Andhra Pradesh BIEAP AP Inter 2nd Year Accountancy Study Material 7th Lesson Retirement / Death of a Partner Textbook Questions and Answers.

AP Inter 2nd Year Accountancy Study Material 7th Lesson Retirement / Death of a Partner

Very Short Answer Questions

Question 1.

What is meant by the retirement of a partner?

Answer:

A partner who opts to retire from an existing partnership firm is called ‘Retirement of a partner.

Question 2.

What do you understand by a Gaining ratio?

Answer:

The ratio in which the share of the retiring partner is taken over by other partners is called the ‘Gaining ratio’. To calculate the new profit sharing ratio, the share of profit of the retiring partner taken over by each continuing partner is added to his respective share of profit before the retirement of the outgoing partner.

Gaining ratio = New ratio – Old ratio

Question 3.

What are the adjustments required for the retirement or death of a partner?

Answer:

On the retirement or death of a partner, the existing partnership deed comes to an end and in its place, a new partnership deed needs to be framed whereby the remaining partners continue to do their business on changed terms and conditions. There is not much difference in accounting at the time of retirement or in the event of death. In both cases, we are required to determine the amount due to the retiring partner (in case of retirement) and to the legal representatives (in case of deceased partner) after making necessary adjustments in respect of goodwill, revaluation of assets and liabilities, and transfer of accumulated profits and losses. In addition to the above, the new profit-sharing ratio of the remaining partners and the gaining ratio is to be computed.

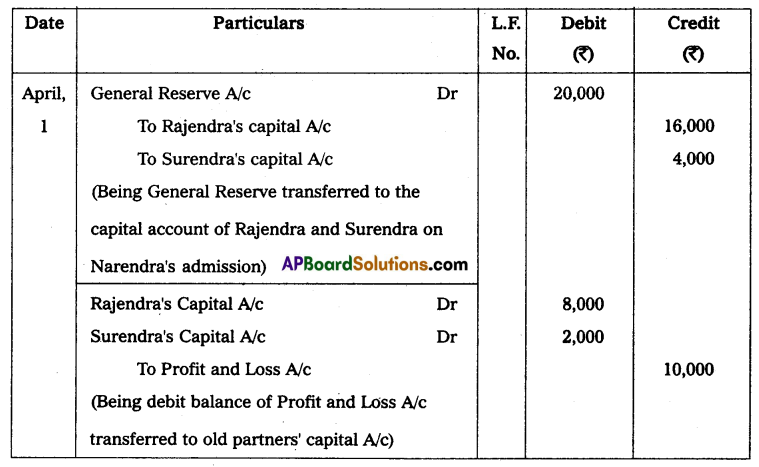

![]()

Question 4.

How is the account of the deceased partner settled?

Answer:

The deceased partner’s capital account is credited with the balance of capital at the beginning of the year, interest on capital, the share of profit on revaluation of assets and liabilities, the share of undistributed profits, the share of profit to the date of death, and his share of goodwill. The account is debited with drawings to the date of death, interest on drawings, and the balance is transferred to the executor’s account of the deceased partner.

Question 5.

Explain the modes of payment to the retiring partner.

Answer:

The outgoing partner’s account is settled as per the terms of the partnership deed i.e., in lumpsum immediately or in various installments with or without interest. In the absence of any agreement section 37 of the Indian Partnership Act, 1932 is applicable, which states that the outgoing partner has an option to receive either 6% interest till the date of payment or such share of profits that have been earned with his money (based on capital ratio). If the firm is not in a position to make payment immediately, the amount due is transferred to the retiring partner’s loan account.

Textual Exercises

Question 1.

Madhu, Nehra, and Tina are partners sharing profits in the ratio of 5 : 3 : 2. Calculate the new profit sharing ratio if

1. Madhu retires

2. Nehra retires

3. Tina retires

Solution:

1. New profit sharing ratio, if Madhu retires 3 : 2.

2. New profit sharing ratio, if Nehra retires 5 : 2.

3. New profit sharing ratio, if Tina retires 5 : 3.

Question 2.

Hari, Prasad, and Anwar are partners sharing profits in the ratio of 3 : 2 : 1. Hari retires and his share is taken up by Prasad and Anwar in the ratio of 3 : 2. Calculate the new profit sharing ratio.

Solution:

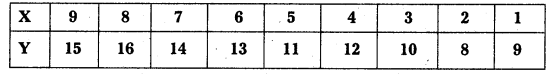

Old ratio of Hari, Prasad, Anwar = 3 : 2 : 1

Gaining ratio on the retirement of Hari = 3 : 2

New share of continuing partner = Old share + Acquired share from retiring partner

Prasad gets \(\frac{3}{5}\) of Hari share = \(\frac{3}{5} \times \frac{3}{6}=\frac{9}{30}\)

New share = \(\frac{2}{6}+\frac{9}{30}=\frac{10+9}{30}=\frac{19}{30}\)

Anwar gets \(\frac{2}{5}\) of Hari share = \(\frac{2}{5} \times \frac{3}{6}=\frac{6}{30}\)

New share = \(\frac{1}{6}+\frac{6}{30}=\frac{5+6}{30}=\frac{11}{30}\)

∴ New profit sharing ratio = 19 : 11.

Question 3.

Ranjana, Sadhna, and Kamana are partners sharing profits in the ratio 4 : 3 : 2. Ranjana retires, and Sadhna and Kamana decided to share future profits in the ratio of 5 : 3. Calculate the Gaining Ratio.

Solution:

Old profit sharing ratio = 4 : 3 : 2

New ratio = 5 : 3

Sadhna gaining ratio = New ratio – Old ratio

= \(\frac{5}{8}-\frac{3}{9}=\frac{45-24}{72}=\frac{21}{72}\)

Kamana gaining ratio = \(\frac{3}{8}-\frac{2}{9}=\frac{27-16}{72}=\frac{11}{72}\)

Gaining ratio = 21 : 11

Question 4.

Murali, Naveen, and Omprakash are partners sharing profits in the ratio of 3 : 4 : 1. Murali retires and surrenders 2/3rd of his share in favour of Naveen and the remaining share in favour of Omprakash. Calculate new profit sharing and the gaining ratio of the remaining partners.

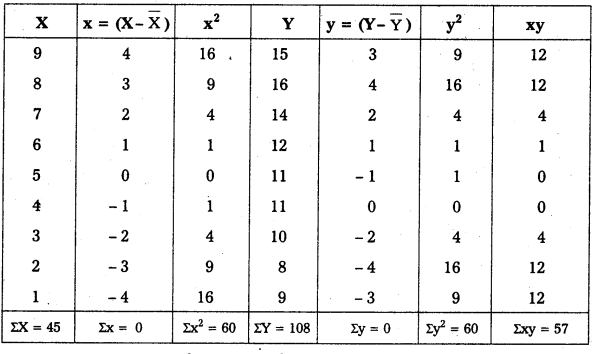

Solution:

Naveen gets \(\frac{2}{3}\) of Murali share = \(\frac{2}{3} \times \frac{3}{8}=\frac{6}{24}\)

Omprakash gets \(\frac{1}{3}\) of Murali share = \(\frac{1}{3} \times \frac{3}{8}=\frac{3}{24}\)

Naveen new share = \(\frac{4}{8}+\frac{6}{24}=\frac{12+6}{24}=\frac{18}{24}\)

Omprakash new share = \(\frac{1}{8}+\frac{3}{24}=\frac{3+3}{24}=\frac{6}{24}\)

New gaining ratio = 18 : 6 = 3 : 1

Gaining ratio = New ratio – Old ratio

Naveen = \(\frac{3}{4}-\frac{4}{8}=\frac{6-4}{8}=\frac{2}{8}\)

Omprakash = \(\frac{1}{4}-\frac{1}{8}=\frac{2-1}{8}=\frac{1}{8}\)

Gaining ratio = 2 : 1

![]()

Question 5.

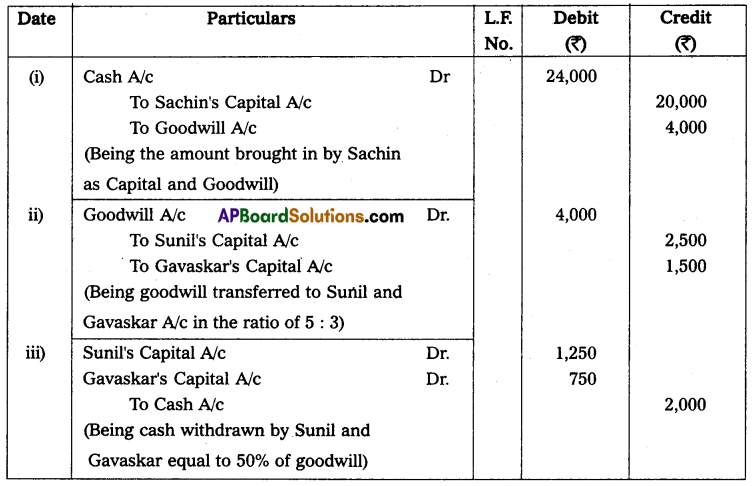

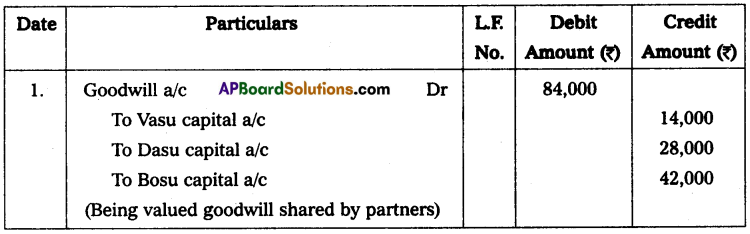

Vasu, Dasu, and Bosu are partners sharing profits in the ratio of 1 : 2 : 3. Dasu retires and at the time of retirement, goodwill is valued at ₹ 84,000. Vasu and Bosu decided to share future profits in the ratio of 2 : 1. Record the necessary journal entries.

Solution:

Journal Entry

Question 6.

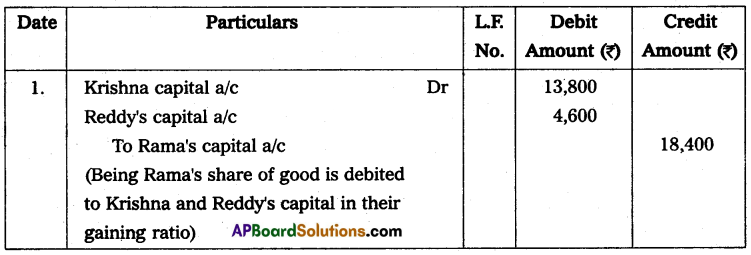

Rama, Krishna, and Reddy are partners in a firm sharing profits and losses in the ratio of 2 : 2 : 1. On Rama’s retirement, the goodwill of the firm is valued at ₹ 46,000. Krishna and Reddy decided to share future profits equally. Record the necessary journal entry for the treatment of goodwill without opening a’ Goodwill Account’.

Solution:

Old ratio = 2 : 2 : 1

New ratio =1 : 1

Krishna gaining ratio = New ratio – Old ratio

= \(\frac{1}{2}-\frac{2}{5} \text { (or) } \frac{5}{10}-\frac{4}{10}=\frac{1}{10}\)

Reddy’s gaining ratio = \(\frac{1}{2}-\frac{1}{5}=\frac{5}{10}-\frac{2}{10}=\frac{3}{10}\) = 1 : 3

Journal Entry

Question 7.

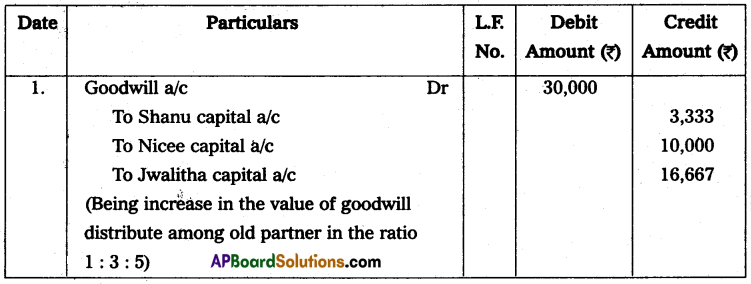

Shanu, Nicee, and Jwalitha are partners sharing profits in the ratio of 1 : 3 : 5. Goodwill is appearing in the books at a value of ₹ 60,000. Nicee retires and goodwill is valued at ₹ 90,000. Shanu and Jwalitha decided to share future profits equally. Record necessary journal entries.

Solution:

Journal Entry

Question 8.

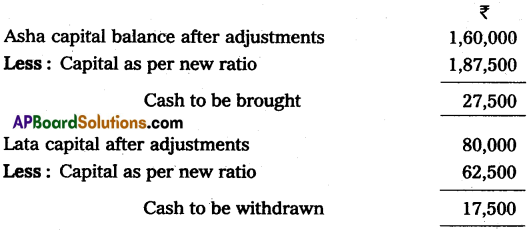

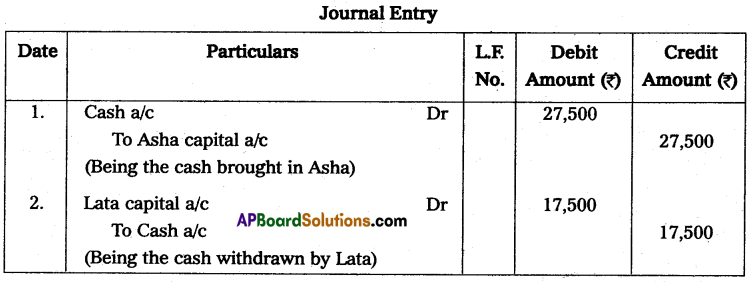

Asha, Deepa, and Lata are partners in the firm sharing profits in the ratio of 3 : 2 : 1. Deepa retires. After making all adjustments relating to revaluation, goodwill and accumulated profit, etc., the capital accounts of Asha and Lata showed a credit balance of ₹ 1,60,000 and ₹ 80,000 respectively. It was decided to adjust the capitals of Asha and Lata in their new profit-sharing ratio. They decided that the requirement of capital is ₹ 2,50,000. You are required to calculate the new capitals of the partners and record necessary journal entries for bringing in or withdrawing of the necessary amounts involved.

Solution:

New profit sharing ratio = 3 : 1

Total capital = 2,50,000

Asha capital = 2,50,000 × \(\frac{3}{4}\) = ₹ 1,87,500

Lata capital = 2,50,000 × \(\frac{3}{4}\) = ₹ 62,500

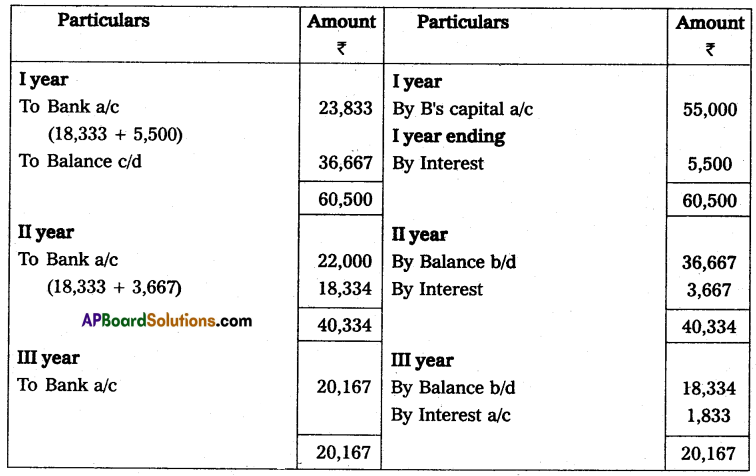

Question 9.

A, B and C are partners in a firm. B retires from the firm on 1st Jan 2015. On the date of his retirement ₹ 55,000 were due to him. It was decided that the payment will be done in 3 equal yearly installments together with interest @ 10% p.a. on the unpaid balance. Prepare necessary entries.

Solution:

B’s Loan a/c

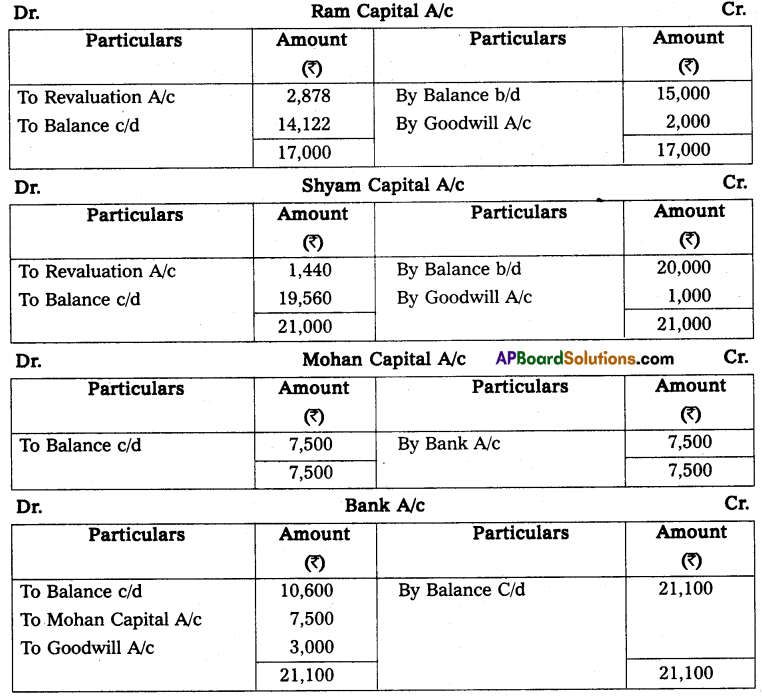

Question 10.

