawee)

Question 15.

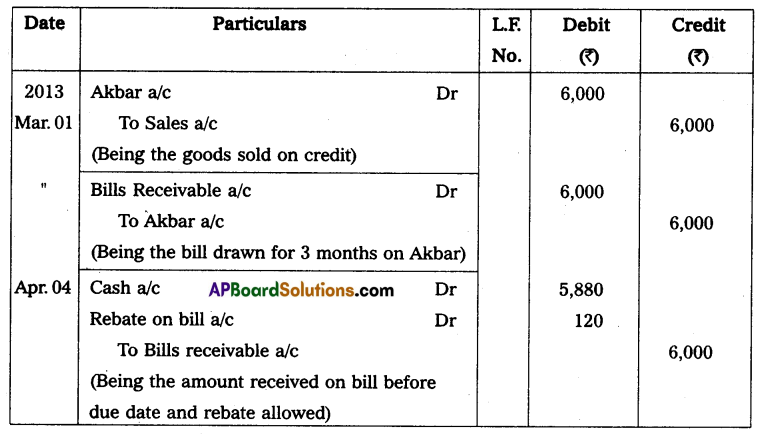

On 1st March 2013, Prudhvi sold goods to Akbar for ₹ 6,000 and drew upon him a bill for the same amount payable after 3 months. Akbar accepted the bill and returned it to Prudhvi. On 4th April 2013, Akbar retired the bill under a rebate of 12% p.a.

Pass the necessary journal entries in the books of Prudhvi and Akbar

Solution:

Journal entries in the books of Prudhvi (Drawer)

Journal entries in the books of Akbar (Drawee)

![]()

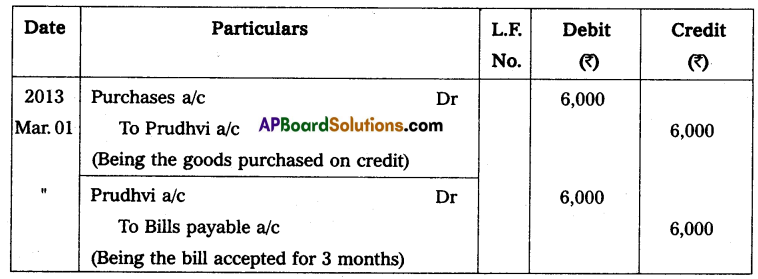

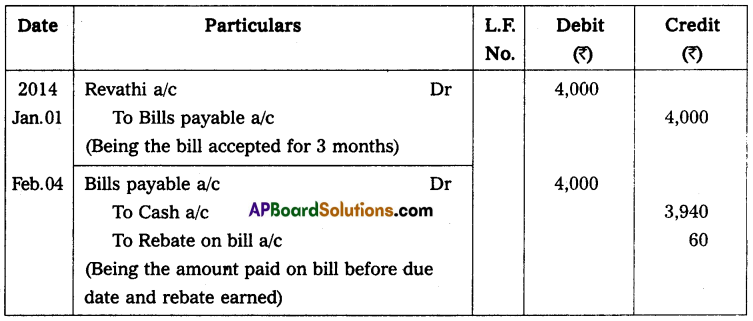

Question 16.

On 1st January 2014 Revathi drew a bill for ₹ 4,000 on Savithri payable after 3 months. Savithri accepted the bill and returned it to Revathi. On 4th February 2014, Savithri retired the bill under a rebate of 9% p.a.

Pass the necessary journal entries in the books of Revathi and Savithri.

Solution:

Journal entries in the books of Revathi (Drawer)

Journal entries in the books of Savithri (Drawee)

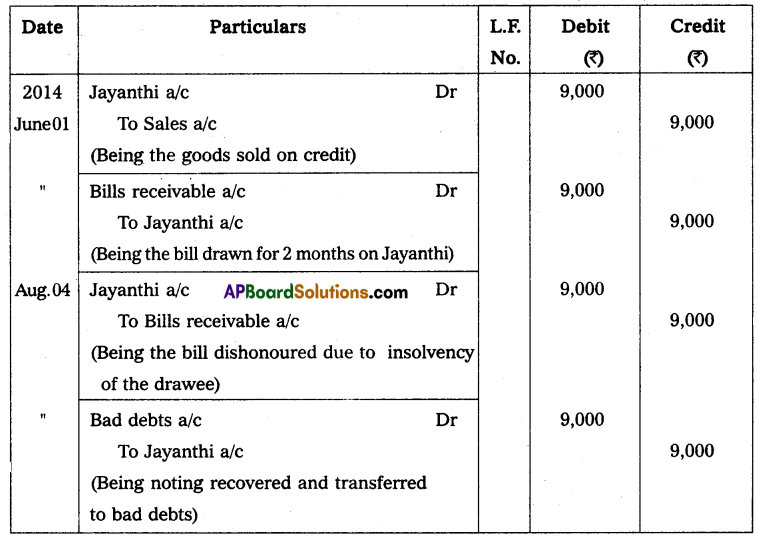

Question 17.