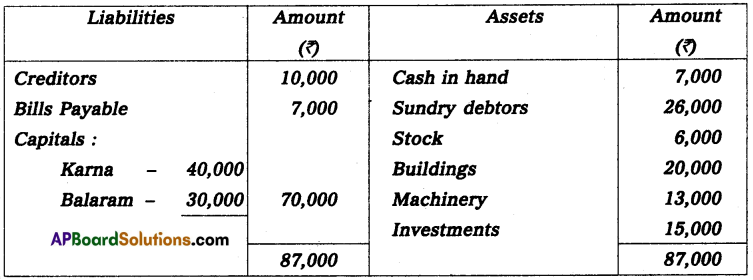

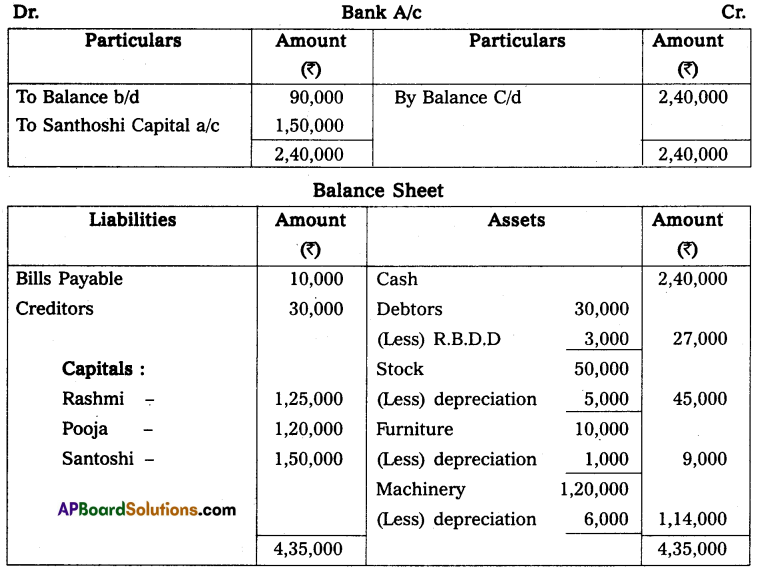

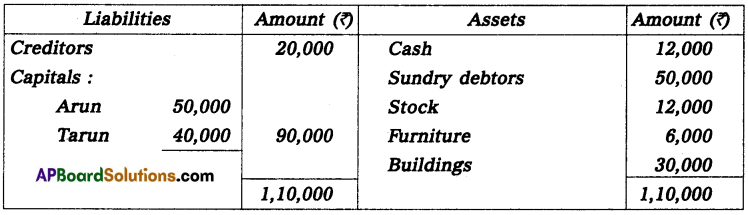

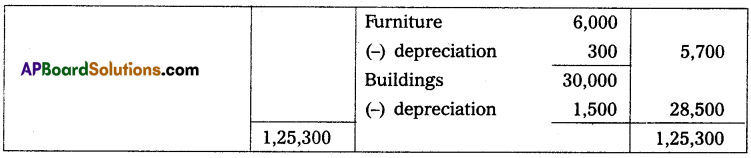

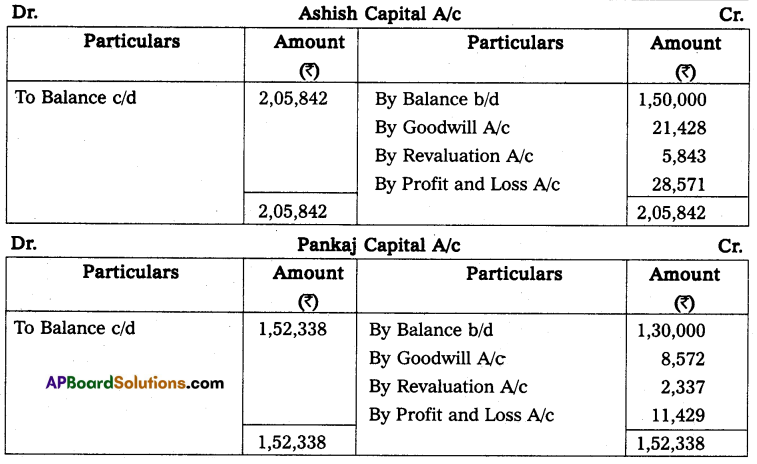

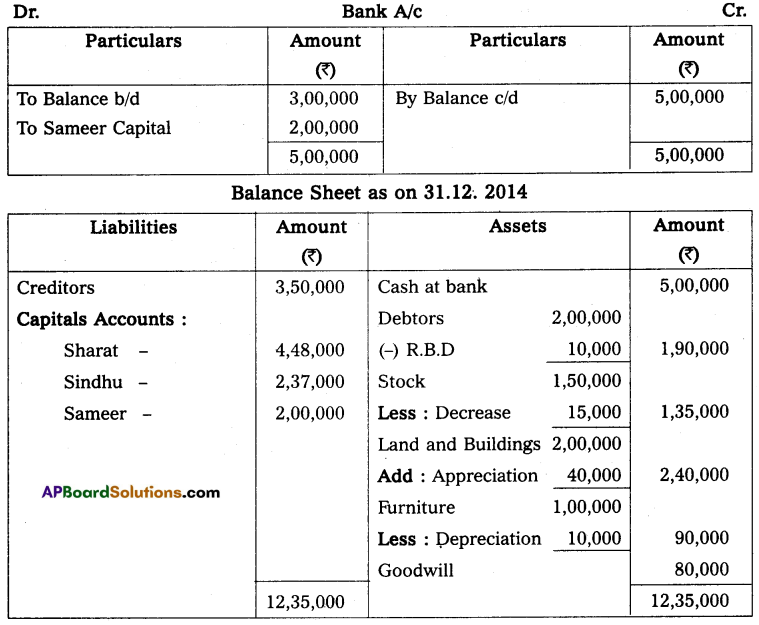

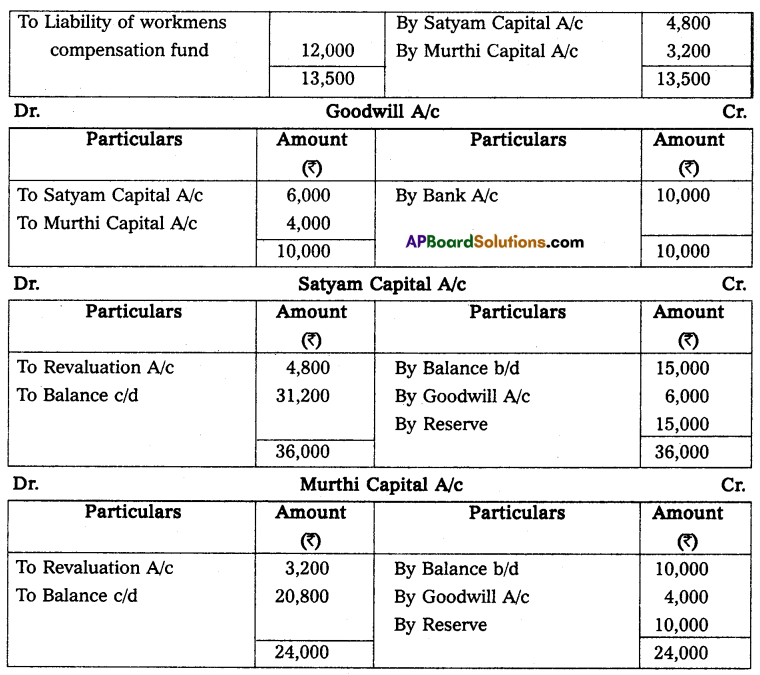

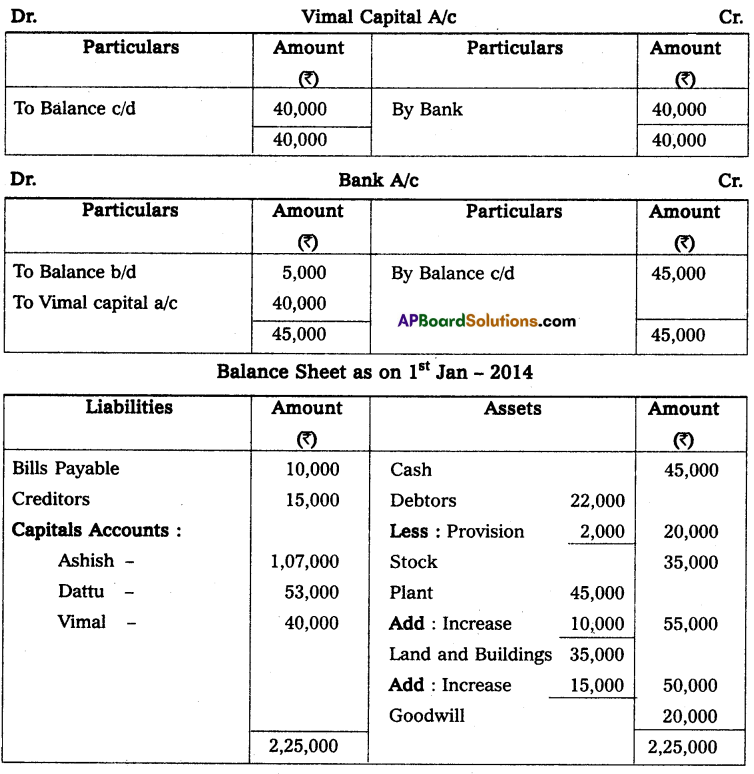

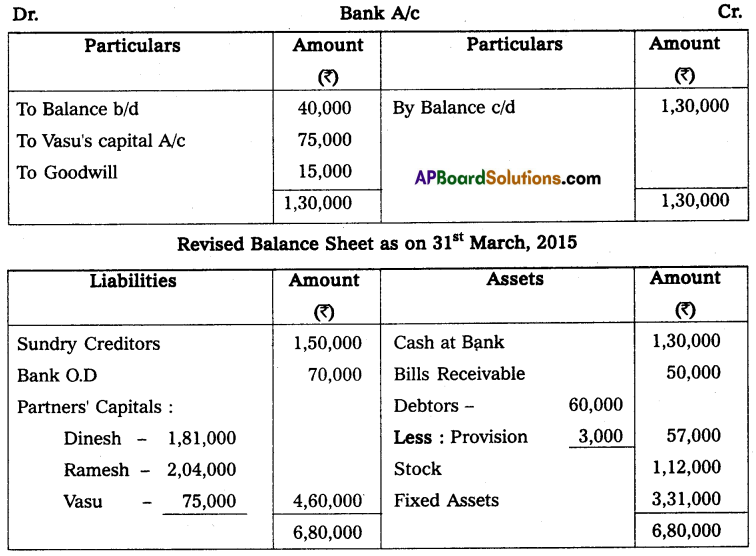

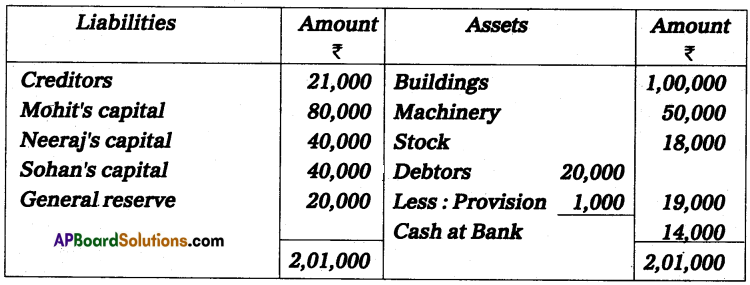

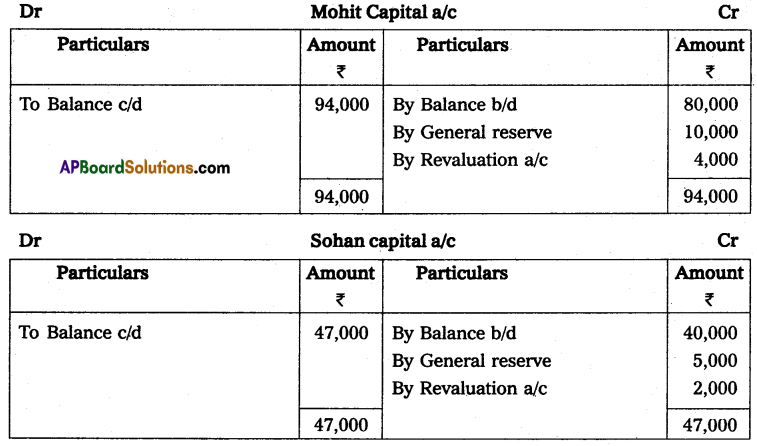

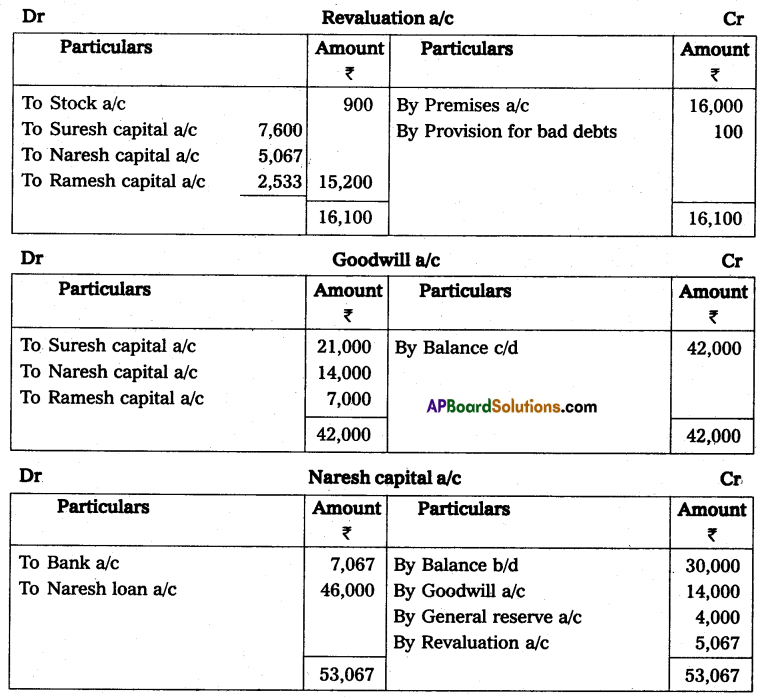

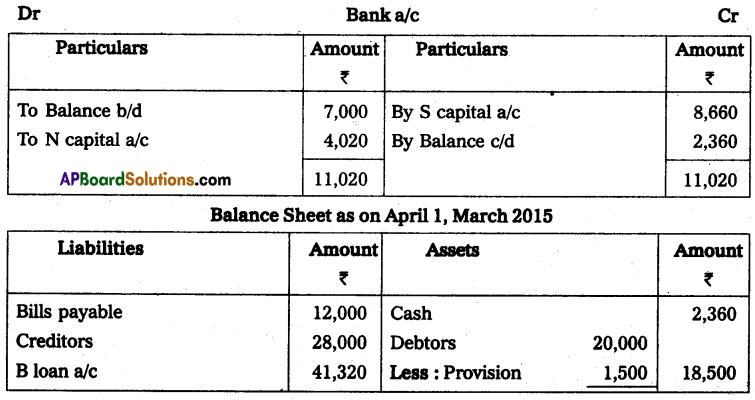

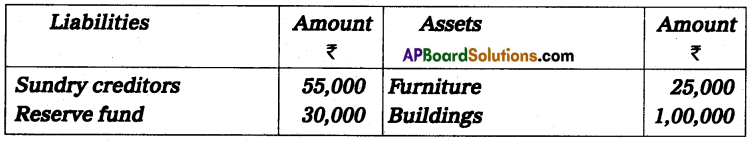

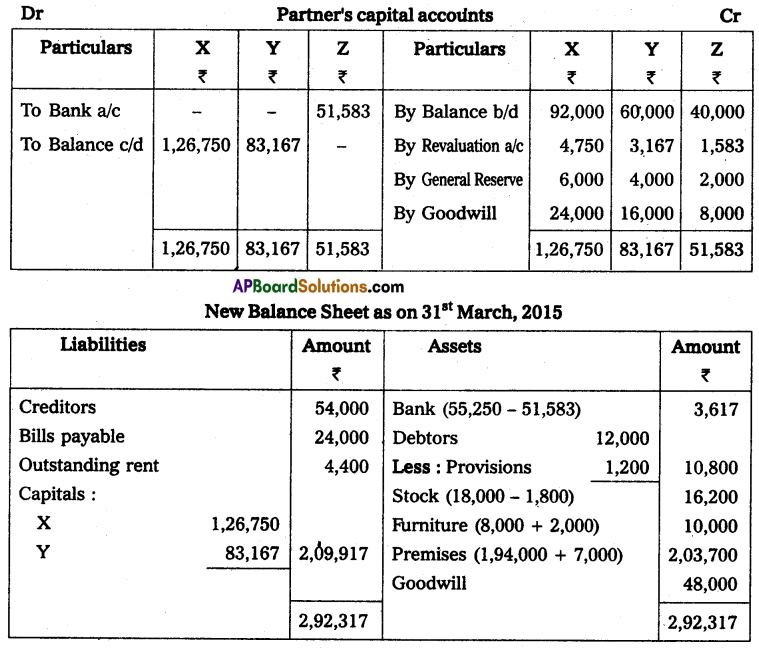

The Balance Sheet of Mohit, Neeraj, and Sohan who are partners in firm sharing profits according to their capitals as on March 31, 2015, was as under:

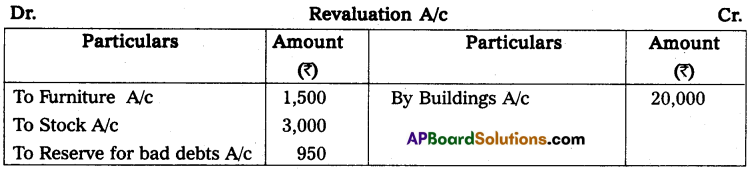

On that date, Neeraj decided to retire from the firm and was paid for his share in the firm subject to the following:

1. Buildings to be appreciated by 20%.

2. Provision for Bad debts to be increased to 15% on Debtors.

3. Machinery to be depreciated by 20%.

Prepare necessary accounts and a new Balance Sheet after retirement.

Solution:

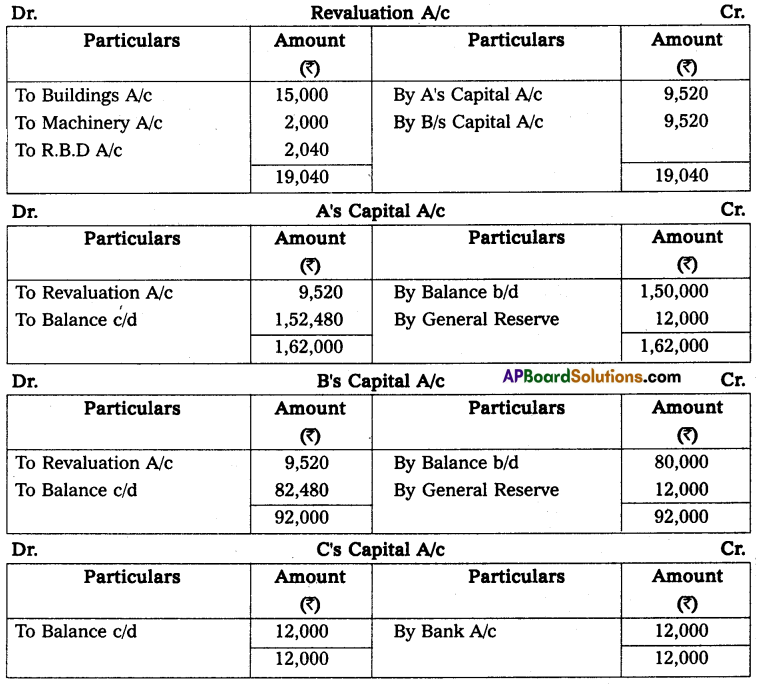

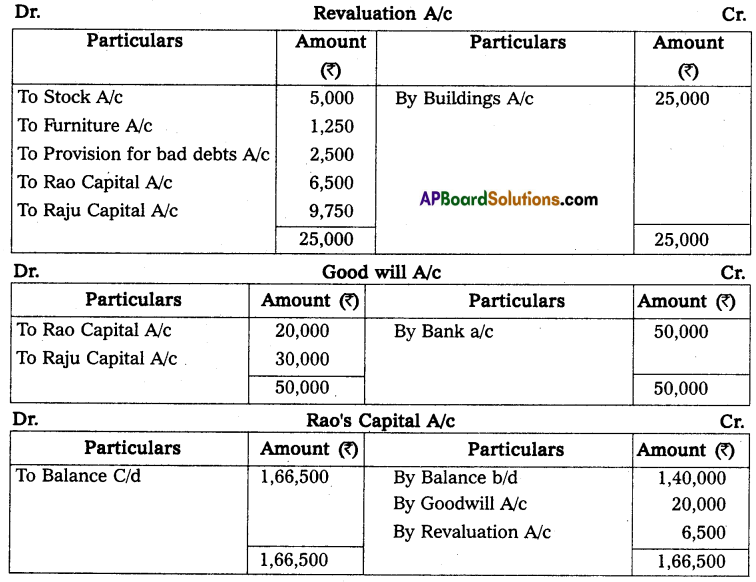

![]()

Question 11.

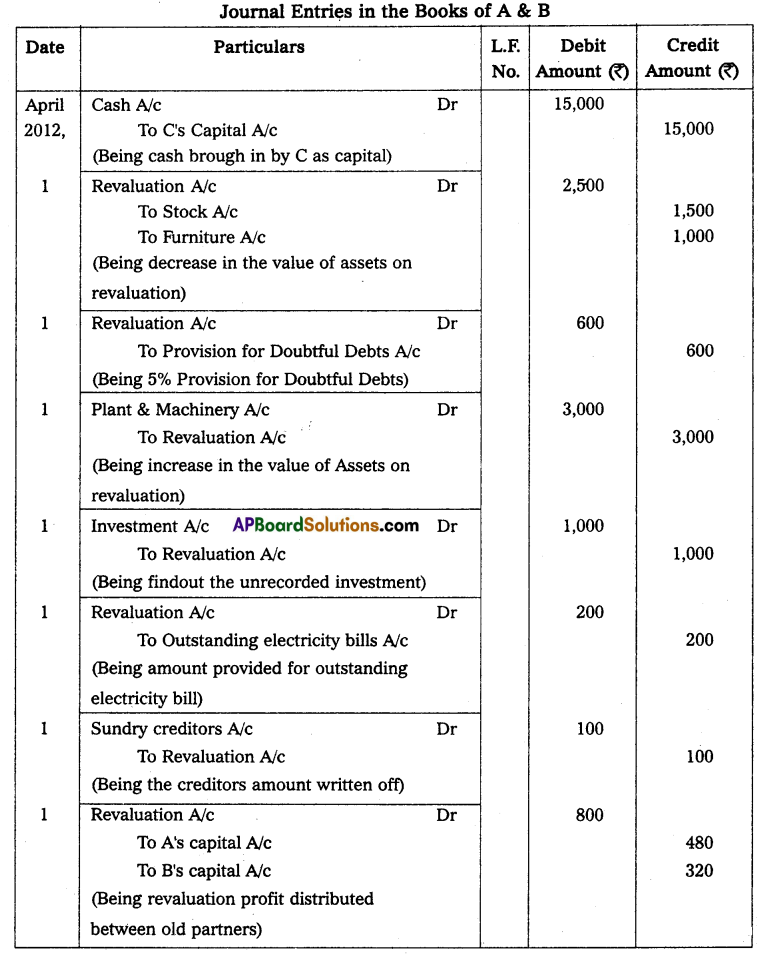

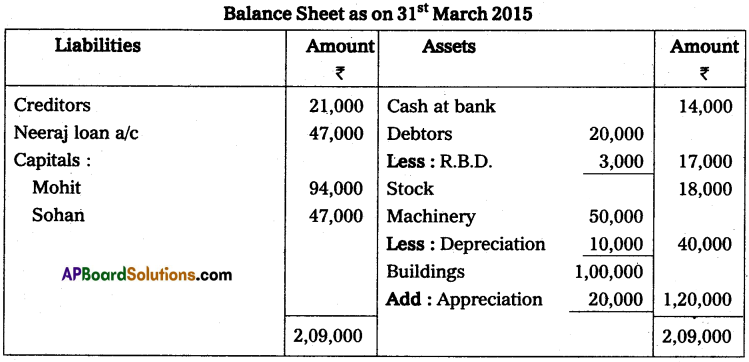

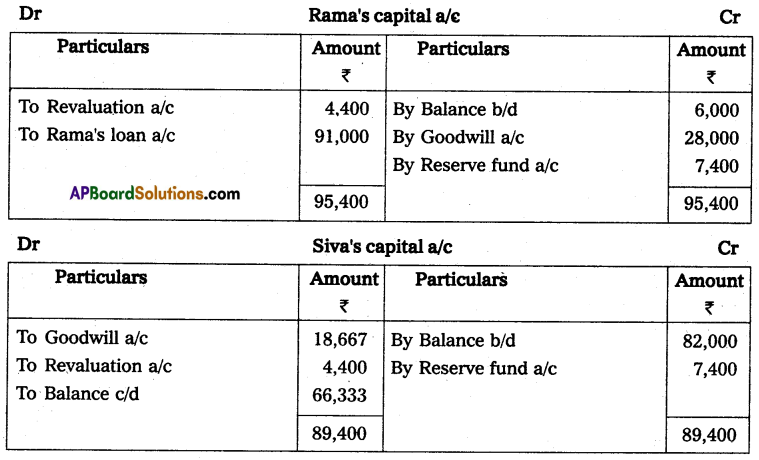

Siva, Rama, and Krishna were partners in firm sharing profits in the ratio of 2 : 2 : 1. Their Balance Sheet as on March 31, 2015, was as follows:

Rama retired on March 31, 2015, on the following terms:

(i) Goodwill of the firm was valued at ₹ 70,000 and was not to appear in the books.

(ii) Bad debts amounting to ₹ 2,000 were to be written off.

(iii) Patents were considered valueless.

Prepare Revaluation Account, Partner’s Capital Accounts, and the Balance Sheet.

Solution:

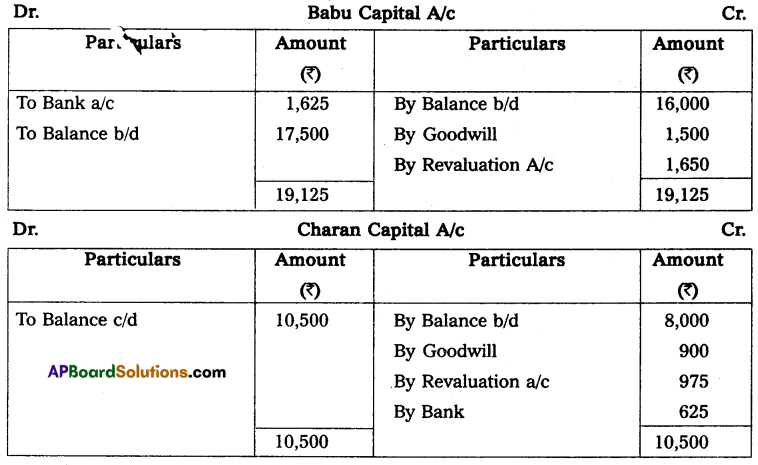

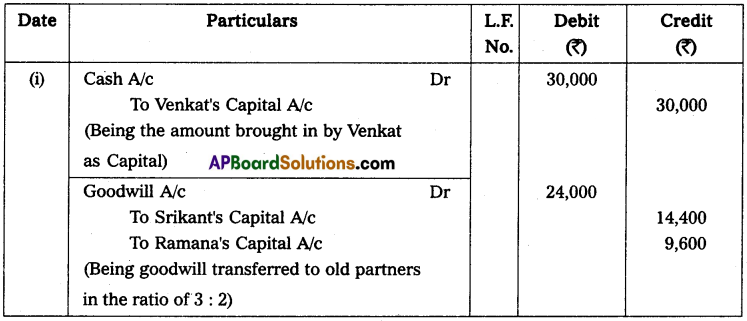

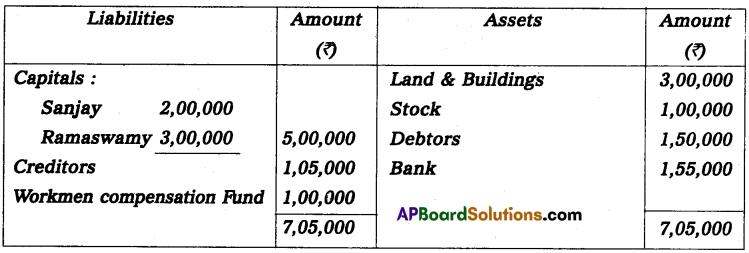

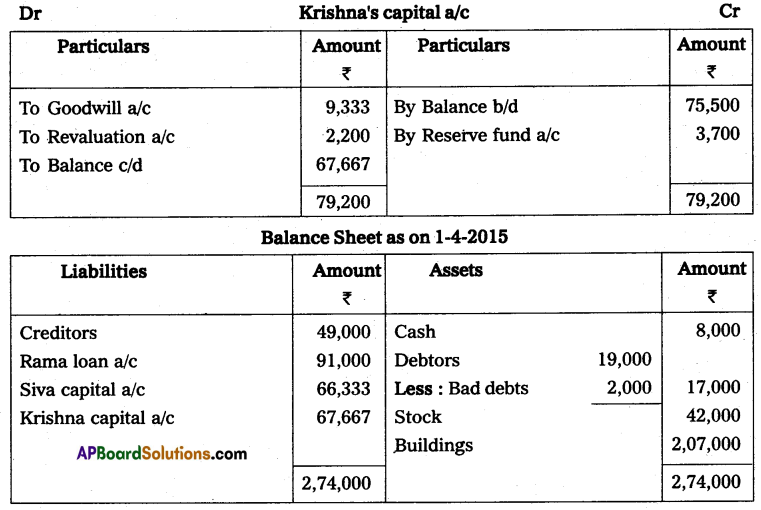

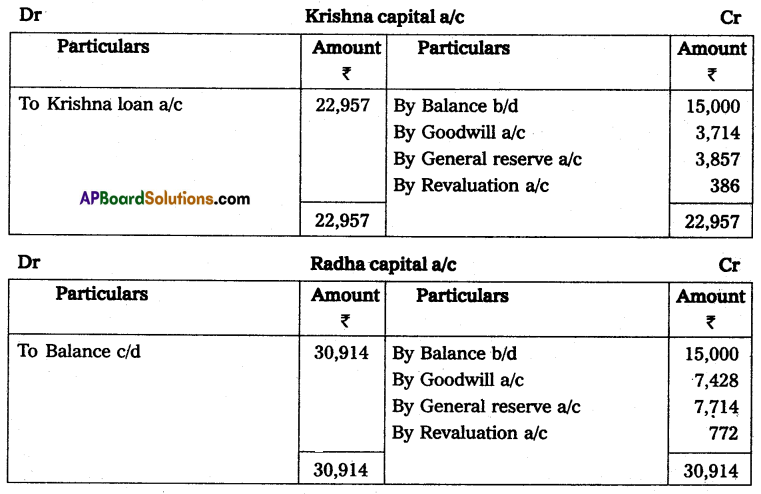

Question 12.

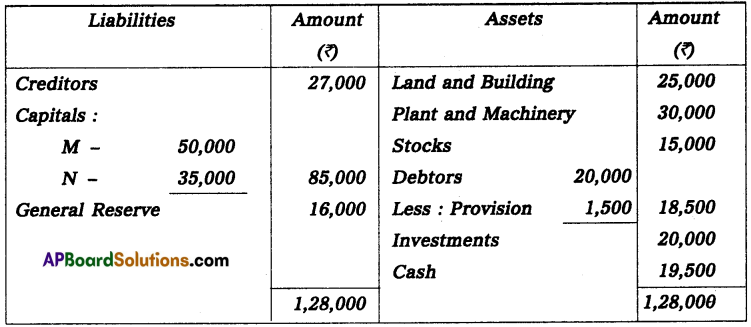

Radha, Krishna, and Satya were in partnership sharing profit and losses in the ratio of 4 : 2 : 1. On April 1, 2015, Krishna retires from the firm. On that date, their Balance Sheet was as follows:

The terms were:

(a) Goodwill of the firm was valued at ₹ 13,000.

(b) Expenses owing to be brought down to ₹ 3,750.

(c) Machinery and Loose Tools are to be valued at 10% less than their book value.

(d) Factory premises are to be revalued at ₹ 24,300.

Prepare:

1. Revaluation account

2. Partner’s capital accounts and

3. Balance sheet of the firm after the retirement of Krishna

Solution:

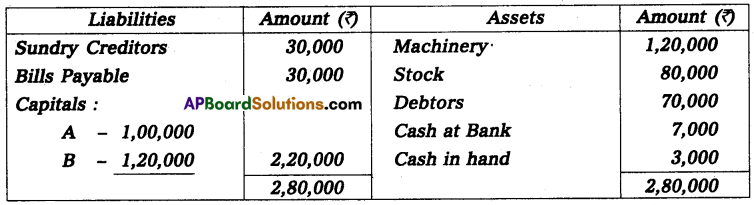

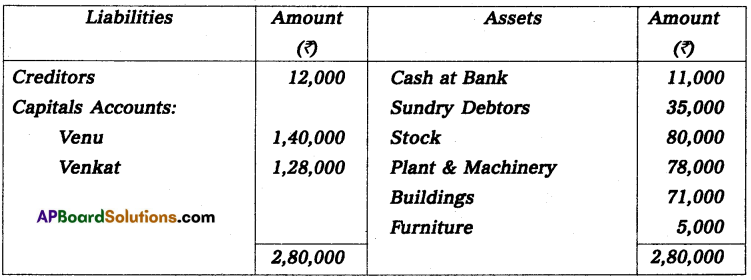

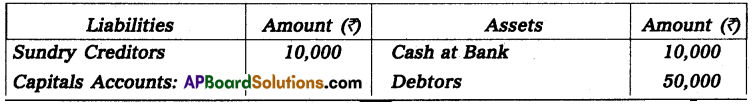

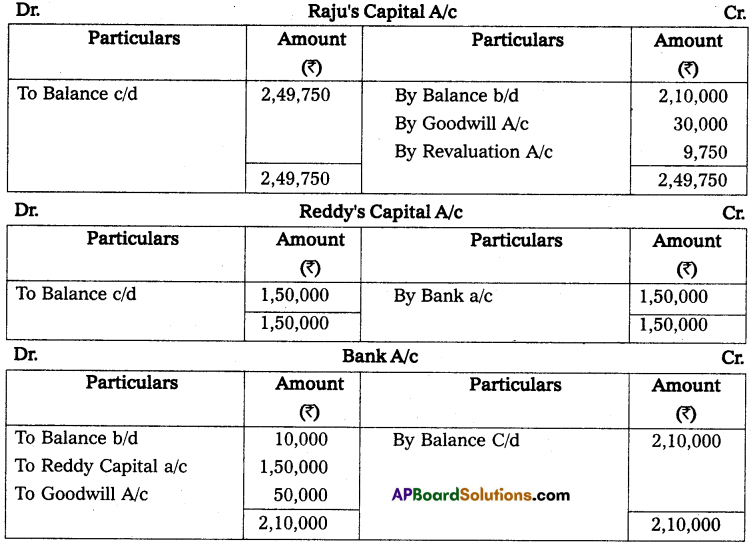

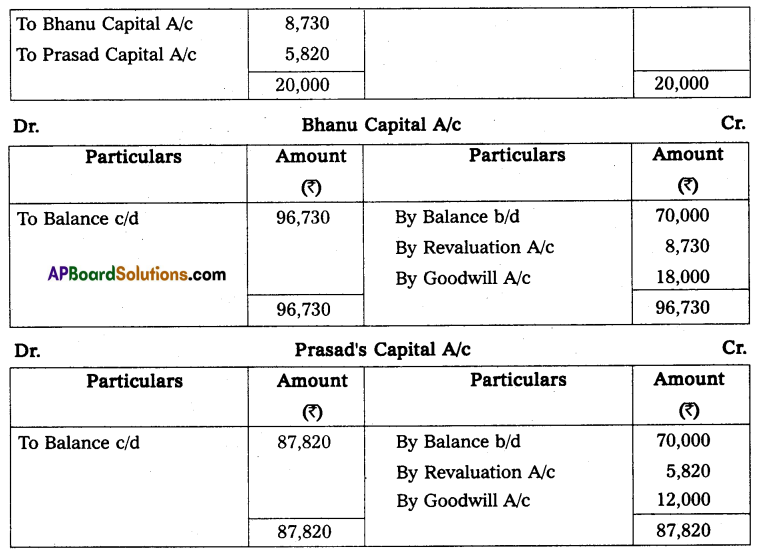

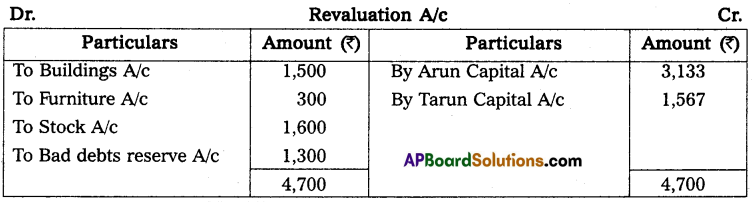

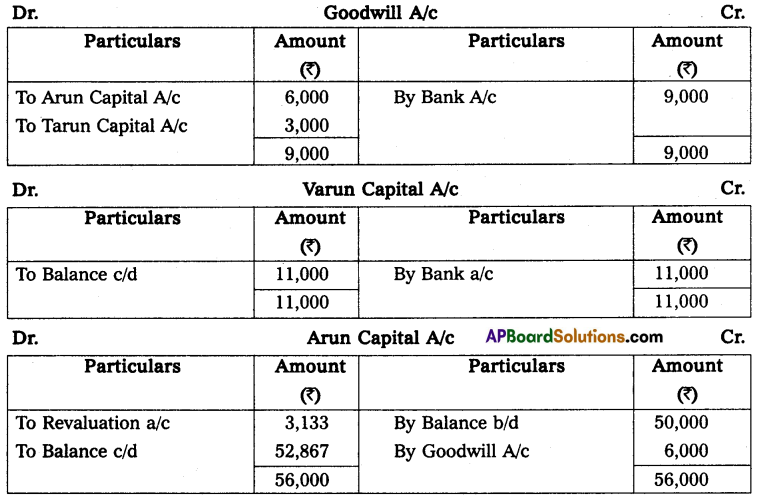

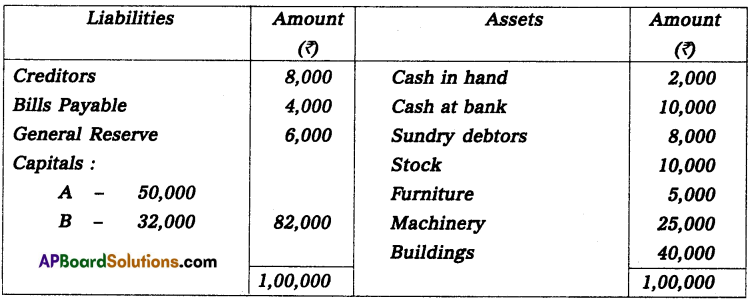

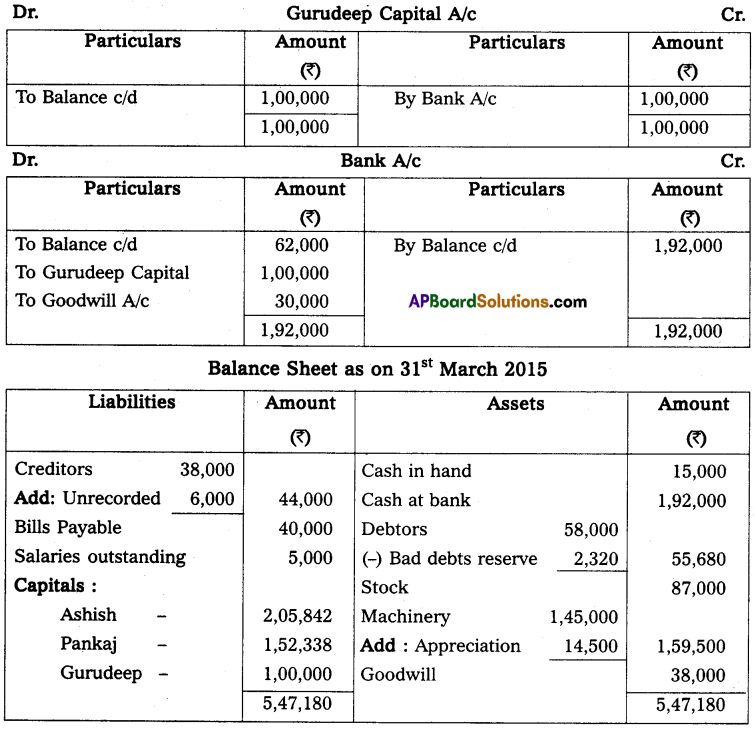

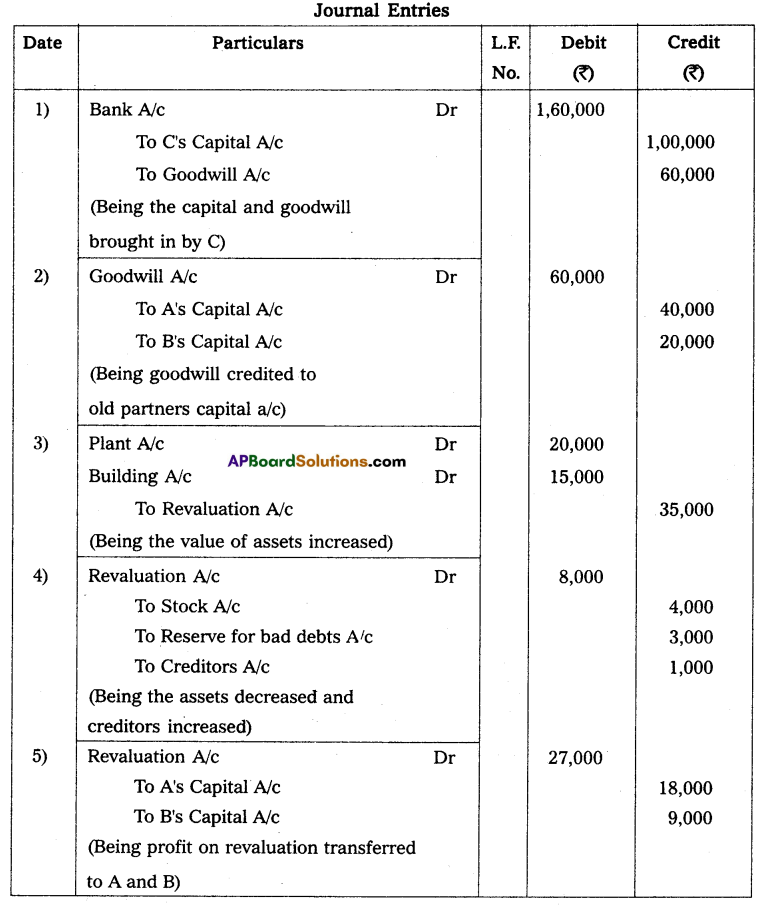

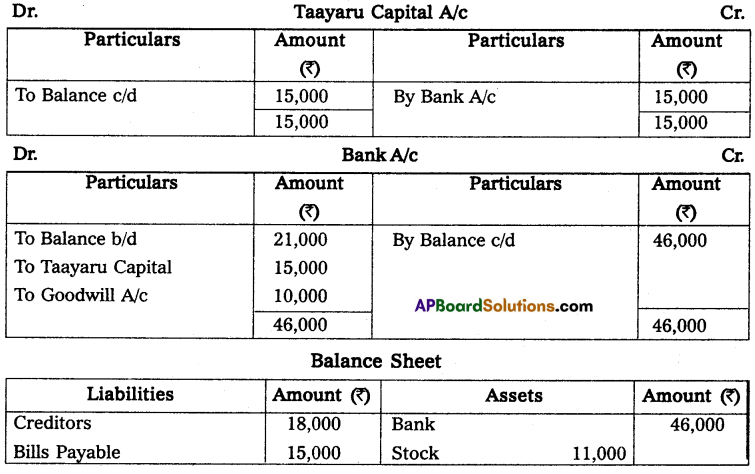

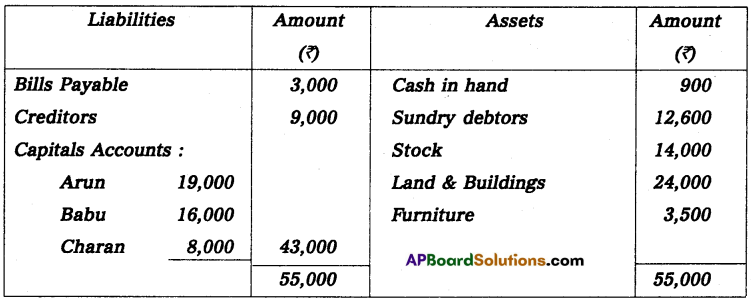

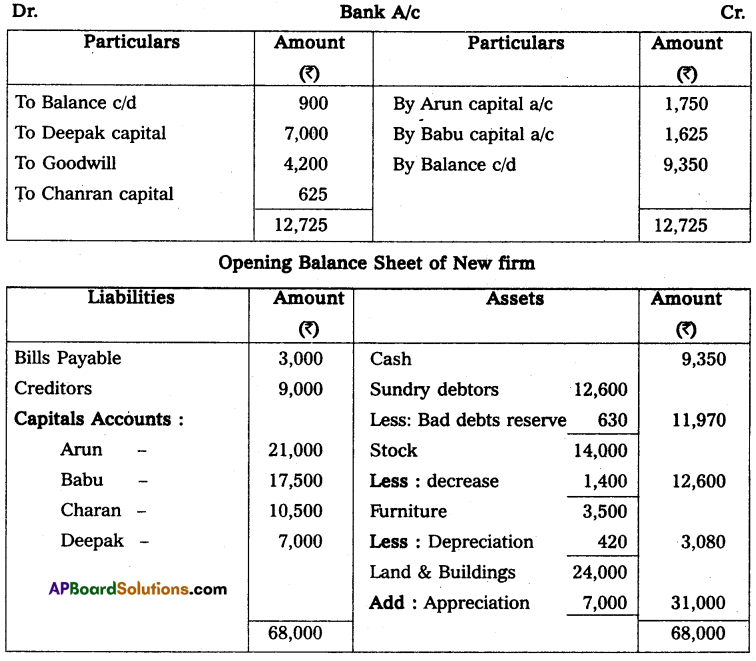

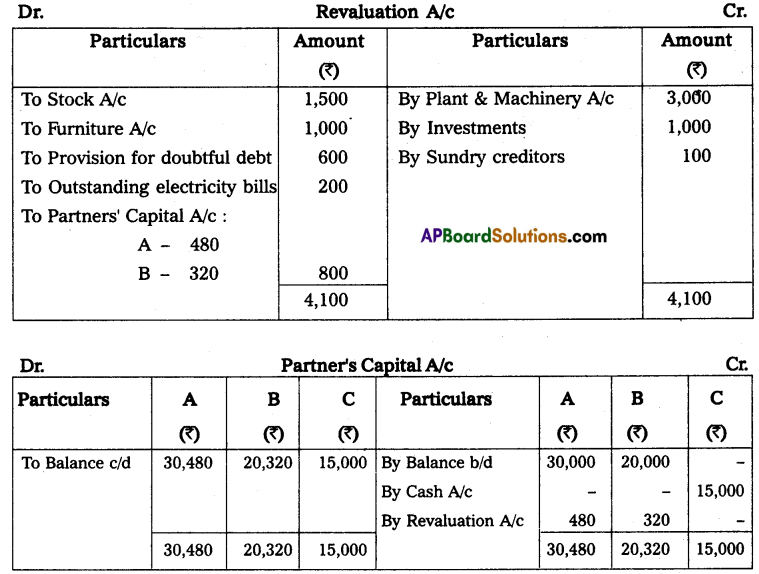

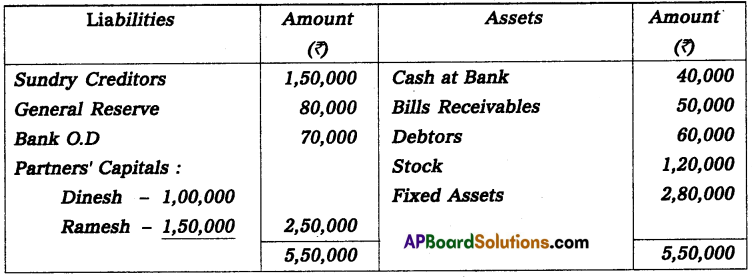

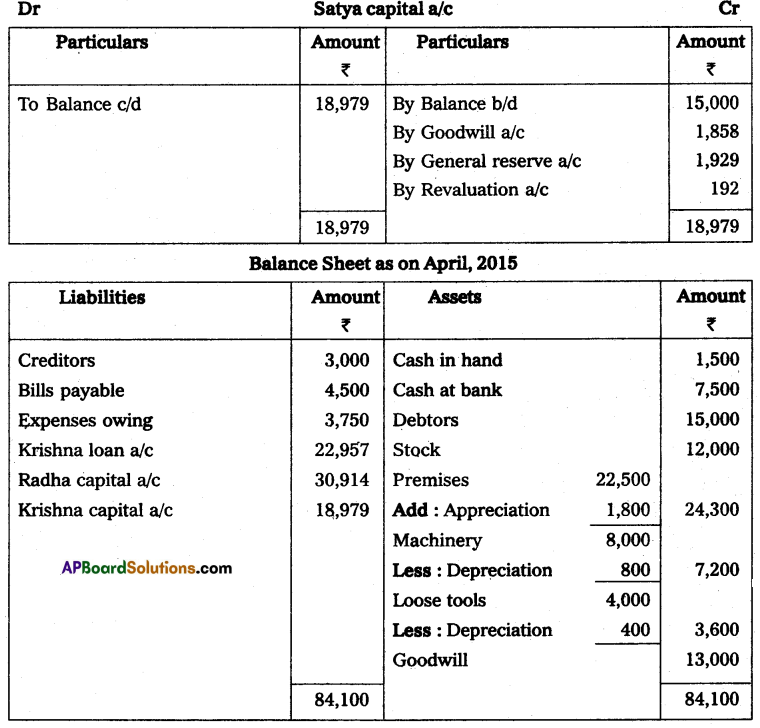

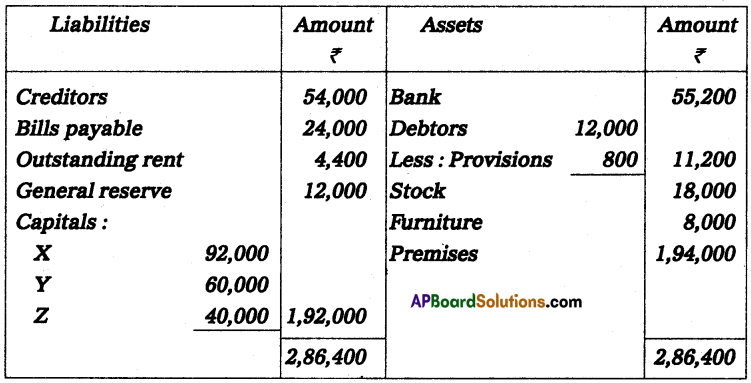

Question 13.

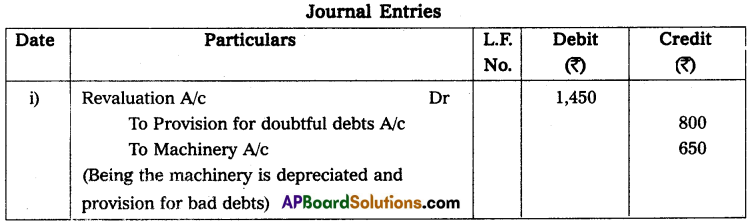

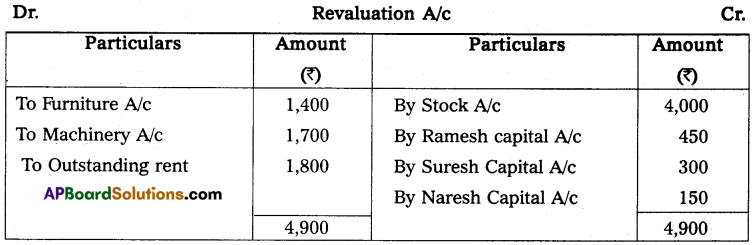

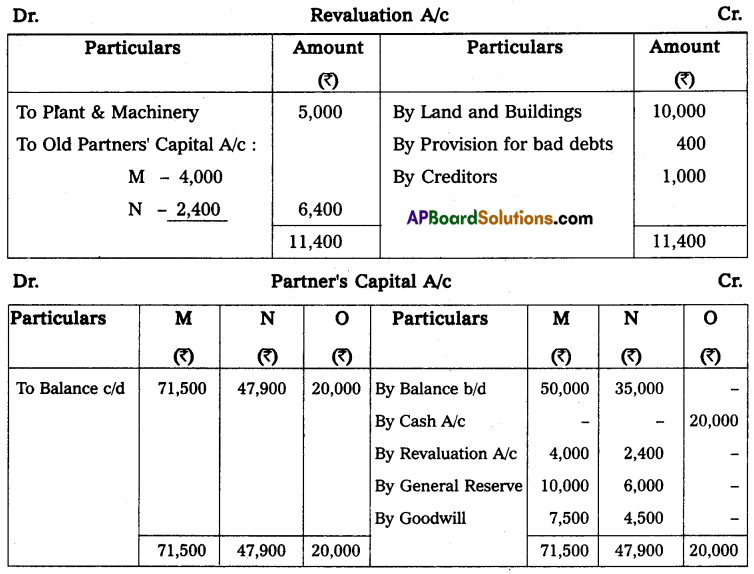

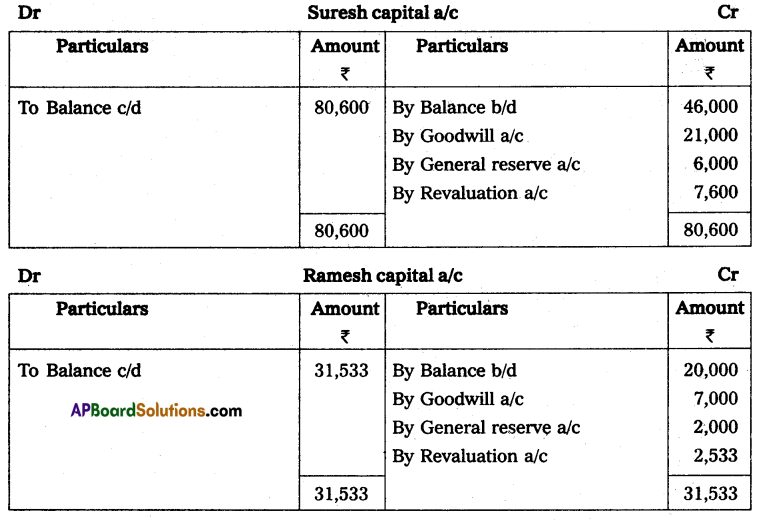

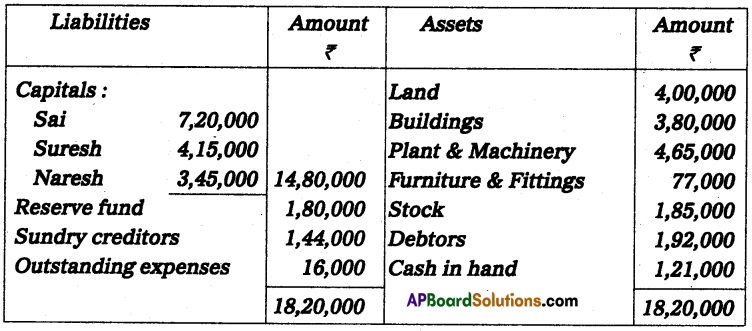

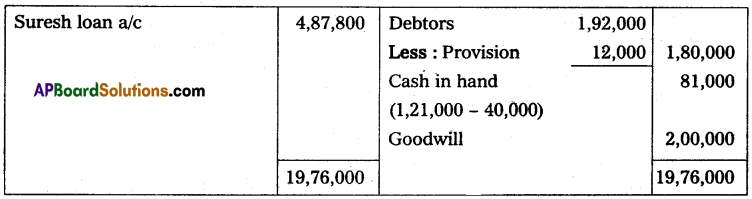

Suresh, Naresh, and Ramesh are partners sharing profits in the ratio of 3 : 2 : 1. Naresh retired from the firm due to his illness. On that date the Balance Sheet of the firm was as follows:

Books of Suresh, Naresh, and Ramesh Balance Sheet as on March 31, 2015.

Additional information:

(i) Premises have appreciated by 20%, stock depreciated by 10%, and provision for doubtful debts was to be made 5% on debtors.

(ii) Goodwill of the firm valued at ₹ 42,000.

(iii) ₹ 46,000 from Naresh’s capital account be transferred to his loan account and the balance be paid through the bank.

(iv) New profit sharing ratio of Suresh and Ramesh is decided to be 5 : 1.

Give the necessary ledger accounts and balance sheet of the firm after Naresh’s retirement.