Damayanthi sold goods worth ₹ 9,000 to Jayanthi on 1st June 2014 and drew a bill for 2 months for the same amount Jayanthi accepted the bill and returned it to Damayanthi. Before the due date of the bill, Jayanthi became insolvent and nothing could be recovered from her estate.

Pass the necessary journal entries in the books of Damayanthi and Jayanthi.

Solution:

Journal entries in the books of Damayanthi (Drawer)

Journal entries in the books of Jayanthi (Drawee)

![]()

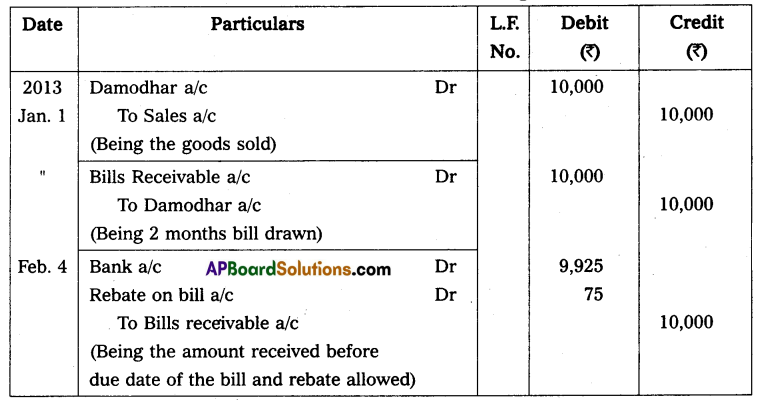

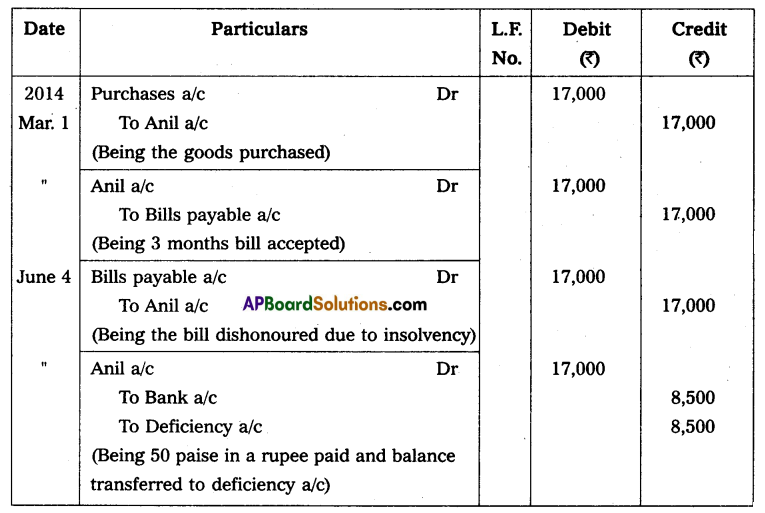

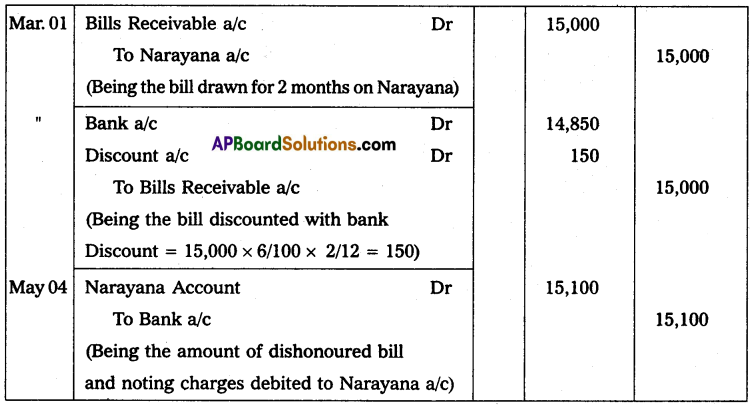

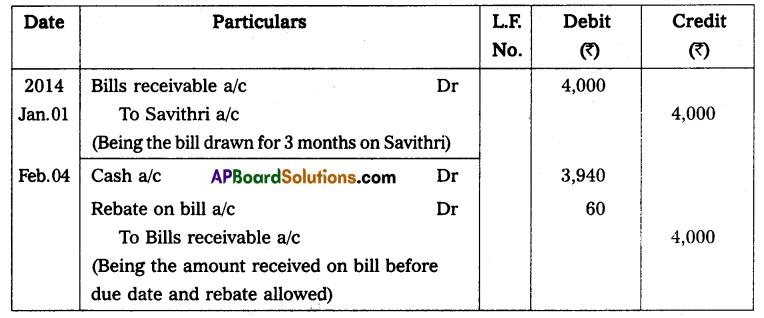

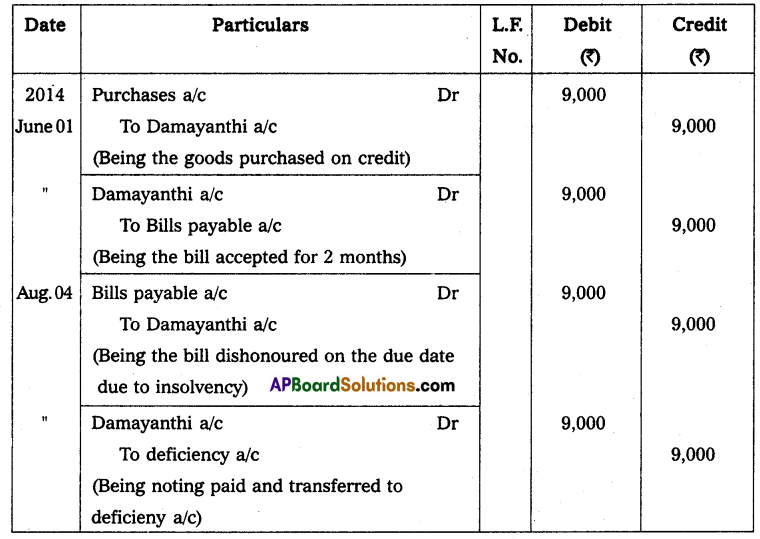

Question 18.

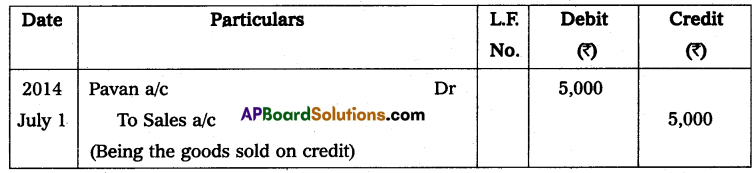