Solution:

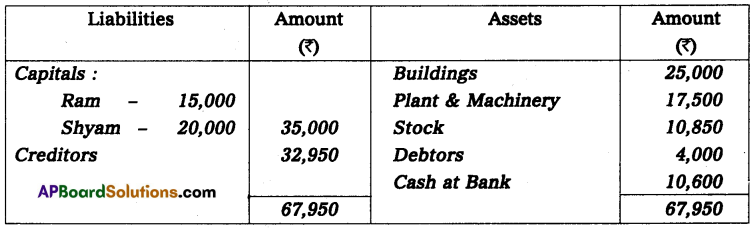

![]()

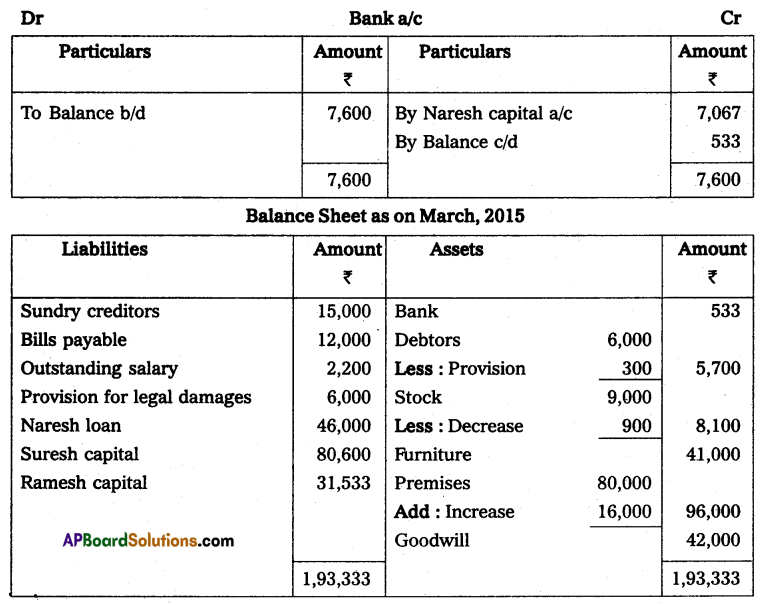

Question 14.

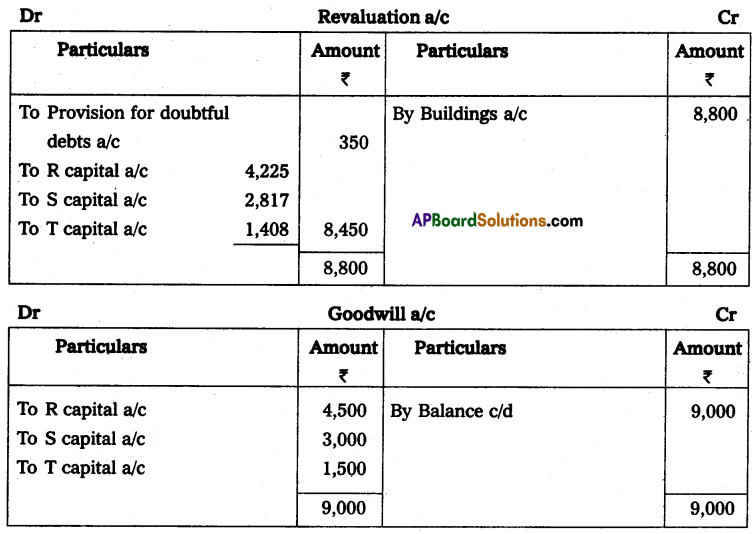

R, S, and T were carrying on business in partnership sharing profits in the ratio of 3 : 2 : 1 respectively. On March 31, 2015, the Balance Sheet of the firm stood as follows:

S retired on the above-mentioned date on the following terms:

(a) Buildings to be appreciated by ₹ 8,800.

(b) Provision for doubtful debts to be made @ 5% on debtors.

(c) Goodwill of the firm to be valued at ₹ 9,000.

(d) ₹ 5,000 to be paid to S immediately and the balance due to him is to be treated as a loan carrying interest @ 6% per annum.

Prepare the balance sheet of the reconstituted firm.

Solution:

Question 15.

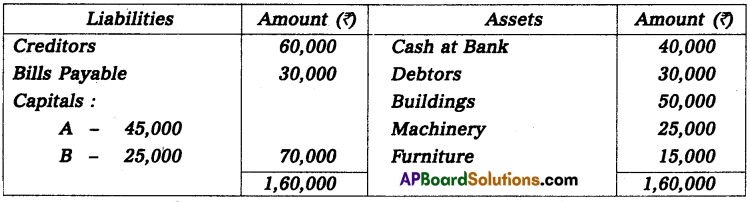

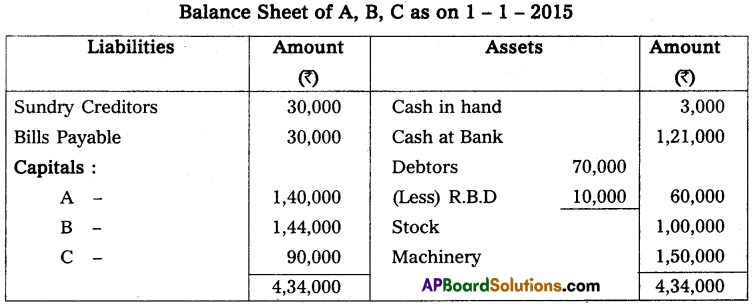

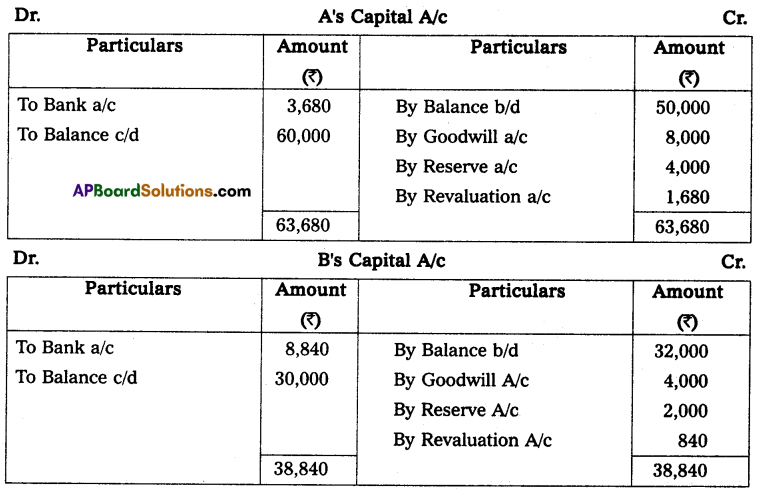

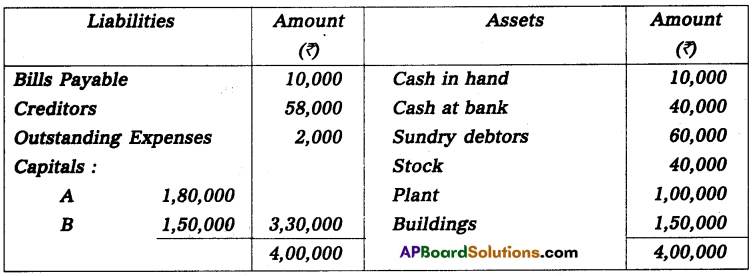

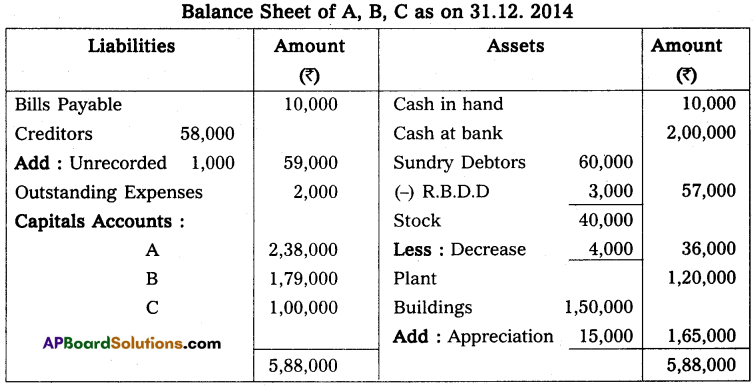

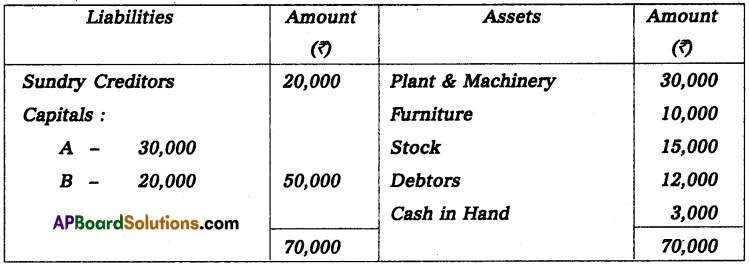

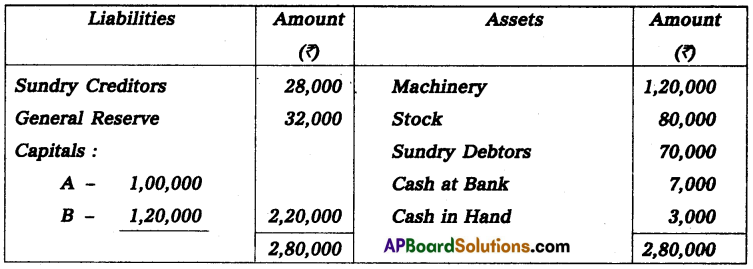

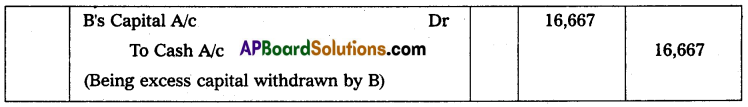

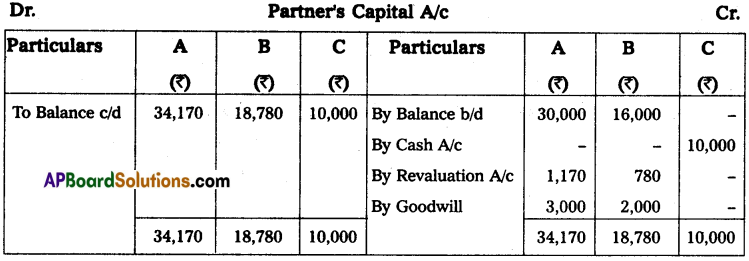

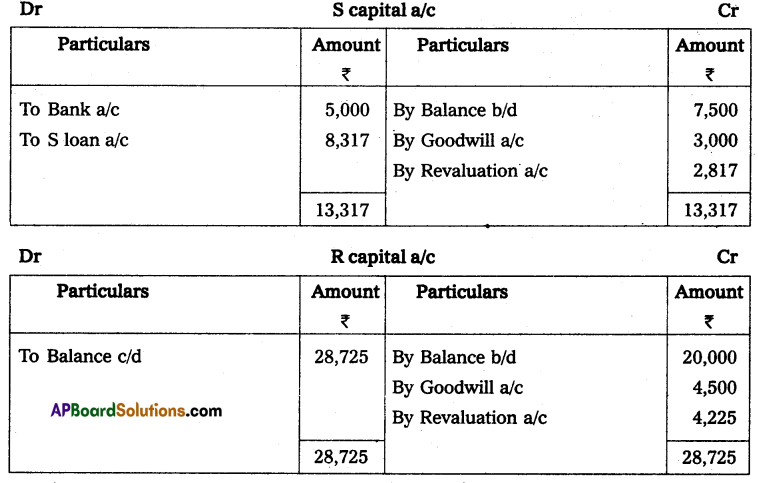

The balance sheet of A, B, and C who were sharing the profits in proportion to their capitals stood on March 31, 2015.

Balance Sheet as on March 31, 2015

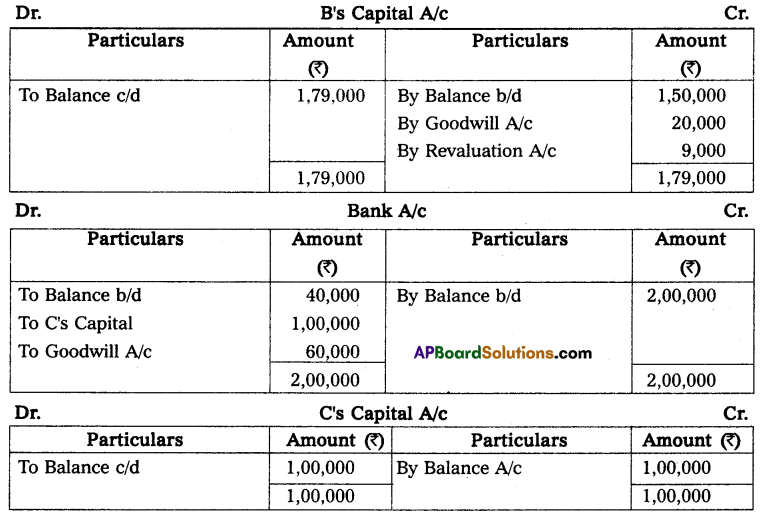

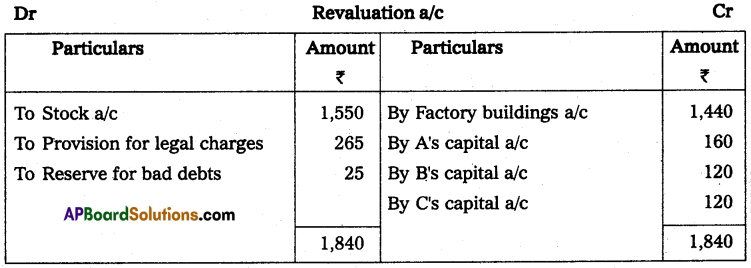

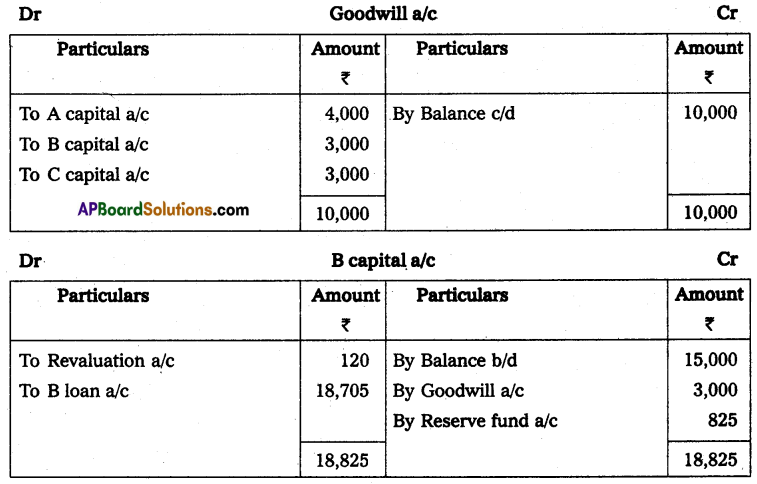

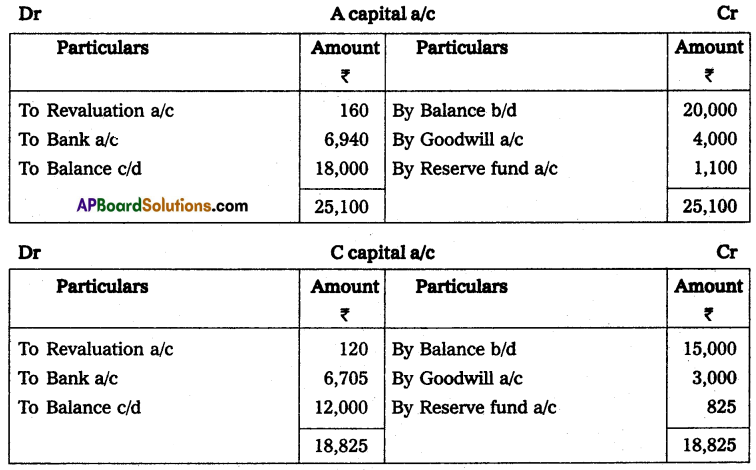

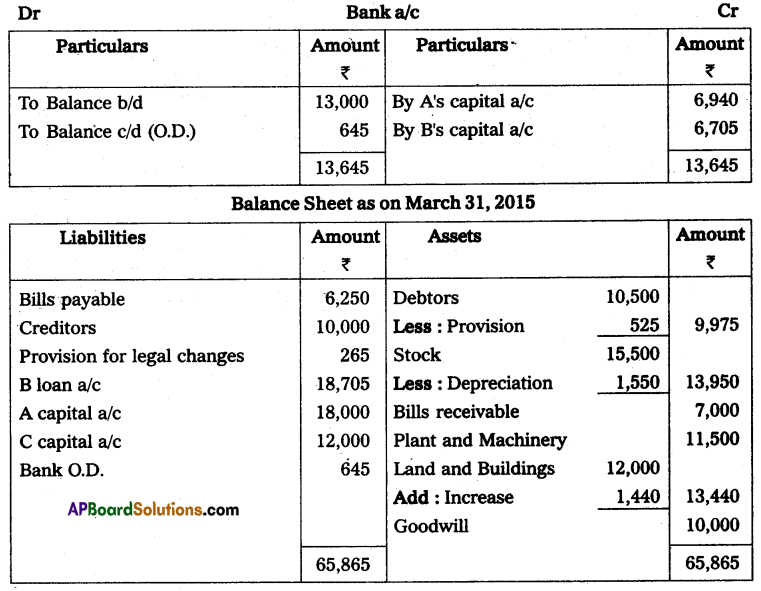

B retired on the date of the Balance Sheet and the following adjustments were to be made:

(a) Stock was depreciated by 10%.

(b) Factory building was appreciated by 12%.

(c) Provision for doubtful debts to be created upto 5%.

(d) Provision for legal charges to be made at Rs. 265.

(e) The goodwill of the firm is to be fixed at Rs. 10,000.

(f) The capital of the new firm is to be fixed at Rs. 30,000.

The continuing partners decide to keep their capitals in the new profit sharing ratio of 3 : 2. Work out the final balances in the capital accounts of the firm, and the amounts to be brought in and/or withdrawn by A and C to make their capitals proportionate to the new profit sharing ratio.

Solution:

Note: Capital of the new firm = ₹ 30,000

A’s capital should according to his share = \(\frac{3}{5}\) × 30,000 = ₹ 18,000

C’s capital = \(\frac{3}{5}\) × 30,000 = ₹ 12,000

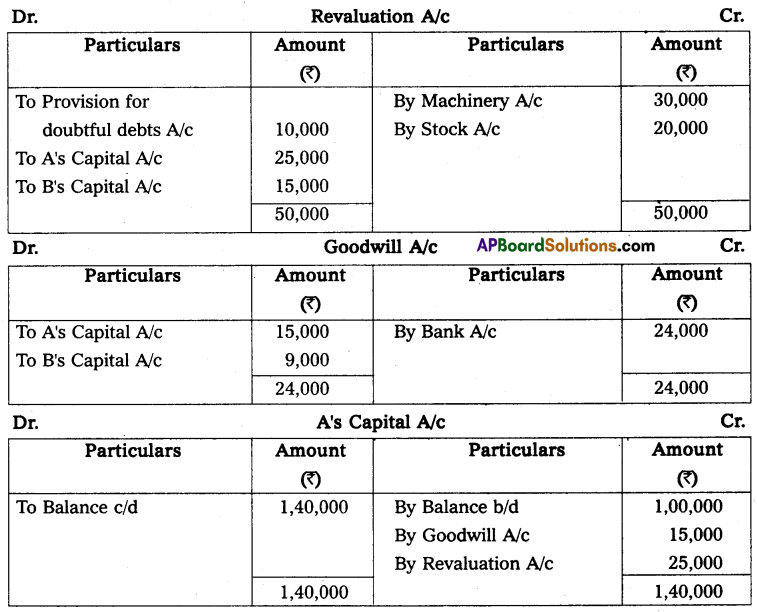

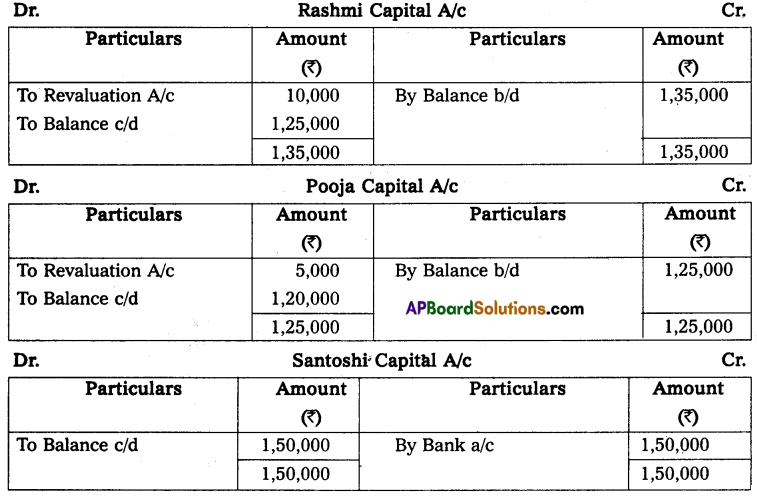

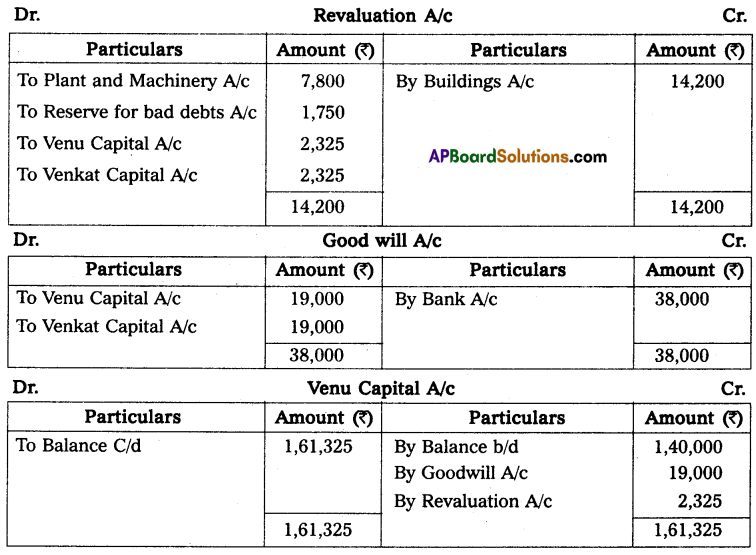

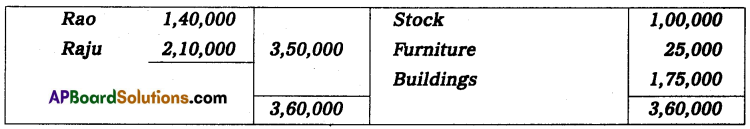

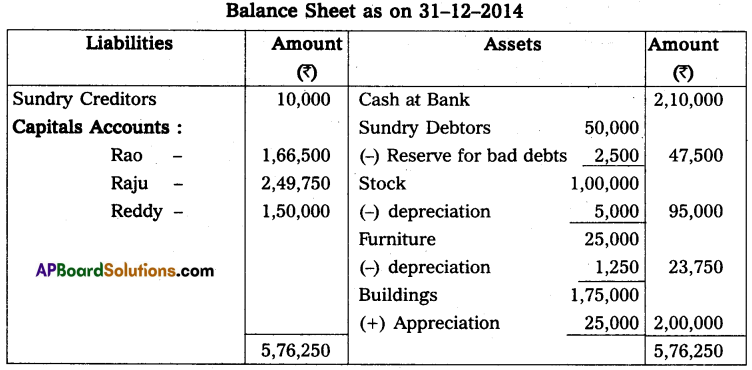

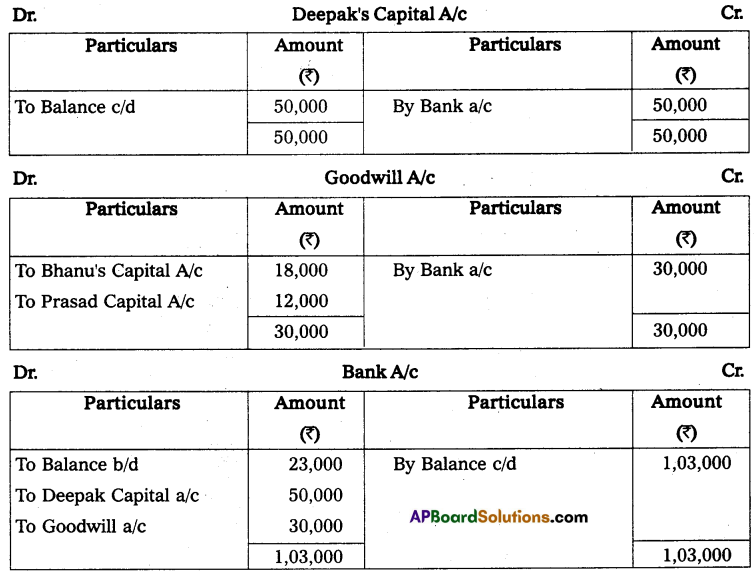

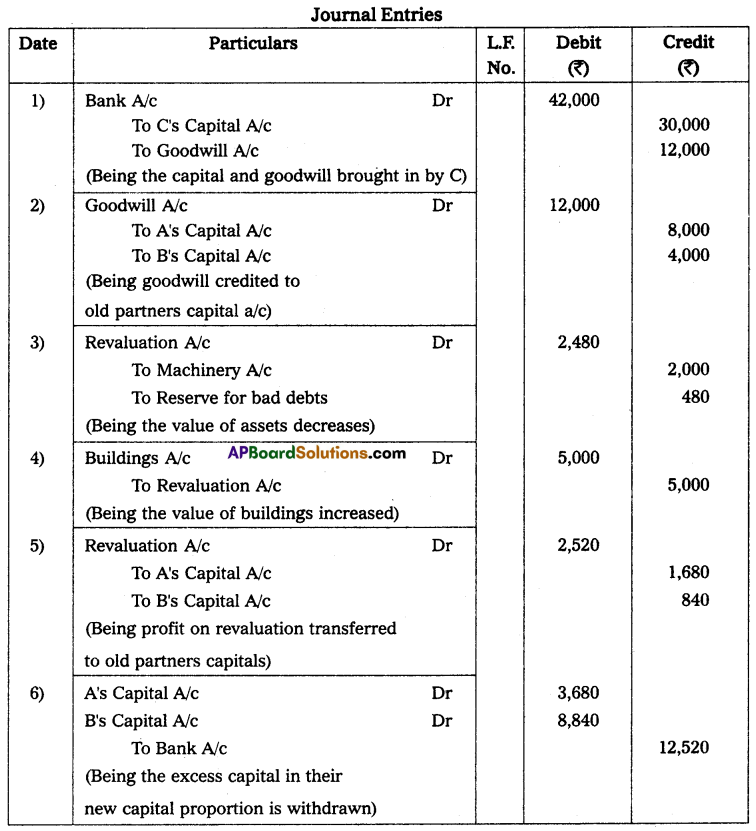

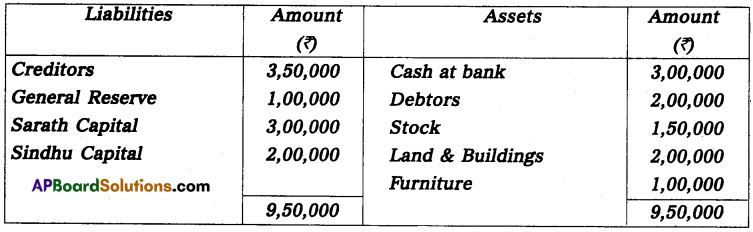

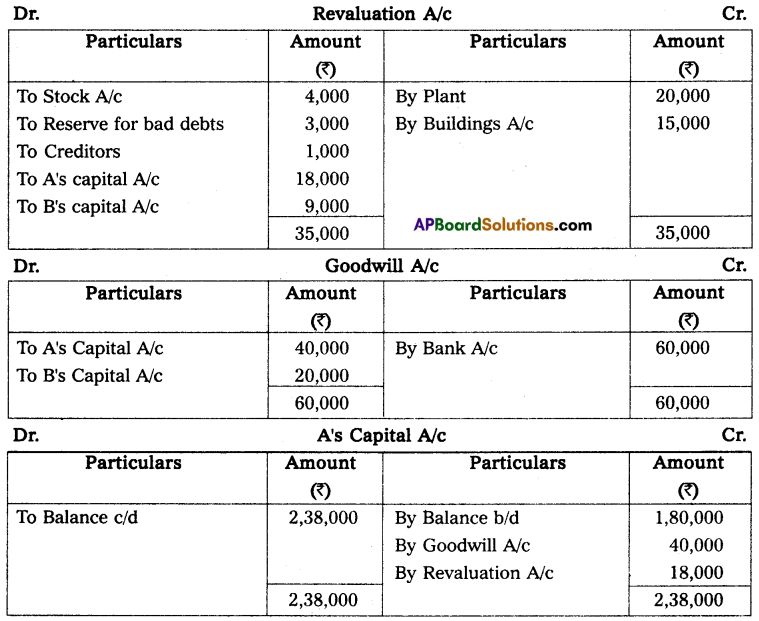

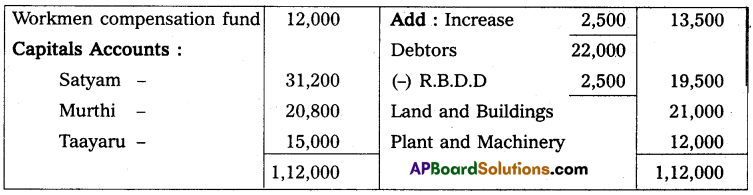

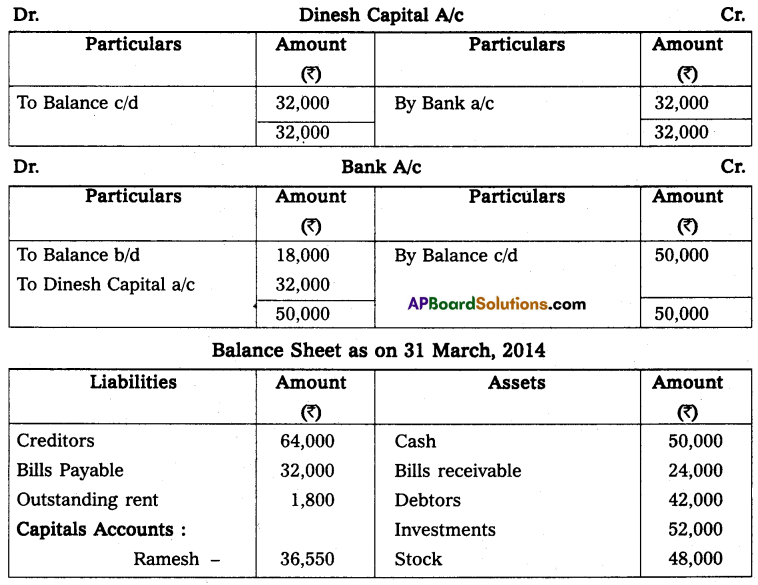

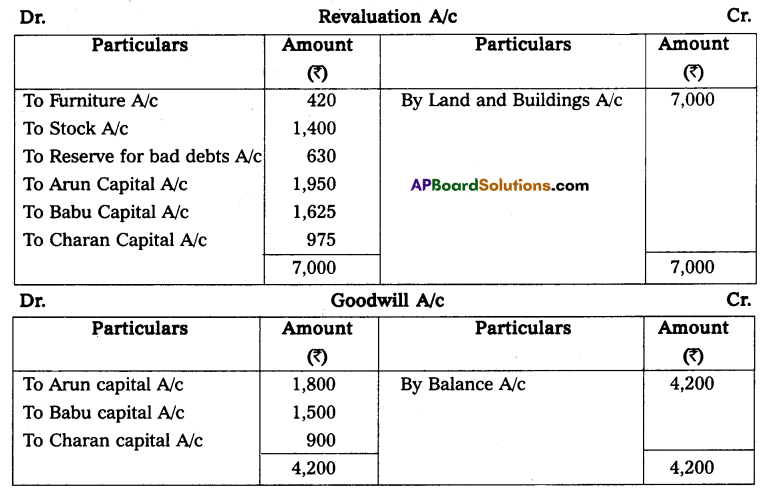

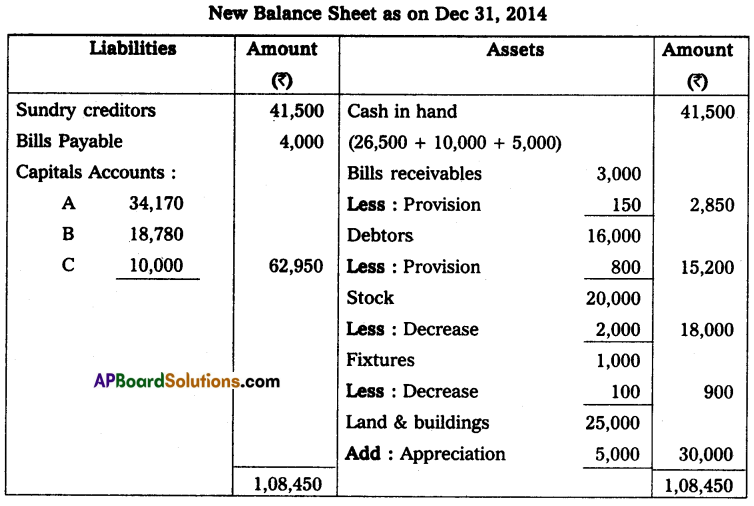

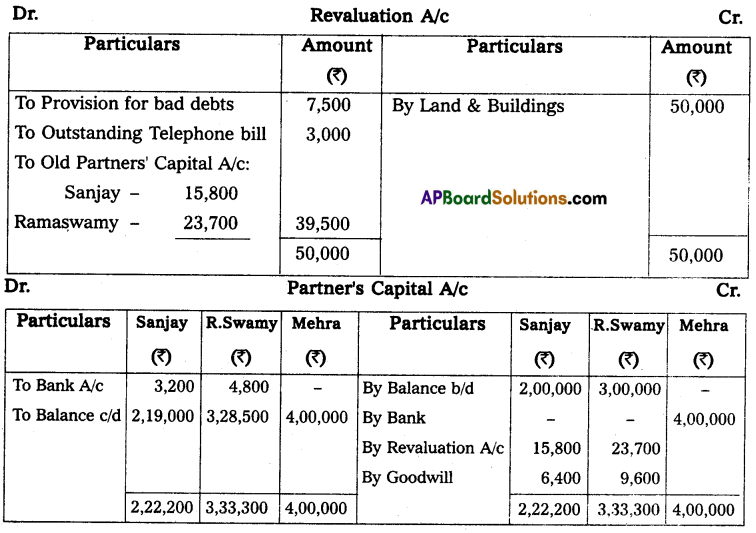

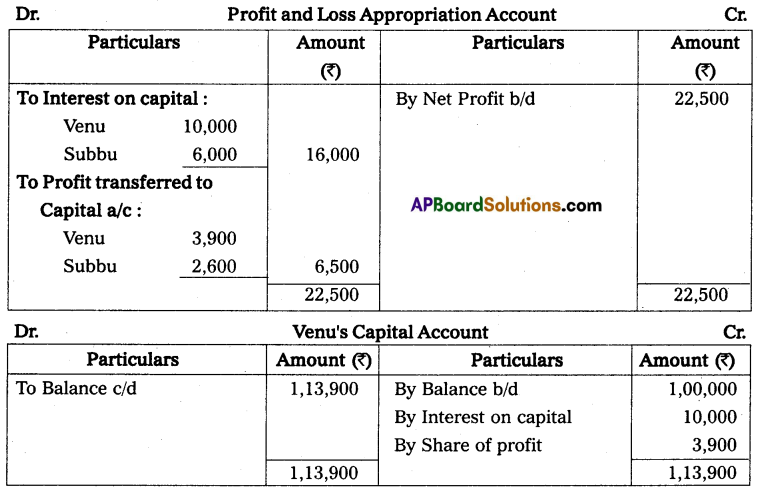

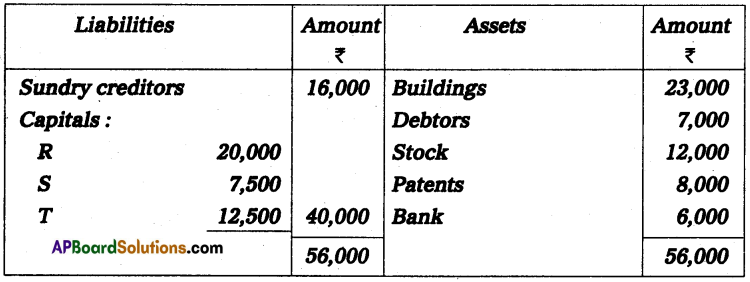

Question 16.

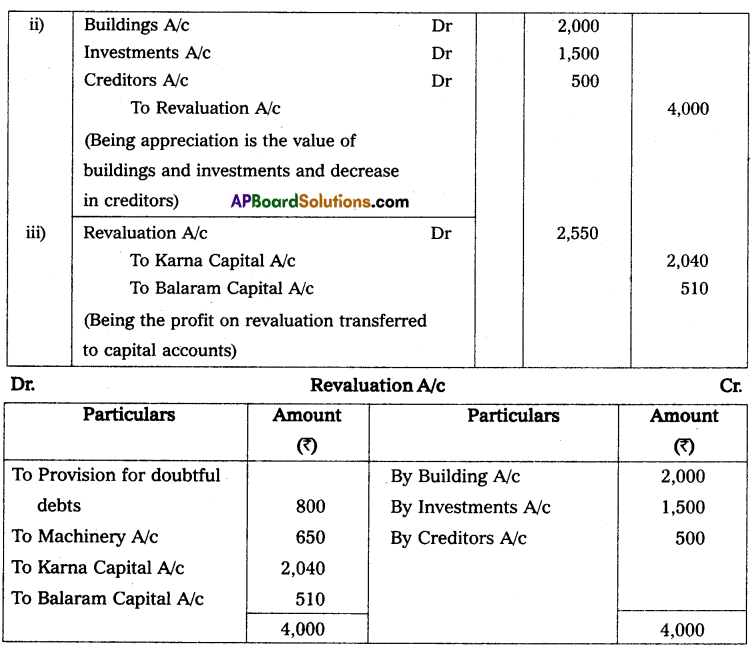

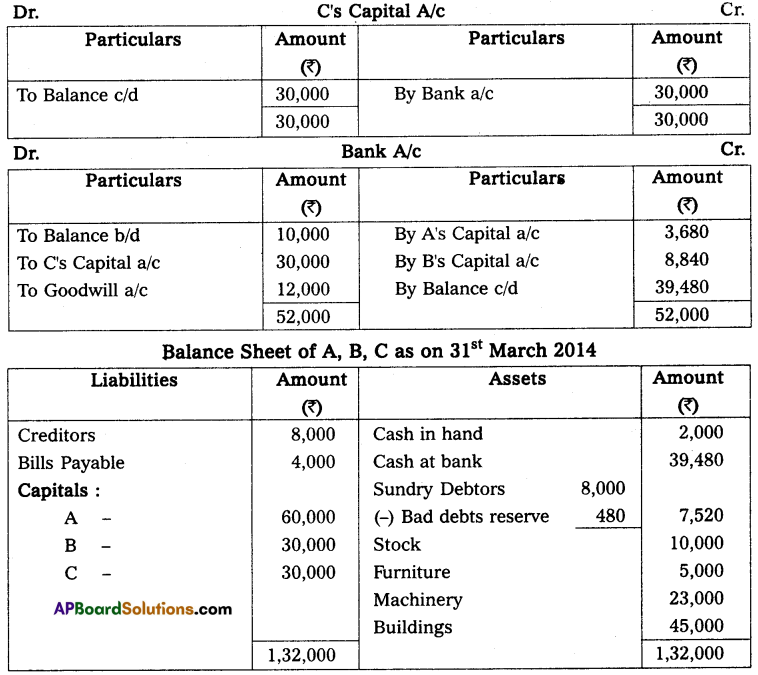

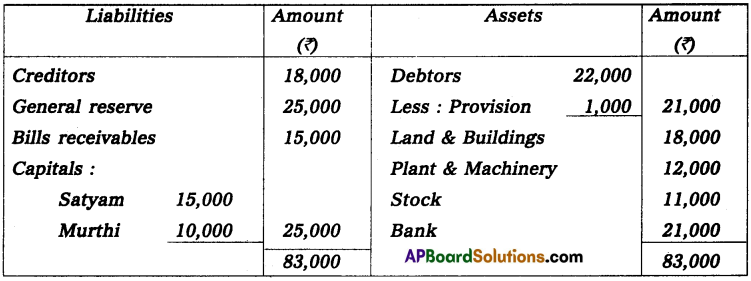

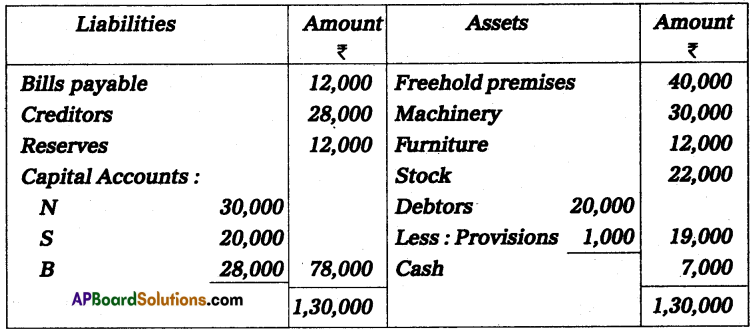

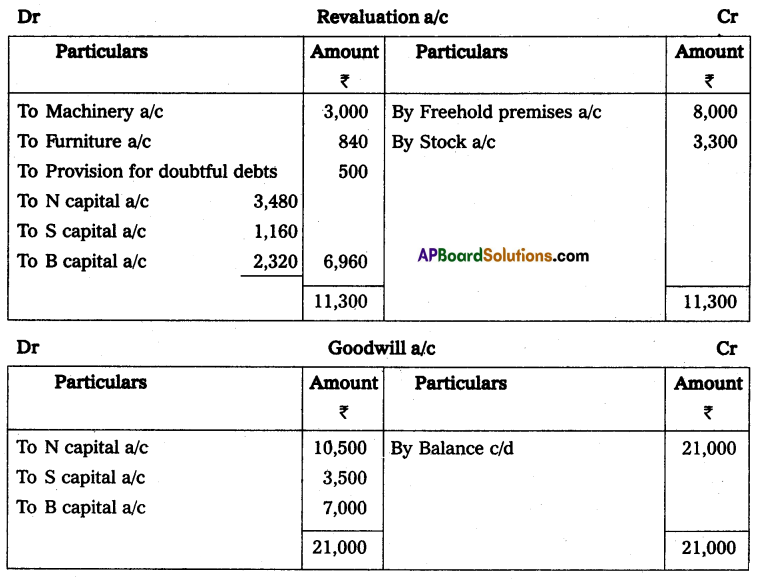

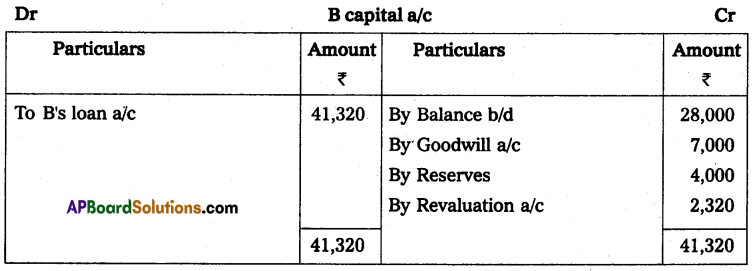

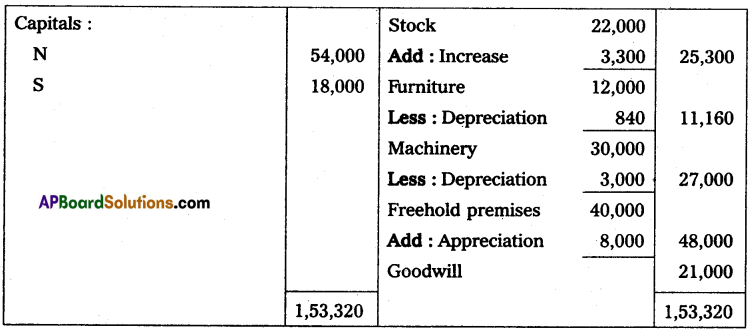

N, S, and B are partners in firm sharing profits and losses in the ratio of 3 : 1 : 2. The Balance Sheet on April 1, 2015, was as follows:

B retires from the business and the partners agree to the following:

(a) Freehold premises and stock are to be appreciated by 20% and 15% respectively.

(b) Machinery and furniture are to be depreciated by 10% and 7% respectively.

(c) Bad debts reserve is to be increased to ₹ 1,500.

(d) Goodwill is valued at ₹ 21,000 on B’s retirement.

(e) The continuing partners have decided to adjust their capitals in their new profit-sharing ratio after the retirement of B. The capital requirement to continue the firm is ₹ 72,000. Surplus/deficit, if any, in their capital accounts will be adjusted.

Prepare necessary ledger accounts and draw the Balance Sheet of the reconstituted firm.

Solution:

Note: Total capital of the firm = ₹ 72,000

The profit sharing ratio of N and S is 3 : 1

Capital of N = 72,000 × \(\frac{3}{4}\) = ₹ 54,000

Capital of S = 72,000 × \(\frac{1}{4}\) = ₹ 18,000

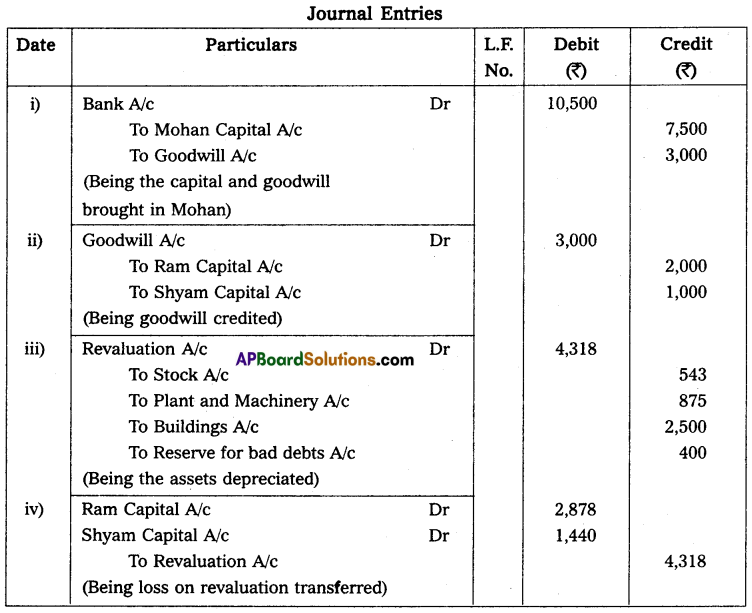

![]()

Question 17.

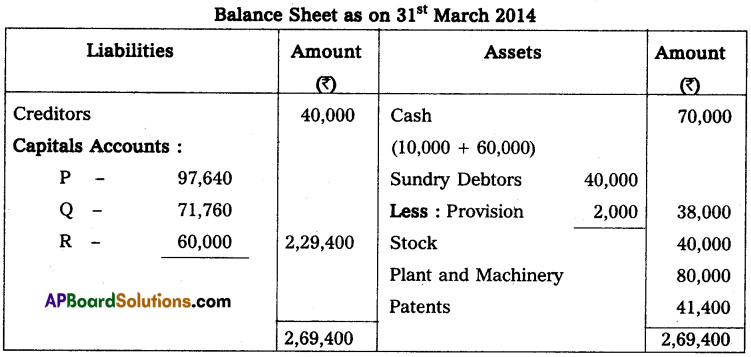

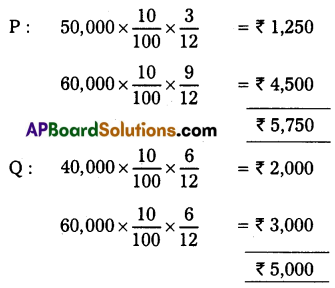

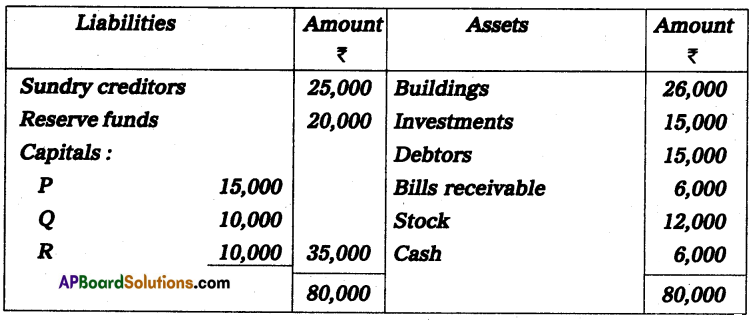

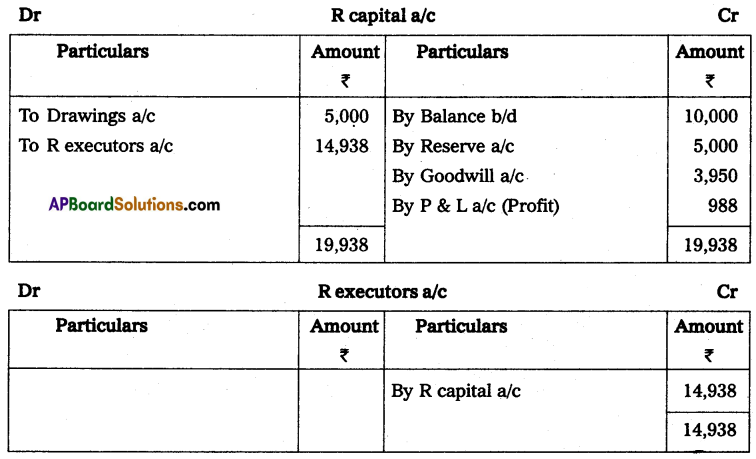

On December 31, 2014, the Balance Sheet of P, Q, and R showed as under:

The partnership deed provides that the profit be shared to the ratio of 2 : 1 : 1 and that in the event of the death of a partner, his executors are entitled to be paid out.

(a) The capital of his credit at the date of the last Balance Sheet.

(b) His proportion of reserves at the date of the last Balance Sheet.

(c) His proportion of profits to the date of death is based on the average profits of the last three completed years.

(d) By way of goodwill, his proportion of the total profits for the three preceding years.

The net profits for the last three years were:

2012 – 16,000; 2013 – 16,000; 2014 – 15,400.

R died on April 1, 2015. He had withdrawn ₹ 5,000 to the date of his death.

Prepare R’s Capital Account that of his executors.