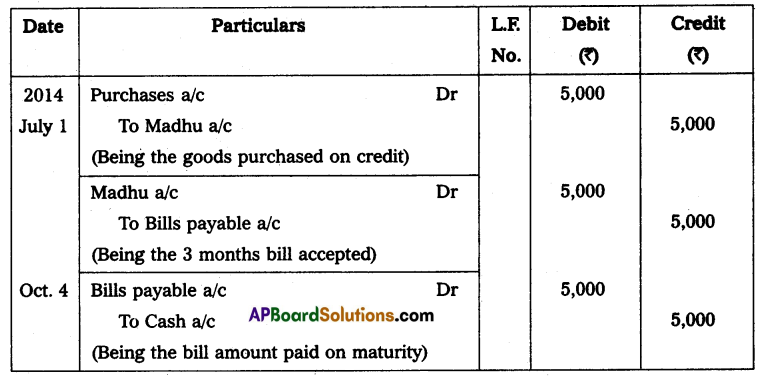

Kumar sold goods worth ₹ 7,000 to Murali on 1st January 2014 and drew upon him a bill for 3 months for the same amount Murali accepted the bill and returned it to Kumar. On the due date, murali requested Kumar to draw a new bill for the amount due. Kumar agreed to draw a new bill for 2 months but he charged interest @ 12% p.a. Murali accepted the new bill which was drawn by Kumar. Before the due date of the bill, Murali became insolvent and only 50 paise in a rupee could be recovered from his estate.

Pass the necessary journal entries in the books of Kumar and Murali.

Solution:

Journal entries in the books of Kumar (Drawer)

Journal entries in the books of Murali (Drawee)