Solution:

Working Notes:

(i) Share of profits (upto the date of death)

Average profits = \(\frac{47,400}{3}\) = ₹ 15,800

Share of profit upto 1st April 2015 = 15,800 × \(\frac{1}{4} \times \frac{3}{12}\) = ₹ 988

(ii) Goodwill:

Total profits = ₹ 47,400

Average profits = \(\frac{47,400}{3}\) = ₹ 15,800

R share of goodwill = 15,800 × \(\frac{1}{4}\) = ₹ 3,950

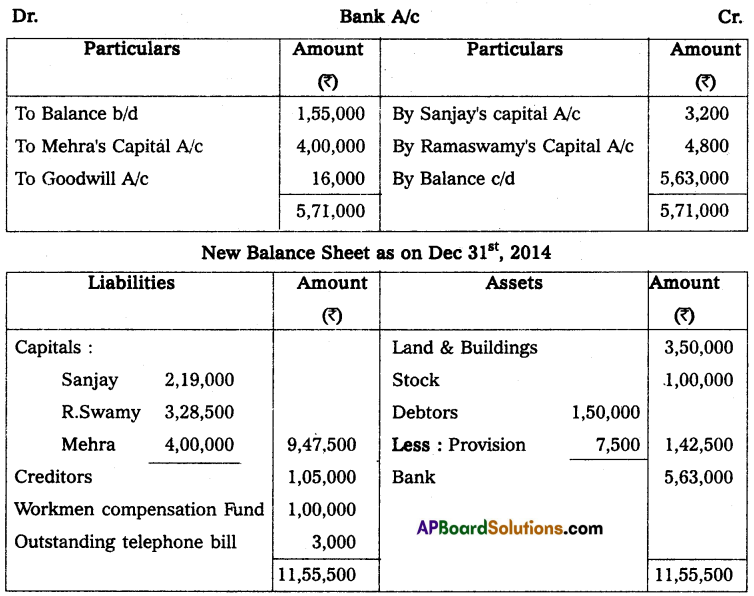

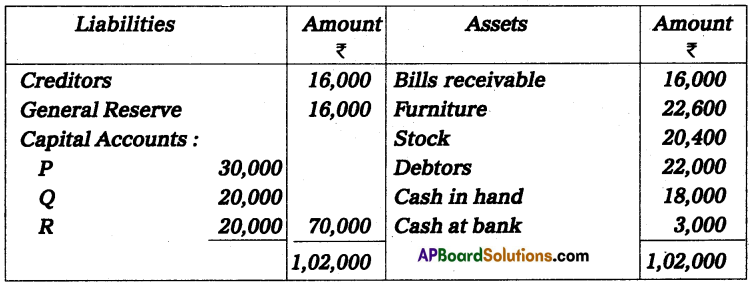

Question 18.

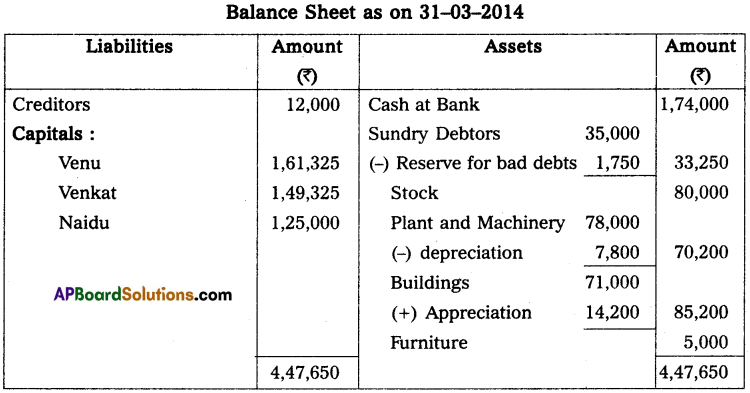

Following is the Balance Sheet of P, Q, and R as on March 31, 2014.

Q died on June 30, 2014. Under the terms of the partnership deed, the executors of a deceased partner were entitled to:

(a) Amount standing to the credit of the Partner’s Capital account.

(b) Interest on capital at 5% per annum.

(c) Share of goodwill on the basis of twice the average of the past three year’s profit.

(d) Share of profit from the closing date of the last financial year to the date of death on the basis of last year’s profit.

Profits for the year ending on March 31, 2012, 2013, and 2014 were ₹ 12,000; ₹ 16,000, and ₹ 14,000 respectively. Profits were shared in the ratio of capital.

Pass the necessary journal entries and draw up Q’s capital account to be rendered to his executor.

Solution:

Working Notes:

(i) Interest on capital = 20,000 × \(\frac{5}{100} \times \frac{3}{12}\) = ₹ 250

(ii) Goodwill:

3 years profits = 12,000 + 16,000 + 14,000 = ₹ 42,000

Average profits = \(\frac{42,000}{3}\) = ₹ 14,000

Goodwill = 2 × 14,000 = ₹ 28,000

Share of goodwill = 28,000 × \(\frac{2}{7}\) = ₹ 8,000

Share of profit:

Profit of 2014 = 14,000 × \(\frac{2}{7} \times \frac{3}{12}\) = ₹ 1,000

Share in reserve = 16,000 × \(\frac{2}{7}\) = ₹ 4,571

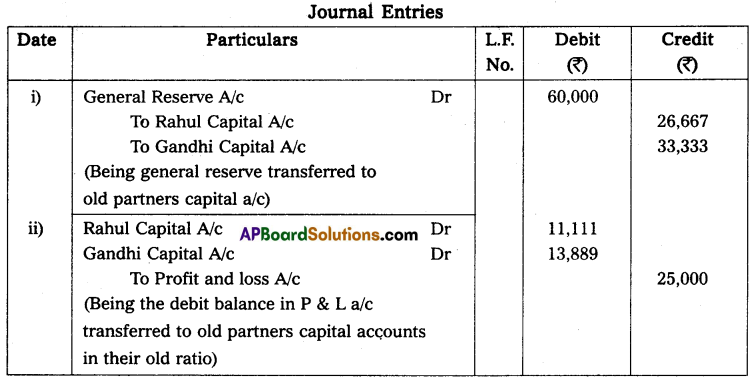

Textual Examples

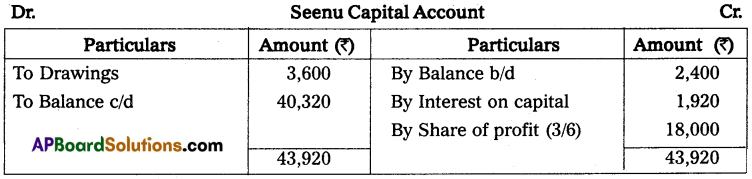

Question 1.

Naveen, Suresh, and Tarun are partners sharing profits and losses in the ratio of 5 : 3 : 2. Tarun retires from the firm, and his share was acquired by Naveen and Tarun in the ratio of 2 : 1. In such a case, calculate the new profit sharing ratio.

Solution:

The old ratio of Naveen, Suresh, and Tarun = 5 : 3 : 2

Gaining ratio of Naveen and Suresh after the retirement of Tarun = 2 : 1

New share of continuing partner = Old share + Acquired share from the outgoing partner

Share acquired by Naveen = \(\frac{2}{10} \times \frac{2}{3}=\frac{4}{30}\)

Naveen’s new share = \(\frac{5}{10}+\frac{4}{30}=\frac{15+4}{30}=\frac{19}{30}\)

Share acquired by Suresh = \(\frac{2}{10} \times \frac{1}{3}=\frac{2}{30}\)

Suresh’s new share = \(\frac{3}{10}+\frac{2}{30}=\frac{9+2}{30}=\frac{11}{30}\)

New ratio = \(\frac{19}{30}: \frac{11}{30}\)

Thus, the new profit sharing ratio of Naveen and Suresh will be = 19 : 11.

![]()

Question 2.

Anil, Dinesh, and Ganga are partners sharing profits in the ratio of 6 : 5 : 4. Dinesh retires. Anil and Ganga decide to share the profits of the new firm in the ratio of 3 : 2. Calculate the gaining ratio.

Solution:

The old ratio of all partners = 6 : 5 : 4

New ratio of continuing partners = 3 : 2

Gaining share of continuing partners = New share – Old share

Ami’s gaining share = \(\frac{3}{5}-\frac{6}{15}=\frac{9-6}{15}=\frac{3}{15}\)

Ganga’s gaining share = \(\frac{2}{5}-\frac{4}{15}=\frac{6-4}{15}=\frac{2}{15}\)

Gaining ratio = \(\frac{3}{15}: \frac{2}{15}\)

Thus, the gaining ratio of Anil and Ganga = 3 : 2

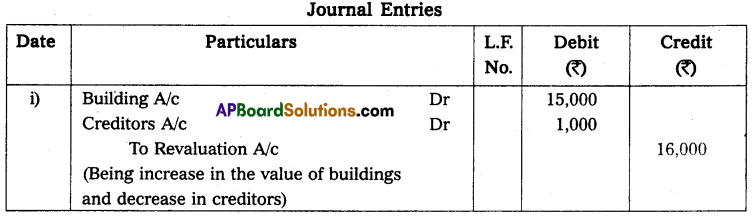

Question 3.

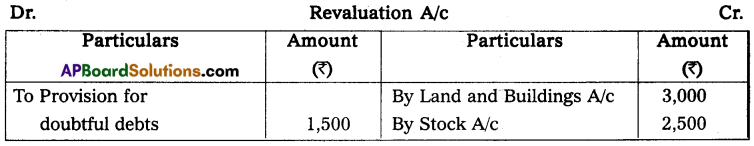

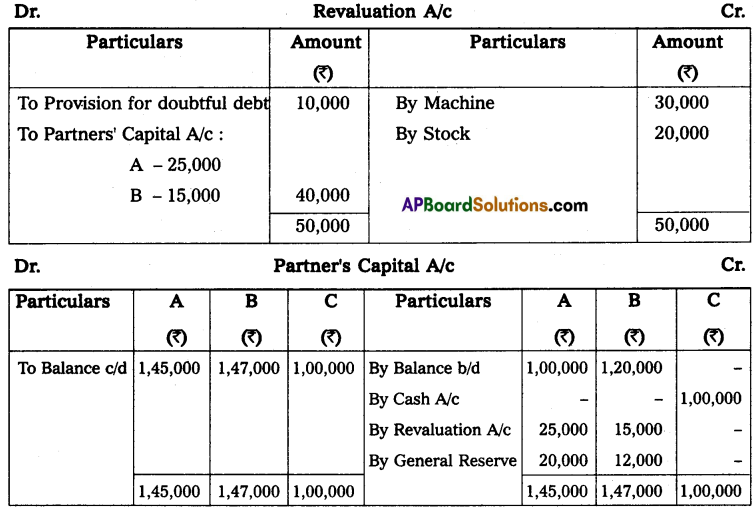

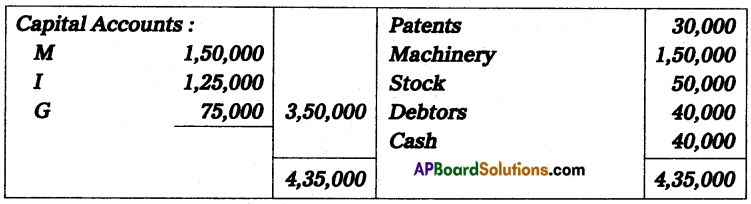

M, I, and G are partners sharing profits and losses in the ratio of 2 : 2 : 1 respectively. On March 31, 2015, their Balance Sheet was as under:

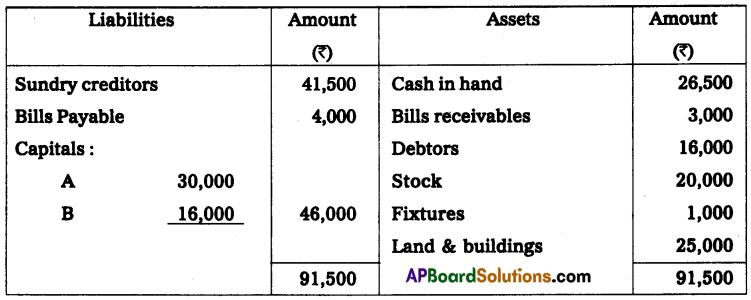

G retires on the above date. It was agreed that Machinery is valued at ₹ 1,40,000; Patents at ₹ 40,000; and Buildings at ₹ 1,25,000. Record the necessary journal entries and prepare the Revaluation Account.

Solution:

Question 4.

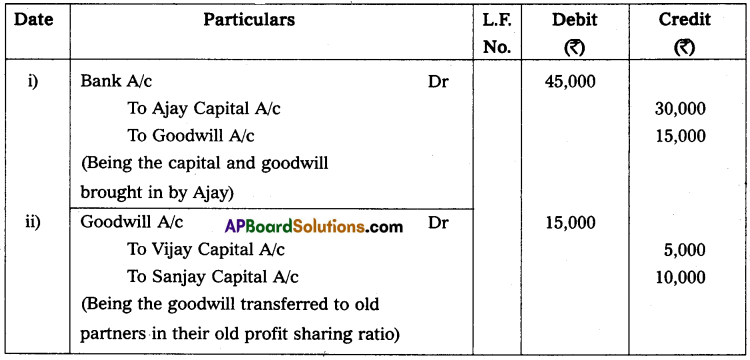

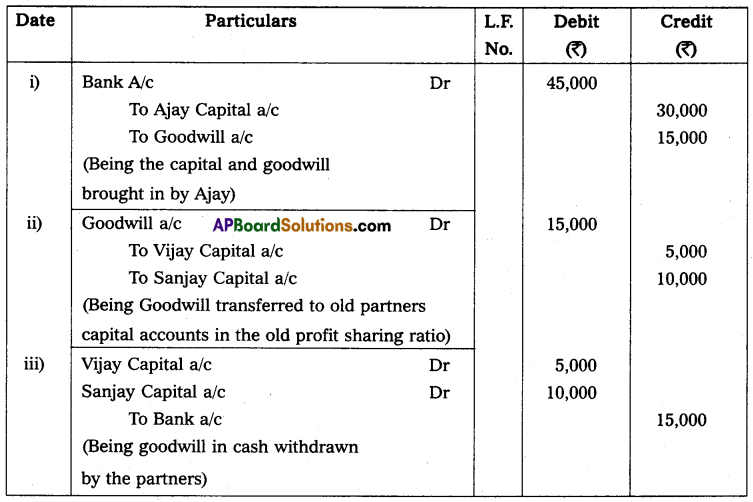

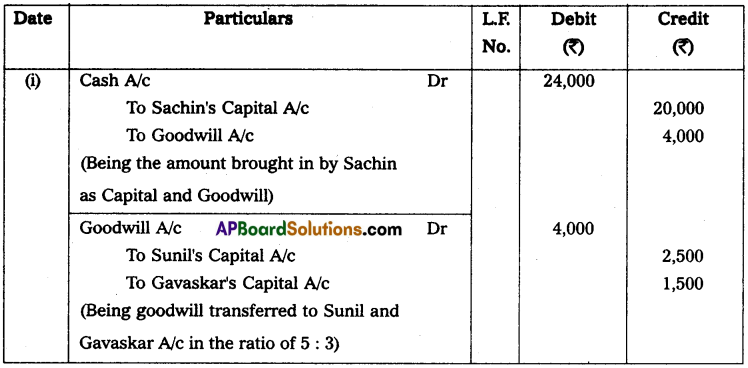

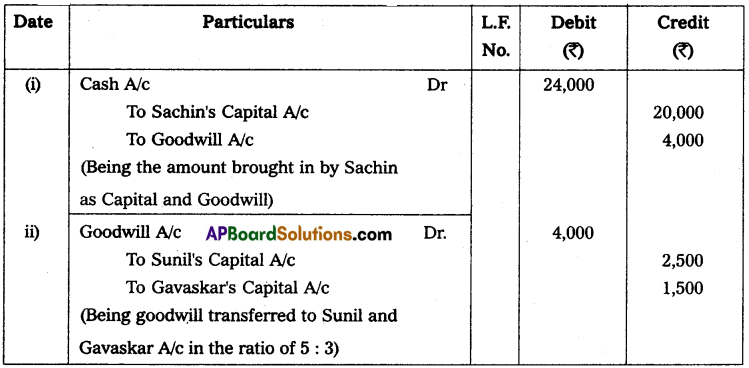

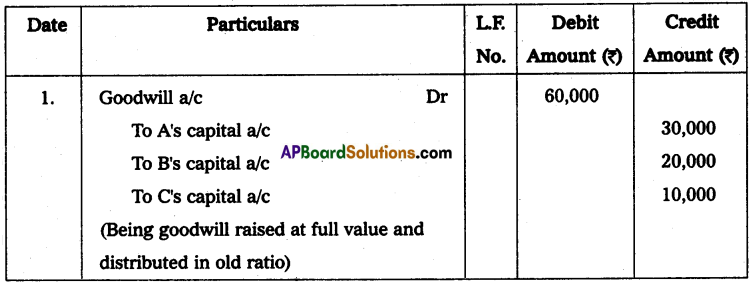

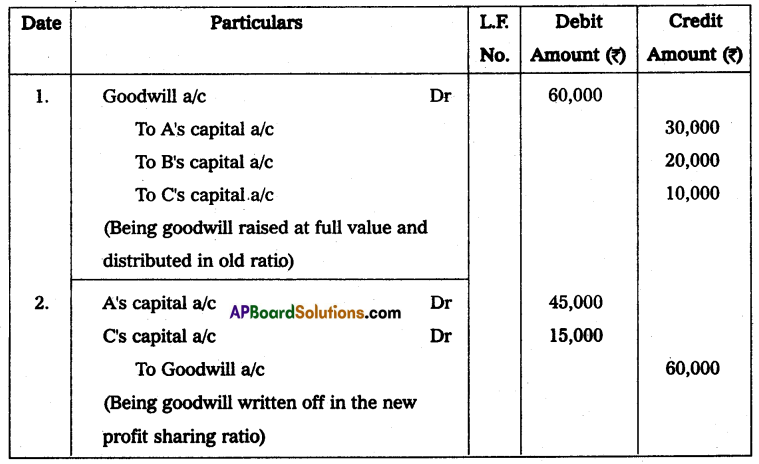

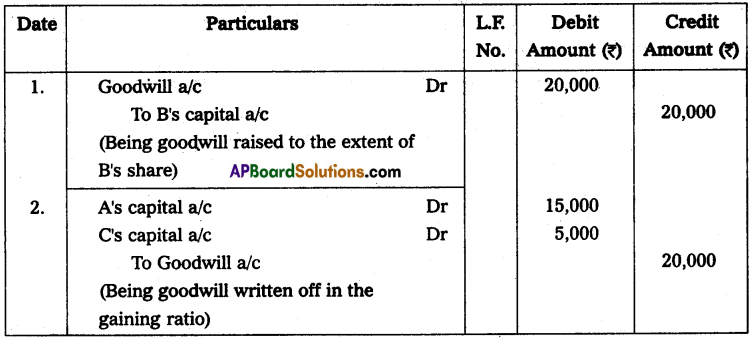

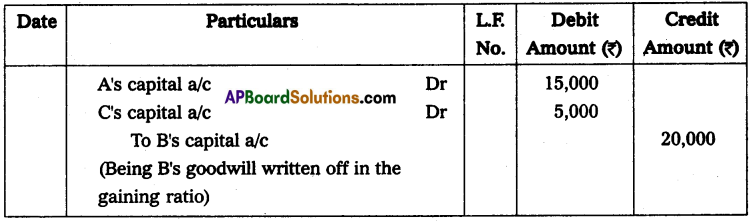

A, B, and Care partners in firm share profits in the ratio of 3 : 2 : 1. B retires. The goodwill of the firm is valued at ₹ 60,000 and the remaining partner A and C continue to share profits in the ratio of 3 : 1. Pass the journal entries under various alternatives:

(a) If goodwill is raised at full value and retained in books.

(b) If goodwill is raised at full value and written off immediately.

(c) If goodwill is raised to the extent of retiring partner’s share and written off immediately.

(d) If goodwill is not after in the firm’s books at all.

Solution:

(a) If goodwill is raised at full value and retained in books.

(b) If goodwill is raised at full value and written off immediately.

(c) If goodwill is raised to the extent of retiring partner’s share and written off immediately.

(d) If goodwill is not after in the firm’s book at all.

Working Notes:

Calculation of gaining ratio:

Old ratio of all partners = 3 : 2 : 1

New ratio of continuing ratio = 3 : 1

Gaining share of continuing partners = New share – Old share

A’s gaining share = \(\frac{3}{4}-\frac{3}{6}=\frac{9-6}{12}=\frac{3}{12}\)

C’s gaining share = \(\frac{1}{4}-\frac{1}{6}=\frac{3-2}{12}=\frac{1}{12}\)

Gaining ratio = \(\frac{3}{12}: \frac{1}{12}\)

Thus, the gaining ratio of A and C = 3 : 1

![]()

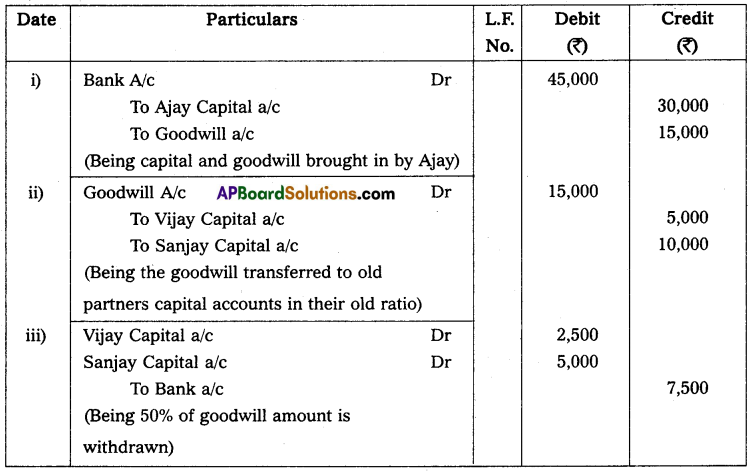

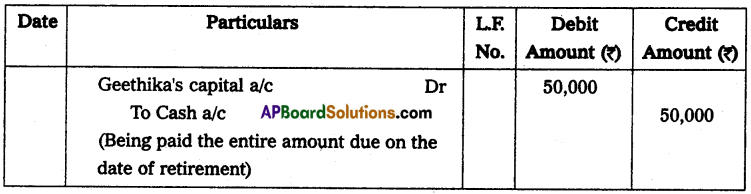

Question 5.

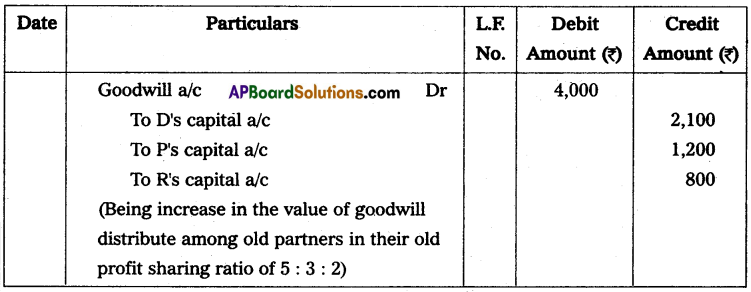

D, P, and R are partners sharing profits in the ratio of 5 : 3 : 2. Goodwill appears in the books at a value of ₹ 20,000. P retires from the business. Pass the necessary journal entries in the following cases:

(a) On the day of P’s retirement, goodwill is valued at ₹ 24,000 and

(b) At the time of retirement goodwill is valued ₹ 18,000.

Solution:

(a) On the day of P’s retirement, goodwill is valued at ₹ 24,000.

(b) At the time of retirement goodwill is valued ₹ 18,000.

Question 6.

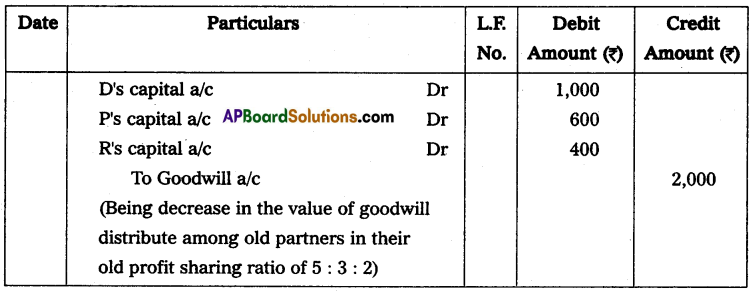

John, Sundar, and Rao are partners in the firm sharing profits in the ratio of 2 : 1 : 1. John retired from the firm, and Sundar and Rao decided that the capital of the new firm will be fixed at ₹ 1,20,000. The capital accounts of Sundarand Rao show a credit balance of ₹ 82,000 and ₹ 41,000 respectively after making all the adjustments. Calculate the actual cash to be paid off or to be brought in by the continuing partners and pass the necessary journal entries.

Solution:

The new profit sharing ratio between Sundar and Rao = 2 : 1

Total capital of the firm = ₹ 1,20,000

New capital based on new ratio of Sundar = 1,20,000 × \(\frac{2}{3}\) = ₹ 80,000

Existing capital (after adjustments) = ₹ 82,000

Cash to be paid off = ₹ 2,000

New capital based on new ratio of Rao = 1,20,000 × \(\frac{1}{3}\) = ₹ 40,000

Existing capital (after adjustments) = ₹ 41,000

Cash to be paid off = ₹ 1,000

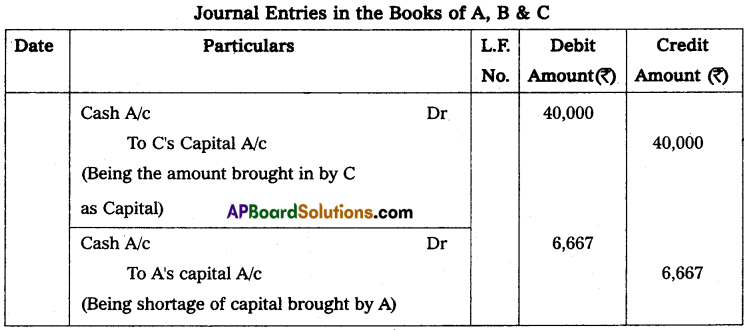

Journal entries in the books of Sundar and Rao

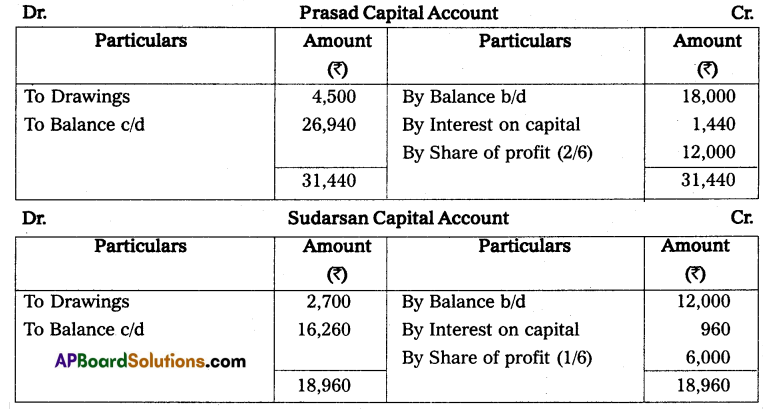

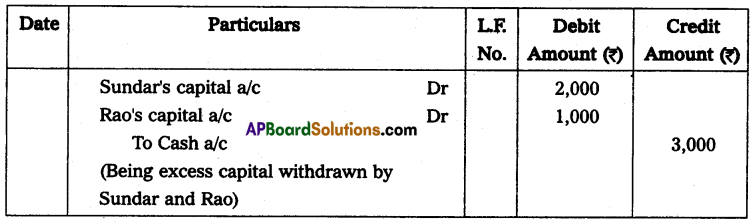

Question 7.

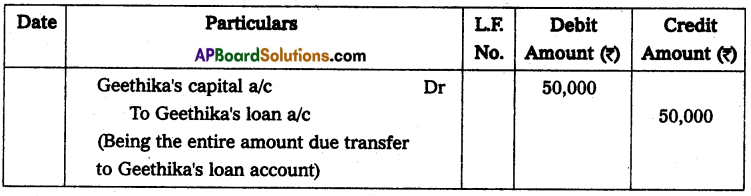

Geethika, Rishitha, and Pravalika are partners in a firm. Geethika retires from the firm. On her date of retirement, ₹ 50,000 becomes due to her.

Prepare necessary entries in the following cases:

1. When payment is made immediately;

2. When payment is not made immediately;

3. When they agree to pay 50% immediately.

Solution:

1. When payment is made immediately.

2. When payment is not made immediately.

3. When they agree to pay 50% immediately.

![]()

Question 8.

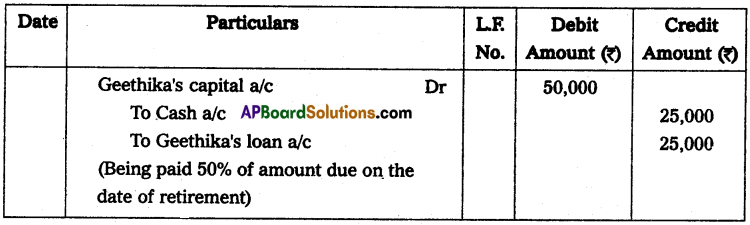

X, Y, and Z were partners in firm sharing profits in 3 : 2 : 1 ratio. On 31.3.2015, Z retires from the firm. On the date of Z’s retirement the balance sheet of the firm was as follows:

On Z’s retirement, it was agreed that;

(i) Premises will be appreciated by 5% and furniture will be appreciated by ₹ 2,000.

(ii) Stock will be depreciated by 10%.

(iii) Provision for bad debts was to be made at 10% on debtors.

(iv) Goodwill of the firm is valued at ₹ 48,000.

(v) Z’s amount will be paid by cheque.

Prepare Revaluation a/c, Partner’s capital a/cs and New Balance Sheet.

Solution:

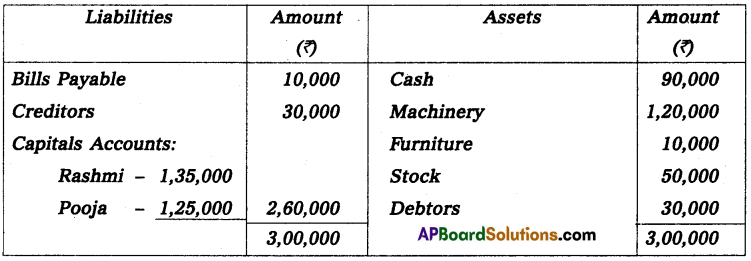

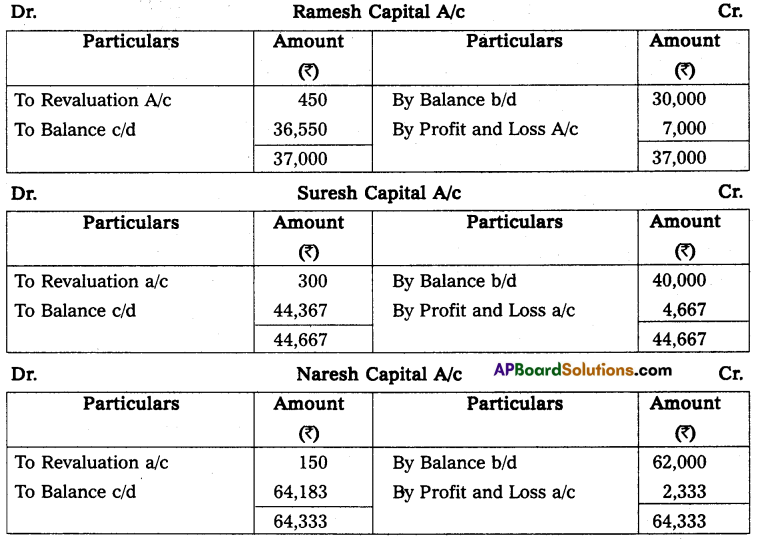

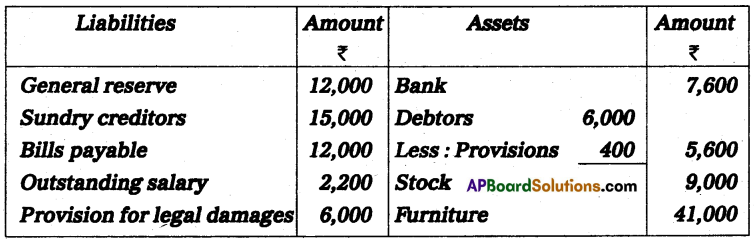

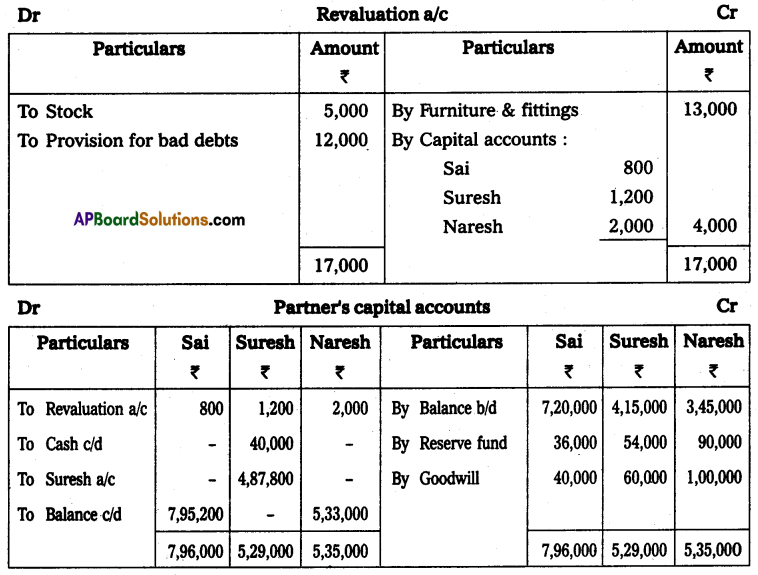

Question 9.

Sai, Suresh, and Naresh were sharing profits in the ratio of 2 : 3 : 5. Balance sheet of Sai, Suresh, and Naresh has on March 31, 2015.

Suresh retires on the above date and the following adjustments are agreed upon his retirement.

1. Stock was valued at ₹ 1,80,000.

2. Furniture and fittings were valued at ₹ 90,000.

3. An amount of ₹ 12,000 was doubtful and a provision for the same was required.

4. Goodwill of the firm was valued at ₹ 2,00,000.

5. Suresh was paid ₹ 40,000 immediately on retirement and the balance was transferred to his loan account.

6. Sai and Naresh were to share future profits in the ratio of 3 : 2.

Prepare the Revaluation account, Capital account, and Balance Sheet of the Reconstituted firm.

Solution:

Question 10.

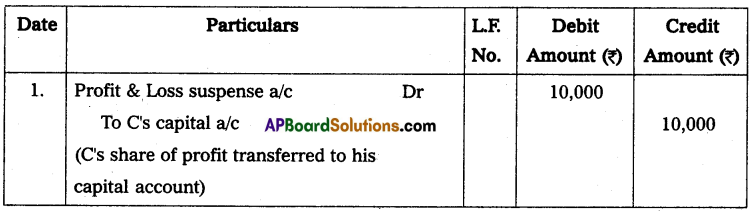

B, C, and D were partners in the firm sharing profits in the ratio of 5 : 4 : 1. the profit of the firm for the year ending on March 31, 2014, was ₹ 1,00,000. C dies on June 30, 2014. Calculate C’s share of profit and pass journal entry.

Solution:

Profit for the period from April 1 to June 30, 2014, shall be calculated as follows:

Total profit for the year ending on 31st March 2014 = ₹ 1,00,000

C’s share of profit = Preceding year’s profit × Proportionate period × Share of a deceased partner

= ₹ 1,00,000 × \(\frac{3}{12} \times \frac{4}{10}\)

= ₹ 10,000

The journal entry will be recorded as follows:

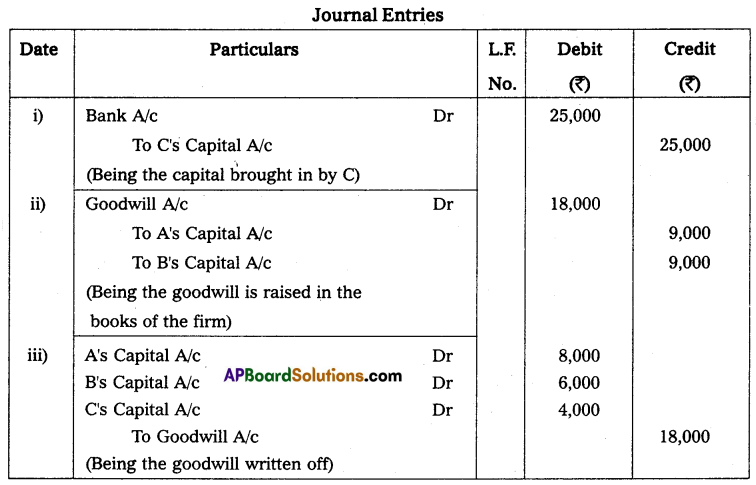

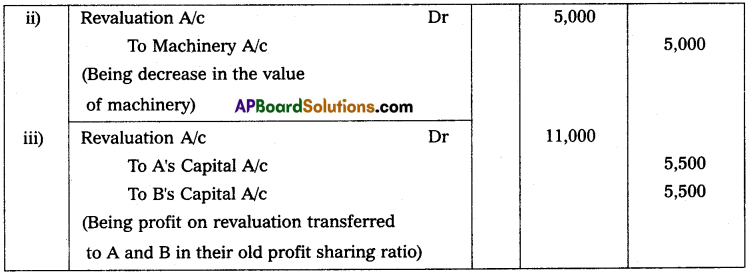

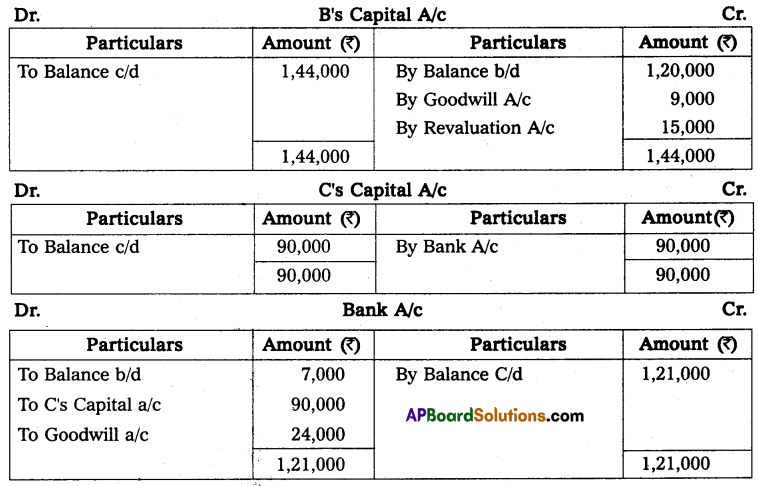

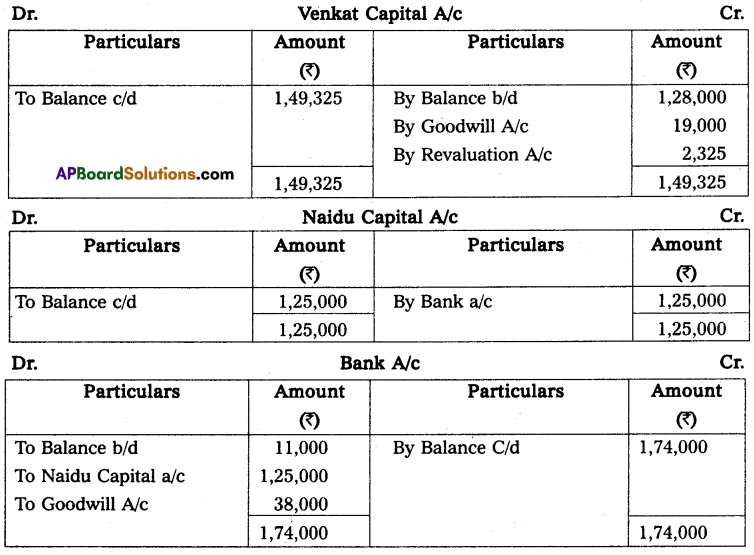

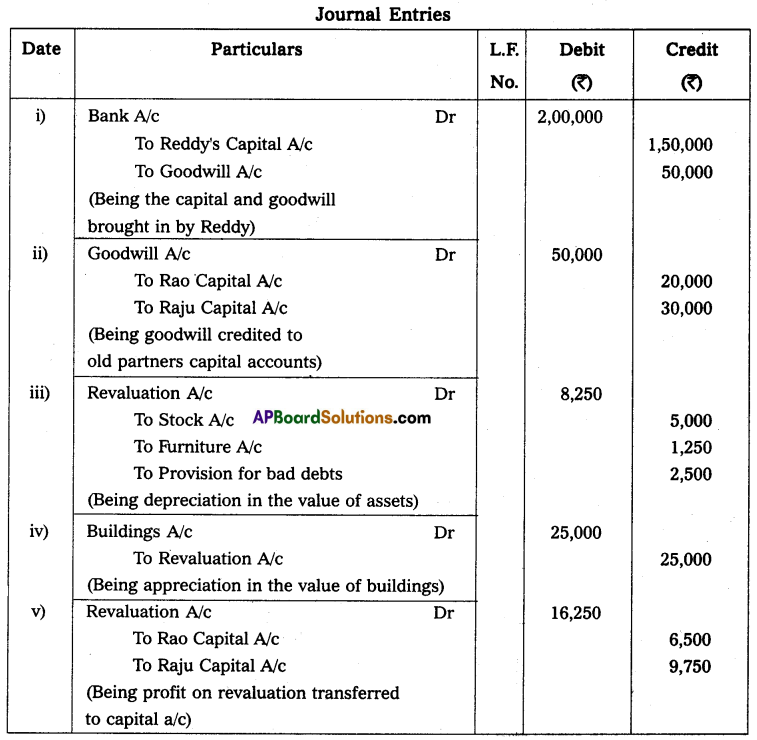

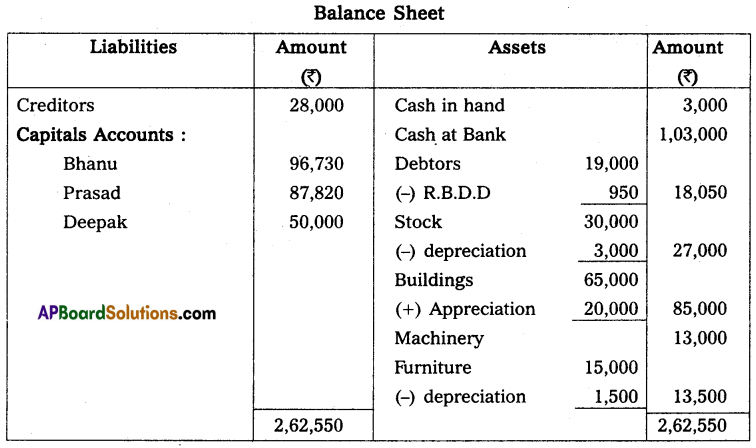

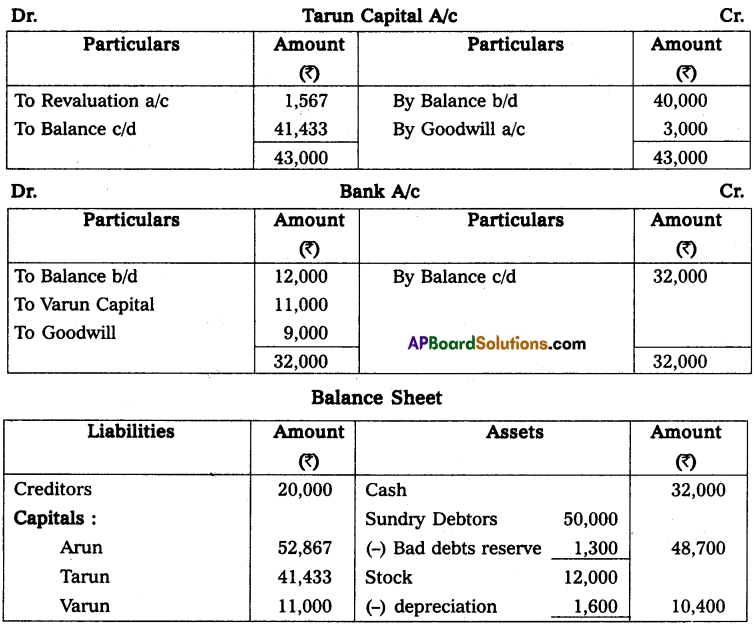

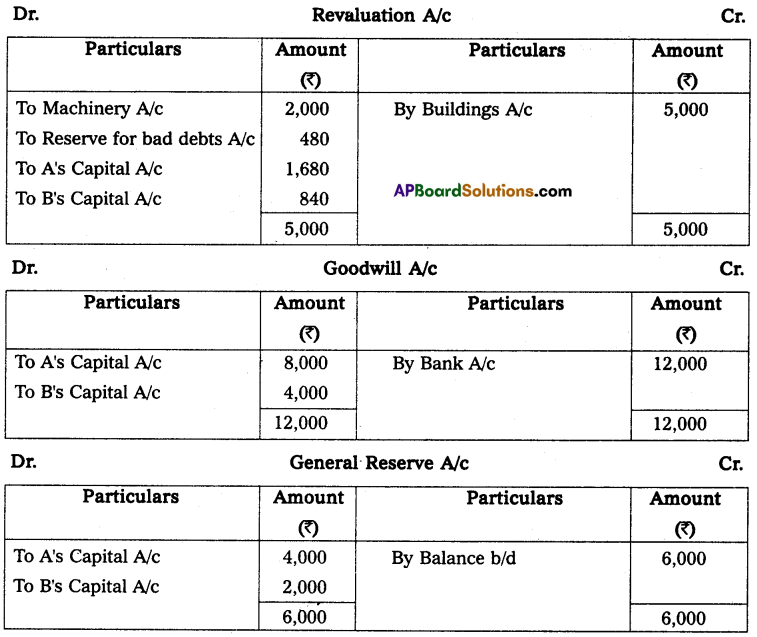

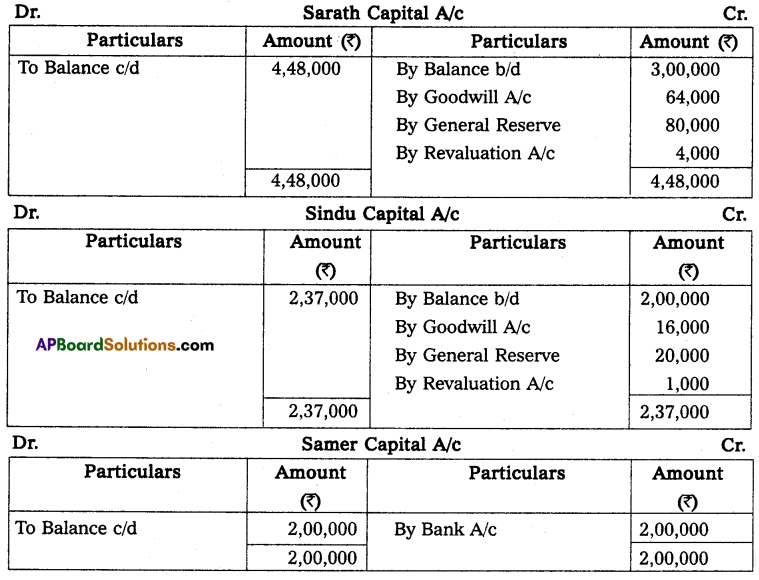

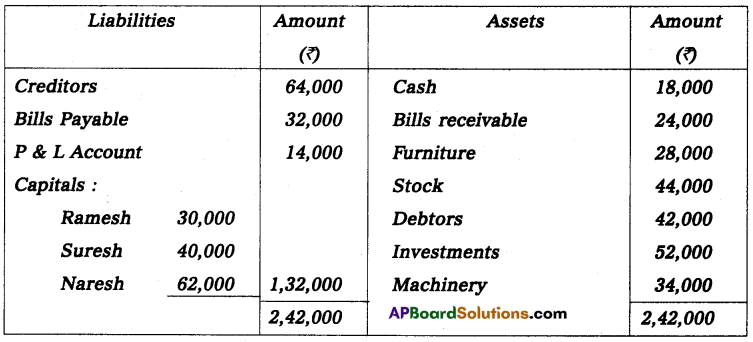

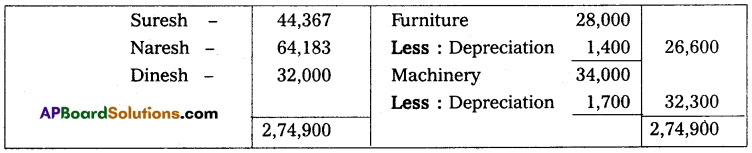

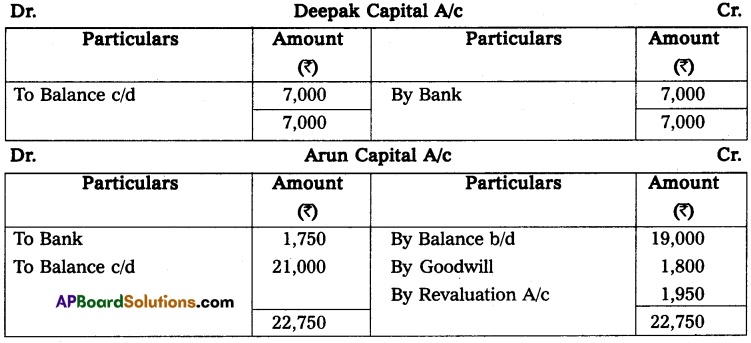

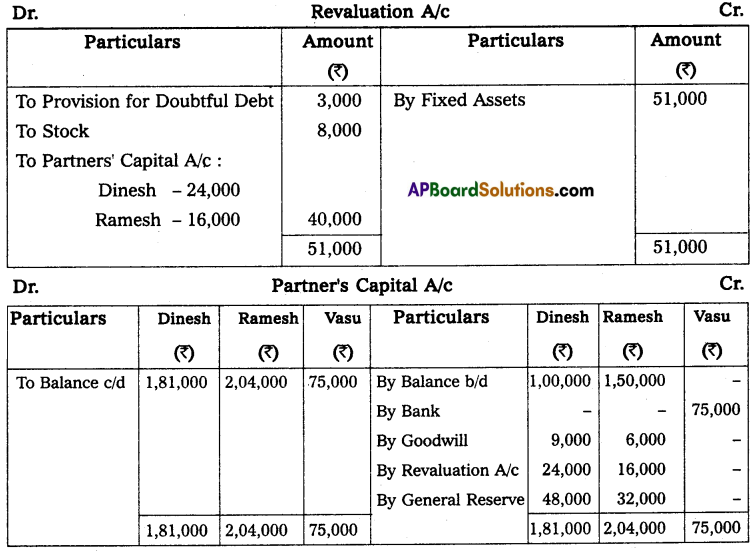

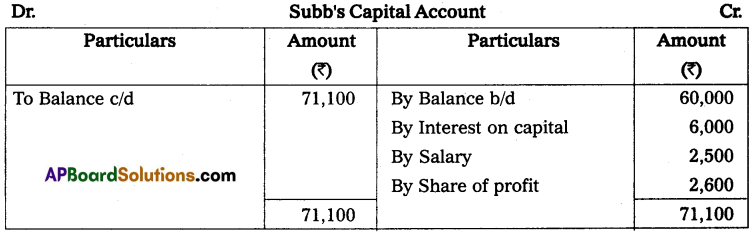

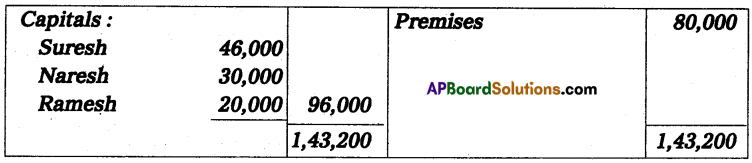

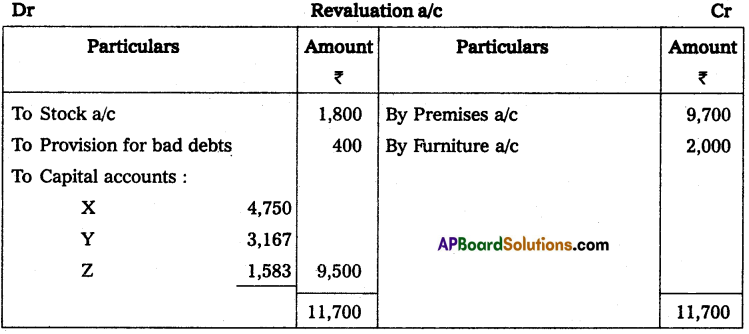

Question 11.

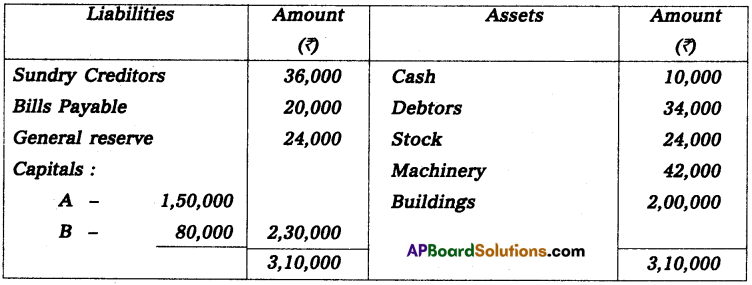

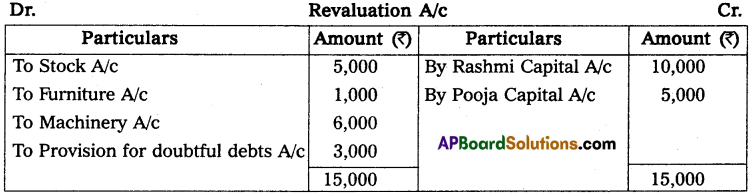

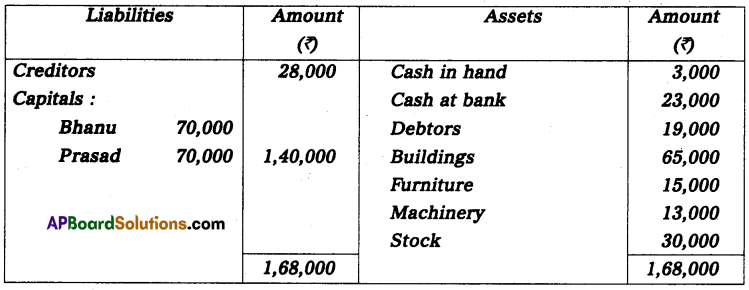

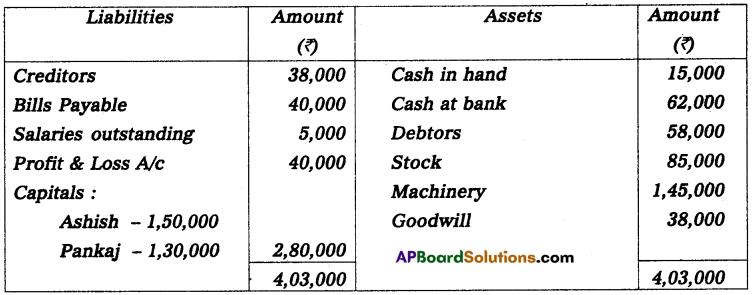

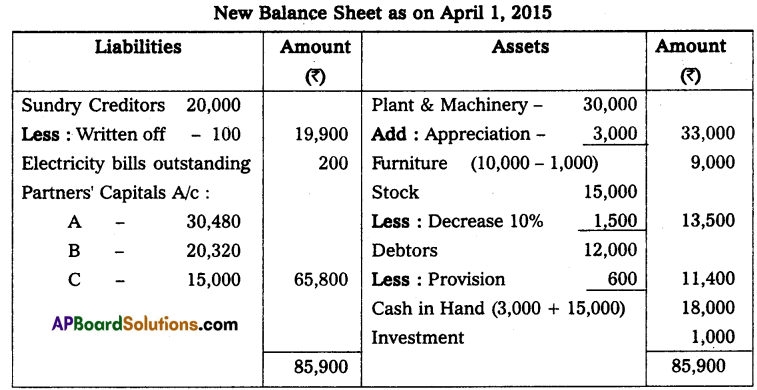

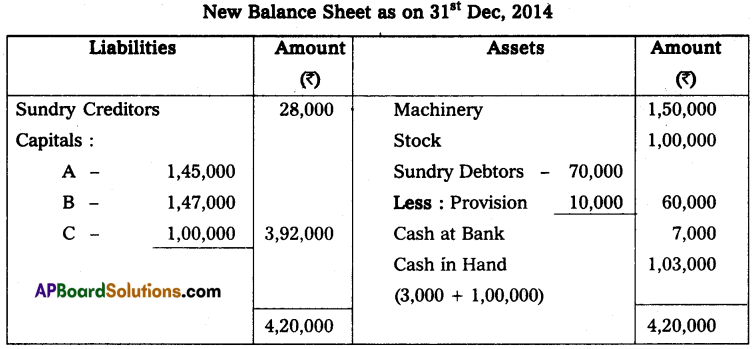

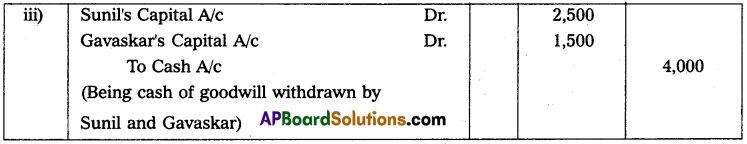

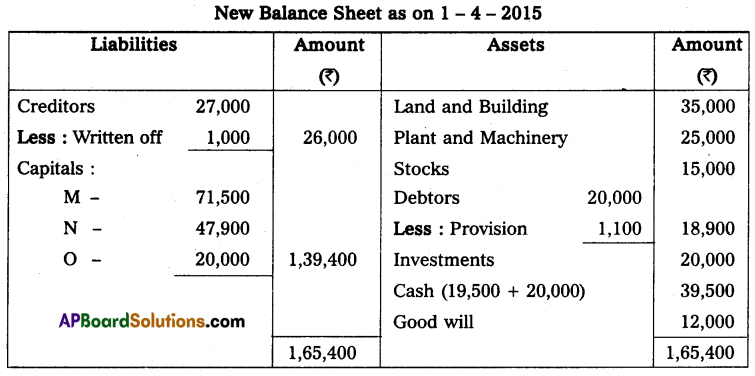

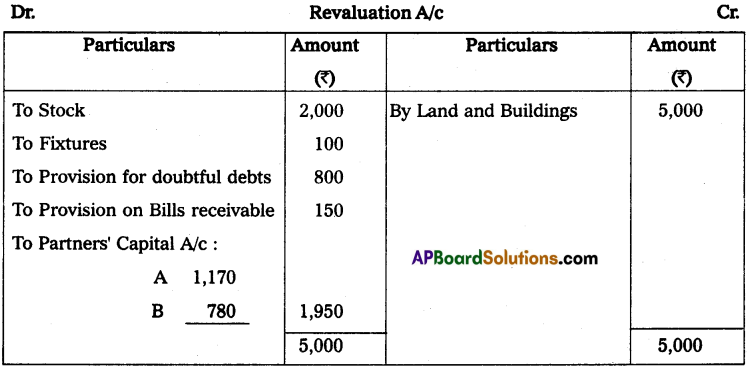

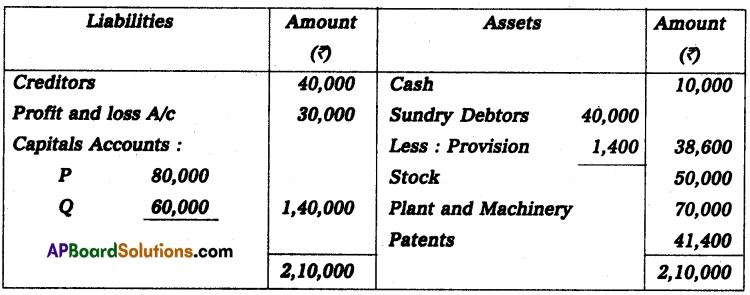

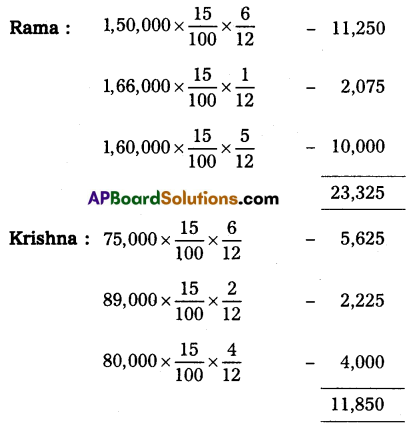

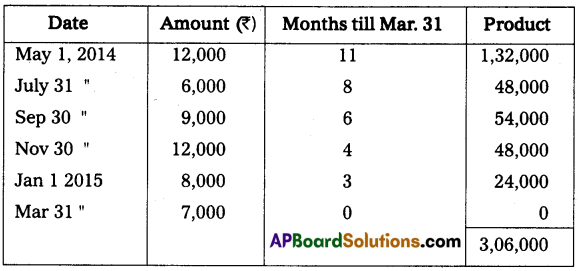

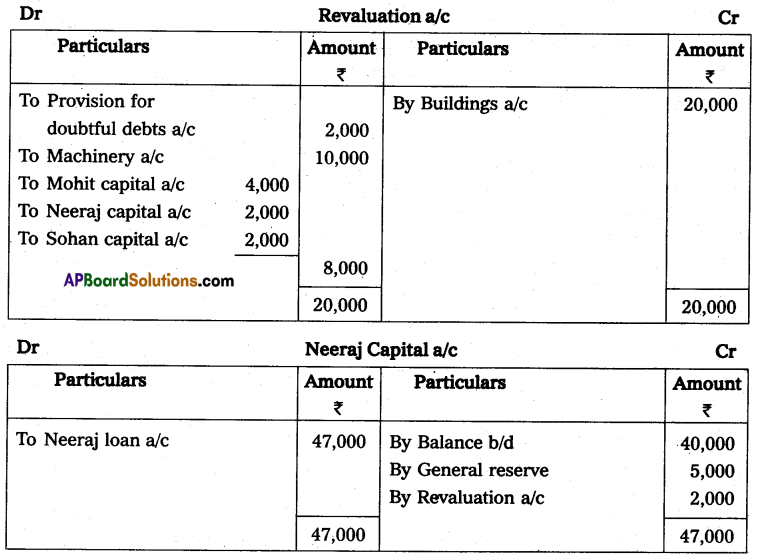

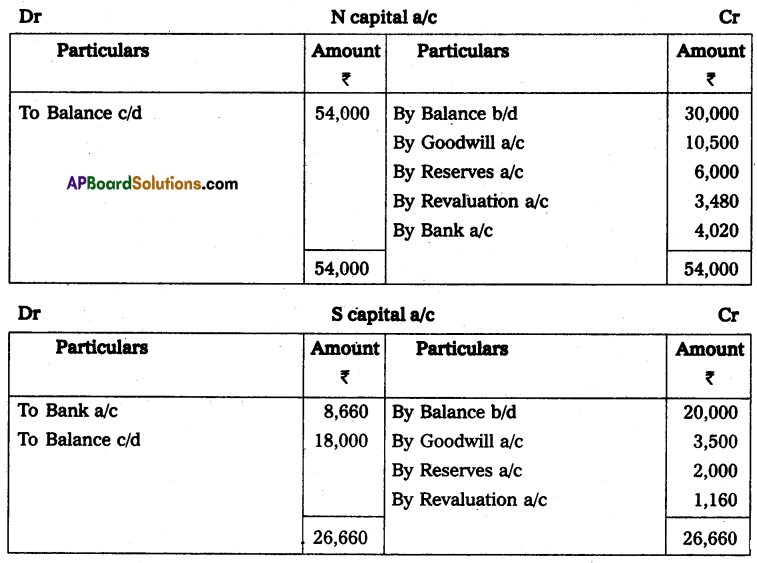

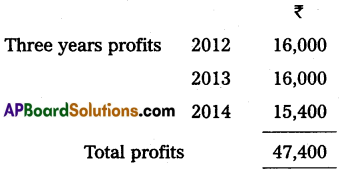

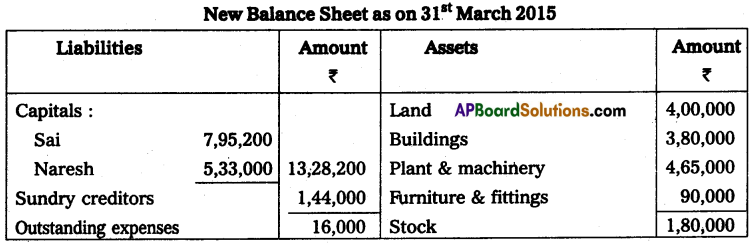

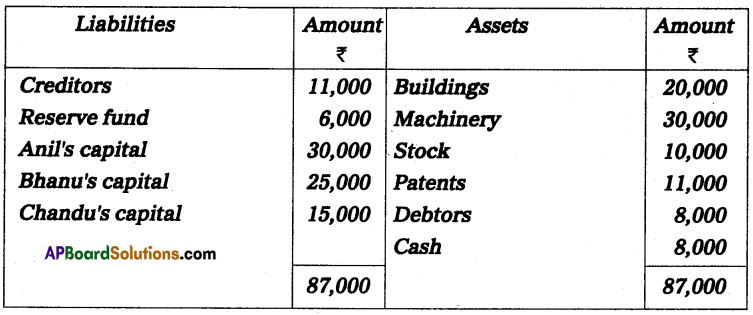

Anil, Bhanu, and Chandu were partners in firm sharing profits in the ratio of 5 : 3 : 2. On March 31, 2014, their Balance Sheet was as under:

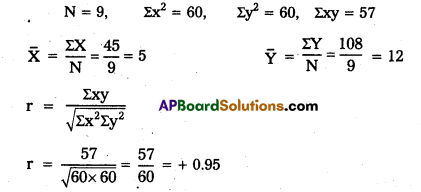

Anil died on October 1, 2014. it was agreed between his executors and the remaining partners that:

(a) Goodwill to be valued at 2\(\frac{1}{2}\) years’ purchase of the average profits of the previous four years which were:

2010-11 – ₹ 13,000

2011-12 – ₹ 12,000

2012-13 – ₹ 20,000

2013-14 – ₹ 15,000

(b) Patents be valued at ₹ 8,000; Machinery at ₹ 28,000; and Building at ₹ 25,000.

(c) Profit for the year 2014-15 to be taken as having accrued at the same rate as that of the previous year.

(d) Interest on capital provided at 10% p.a.

(e) Half of the amount due to Anil is to be paid immediately.

Prepare Anil’s capital account and Anil’s executor’s account as on October 1, 2014.

Solution:

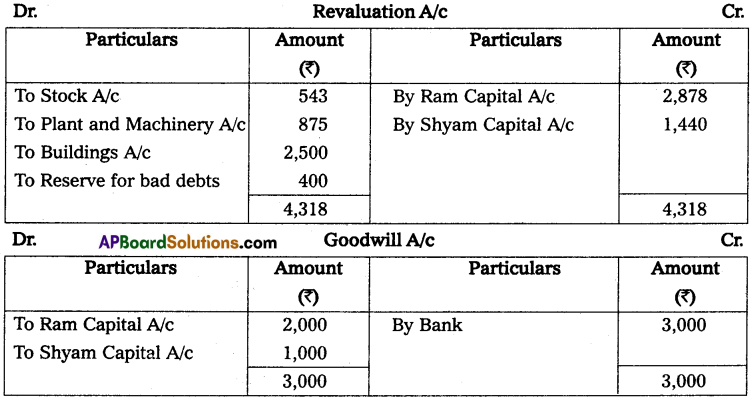

Working Notes:

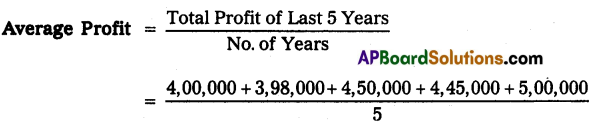

1. Goodwill = Average Profit × 2\(\frac{1}{2}\) year’s purchase

Average profit for 4 years = ₹ 60,000 ÷ 4 = ₹ 15,000

Goodwill = 15,000 × \(\frac{5}{2}\) = ₹ 37,500

Anil’s share of goodwill = 37,500 × \(\frac{5}{10}\) = ₹ 18,750

This goodwill amount will adjust with 3 : 2 ratio between Bhanu and Chandu.

2. Profit from the date of last balance sheet to date of death (April 1, 2014, to October 1, 2014) = 6 months.

Profit for 6 months = ₹ 15,000 × \(\frac{6}{12}\) = ₹ 7,500

Anil’s share of profit = ₹ 7,500 × \(\frac{5}{10}\) = ₹ 3,750

3. Interest on Anil’s capital (April 1, 2014 to October 1, 2014) = ₹ 30,000 × \(\frac{10}{100} \times \frac{6}{12}\) = ₹ 1,500

![]()

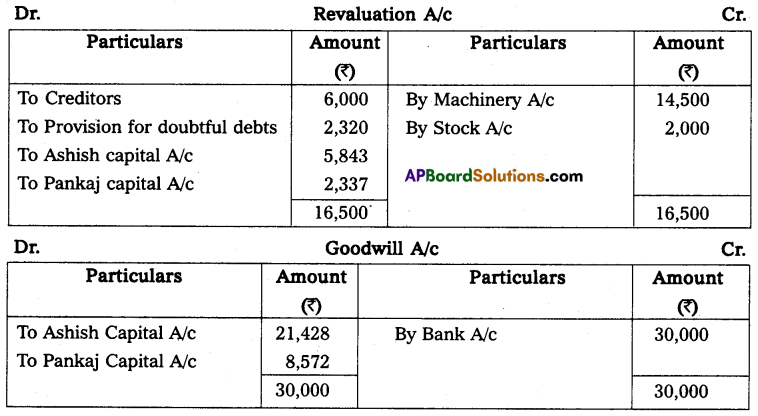

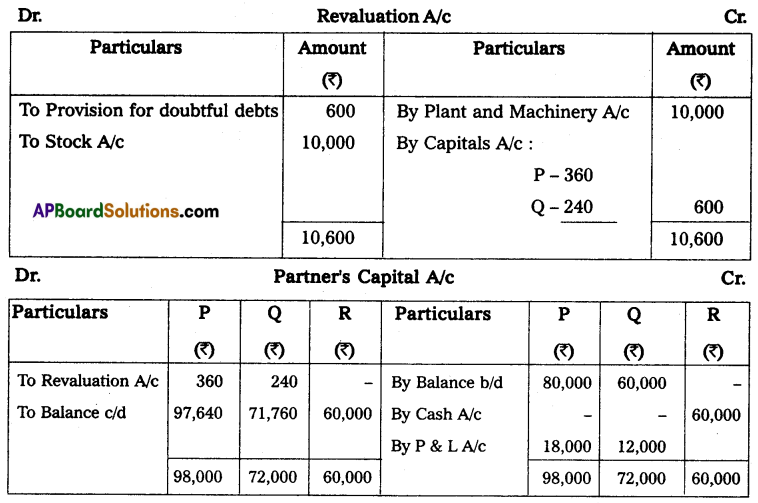

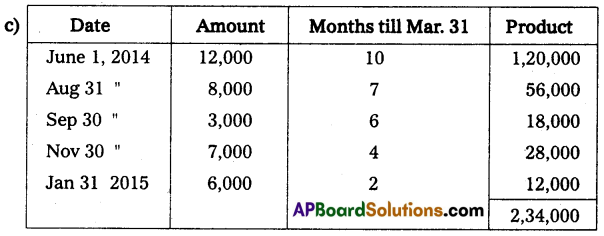

Question 12.

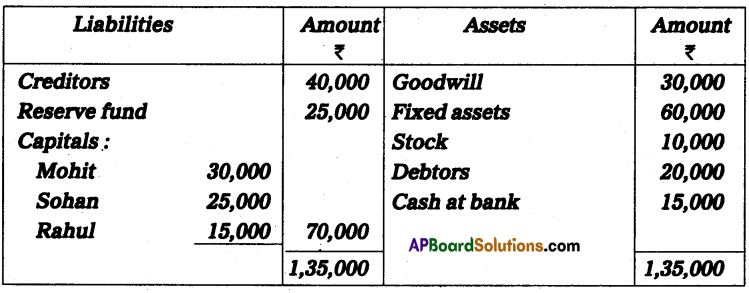

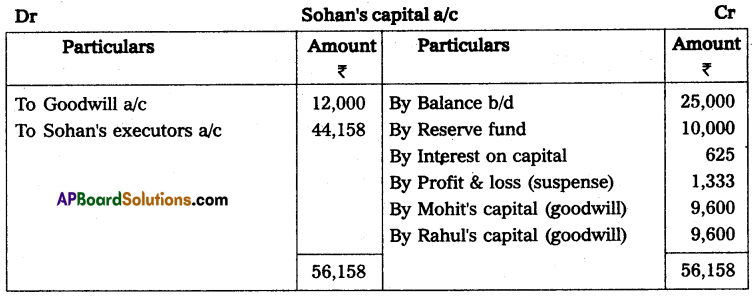

You are given the Balance Sheet of Mohit, Sohan, and Rahul who are partners sharing profits in the ratio of 2 : 2 : 1, as on March 31, 2014.

Sohan died on June 15, 2014. According to the Deed, his legal representatives are entitled to:

(a) Balance in the capital account.

(b) Share of goodwill valued on the basis of thrice the average of the past 4 years’ profits.

(c) Share in profits up to the date of death on the basis of average profits for the past 4 years.

(d) Interest on capital account @ 12% p.a.

Profits for the year ending on March 31 of 2011, 2012, 2013 and 2014 were ₹ 15,000, ₹ 17,000, ₹ 19,000 and ₹ 13,000 respectively.

Mobit and Rahul continued as partners by taking over Sohan’s share equally. Work out the amount payable to Sohan’s legal representatives.

Solution:

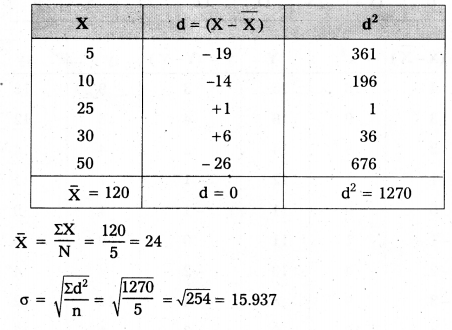

Working Notes:

1. Goodwill = Average Profit × 3 year’s purchase

Average profit for 4 years = ₹ 64,000 ÷ 4 = ₹ 16,000

Goodwill = ₹ 16,000 × 3 = ₹ 48,000

Sohan’ share of goodwill = 48,000 × \(\frac{2}{5}\) = ₹ 19,200

2. Profit from the date of last balance sheet to date of death (April 1, 2014, to June 15, 2014) = 2\(\frac{1}{2}\) months.

Profit for 2\(\frac{1}{2}\) months = ₹ 16,000 × \(\frac{2.5}{12}\) = ₹ 3,333

Sohan’s share of profit = ₹ 3,333 × \(\frac{2}{5}\) = ₹ 1,333

3. Interest on Sohan’s capital (April 1, 2014) to June 15, 2014) = ₹ 25,000 × \(\frac{12}{100} \times \frac{2.5}{12}\) = ₹ 625